- Germany

- /

- Electric Utilities

- /

- DB:EBK

What Investors Should Know About EnBW Energie Baden-Württemberg AG's (FRA:EBK) Financial Strength

The size of EnBW Energie Baden-Württemberg AG (FRA:EBK), a €8.7b large-cap, often attracts investors seeking a reliable investment in the stock market. Doing business globally, large caps tend to have diversified revenue streams and attractive capital returns, making them desirable investments for risk-averse portfolios. However, the key to their continued success lies in its financial health. This article will examine EnBW Energie Baden-Württemberg’s financial liquidity and debt levels to get an idea of whether the company can deal with cyclical downturns and maintain funds to accommodate strategic spending for future growth. Note that this commentary is very high-level and solely focused on financial health, so I suggest you dig deeper yourself into EBK here.

See our latest analysis for EnBW Energie Baden-Württemberg

Does EBK Produce Much Cash Relative To Its Debt?

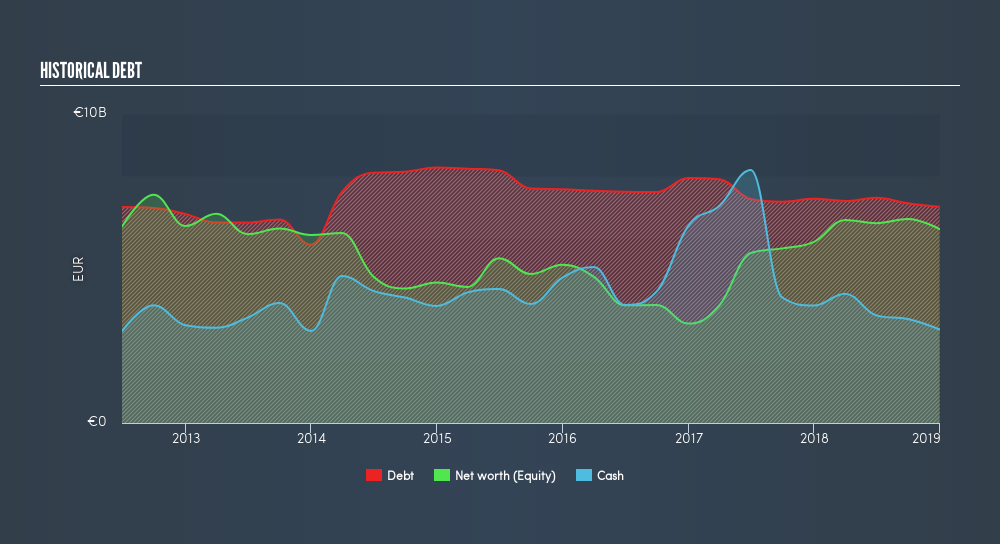

EBK has sustained its debt level by about €7.0b over the last 12 months including long-term debt. At this stable level of debt, the current cash and short-term investment levels stands at €3.0b to keep the business going. Additionally, EBK has produced €828m in operating cash flow in the last twelve months, leading to an operating cash to total debt ratio of 12%, indicating that EBK’s operating cash is less than its debt.

Can EBK meet its short-term obligations with the cash in hand?

Looking at EBK’s €11b in current liabilities, the company has maintained a safe level of current assets to meet its obligations, with the current ratio last standing at 1.14x. The current ratio is calculated by dividing current assets by current liabilities. For Electric Utilities companies, this ratio is within a sensible range as there's enough of a cash buffer without holding too much capital in low return investments.

Does EBK face the risk of succumbing to its debt-load?

Since equity is smaller than total debt levels, EnBW Energie Baden-Württemberg is considered to have high leverage. This isn’t uncommon for large companies because interest payments on debt are tax deductible, meaning debt can be a cheaper source of capital than equity. Accordingly, large companies often have an advantage over small-caps through lower cost of capital due to cheaper financing. We can test if EBK’s debt levels are sustainable by measuring interest payments against earnings of a company. Ideally, earnings before interest and tax (EBIT) should cover net interest by at least three times. In EBK's case, the ratio of 7.4x suggests that interest is well-covered. It is considered a responsible and reassuring practice to maintain high interest coverage, which makes EBK and other large-cap investments thought to be safe.

Next Steps:

At its current level of cash flow coverage, EBK has room for improvement to better cushion for events which may require debt repayment. However, the company exhibits proper management of current assets and upcoming liabilities. I admit this is a fairly basic analysis for EBK's financial health. Other important fundamentals need to be considered alongside. I recommend you continue to research EnBW Energie Baden-Württemberg to get a better picture of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for EBK’s future growth? Take a look at our free research report of analyst consensus for EBK’s outlook.

- Historical Performance: What has EBK's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:EBK

EnBW Energie Baden-Württemberg

Operates as an integrated energy company in Germany, the rest of Europe, and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives