- Germany

- /

- Renewable Energy

- /

- XTRA:RWE

RWE (XTRA:RWE): Valuation Insights as Company Launches First Rhineland-Palatinate Wind Farm

Reviewed by Kshitija Bhandaru

RWE (XTRA:RWE) has just brought its first wind farm in Rhineland-Palatinate online, finalizing the 12.9MW Kail project near the Moselle plateau. This move strengthens RWE’s renewable portfolio and expands its presence in Germany’s onshore wind market.

See our latest analysis for RWE.

RWE’s latest achievement comes at a time of strong momentum for the stock, with a year-to-date share price return of 37.04%. While the company is sharpening its focus on domestic renewables, recent headlines also highlight its strategic decision to exit the $10 billion Hyphen green hydrogen project in Namibia, reflecting a selective approach to global investments. Over both the short and long term, RWE has delivered solid gains, with a 1-year total shareholder return of 33.47% reflecting growing investor confidence as it accelerates its renewable transition.

If this pace of transformation has you interested in what else the market has to offer, now’s a great opportunity to discover fast growing stocks with high insider ownership

With a surge in recent performance and ambitious renewable expansion, the big question is whether RWE shares are still trading below their true value or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 7.9% Undervalued

Comparing the narrative's fair value to the latest share price reveals noticeable upside according to consensus. With analysts setting fair value at €43.98, RWE's last close at €40.51 positions it below the target, stirring debate about future potential.

Major policy tailwinds in core markets, the U.K. retention of a single price zone, extension of CfD periods to 20 years, higher auction price caps, and the new U.S. "Big Beautiful Bill" with tax incentives are expected to provide greater revenue visibility and de-risk project cash flows. These factors may support higher recurring revenues and improved earnings quality over time.

Curious what ambitious assumptions put RWE’s fair value far above today’s price? The narrative hinges on policy-driven growth and a future earnings profile more typical of established market leaders. Wonder which metrics tip the scales? Click through to find out which forecasts give this valuation its punch.

Result: Fair Value of €43.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected supply chain snags and persistently weak wind conditions could quickly dampen optimism and pressure RWE’s earnings outlook. This comes despite today’s positive projections.

Find out about the key risks to this RWE narrative.

Another View: What About Discounted Cash Flow?

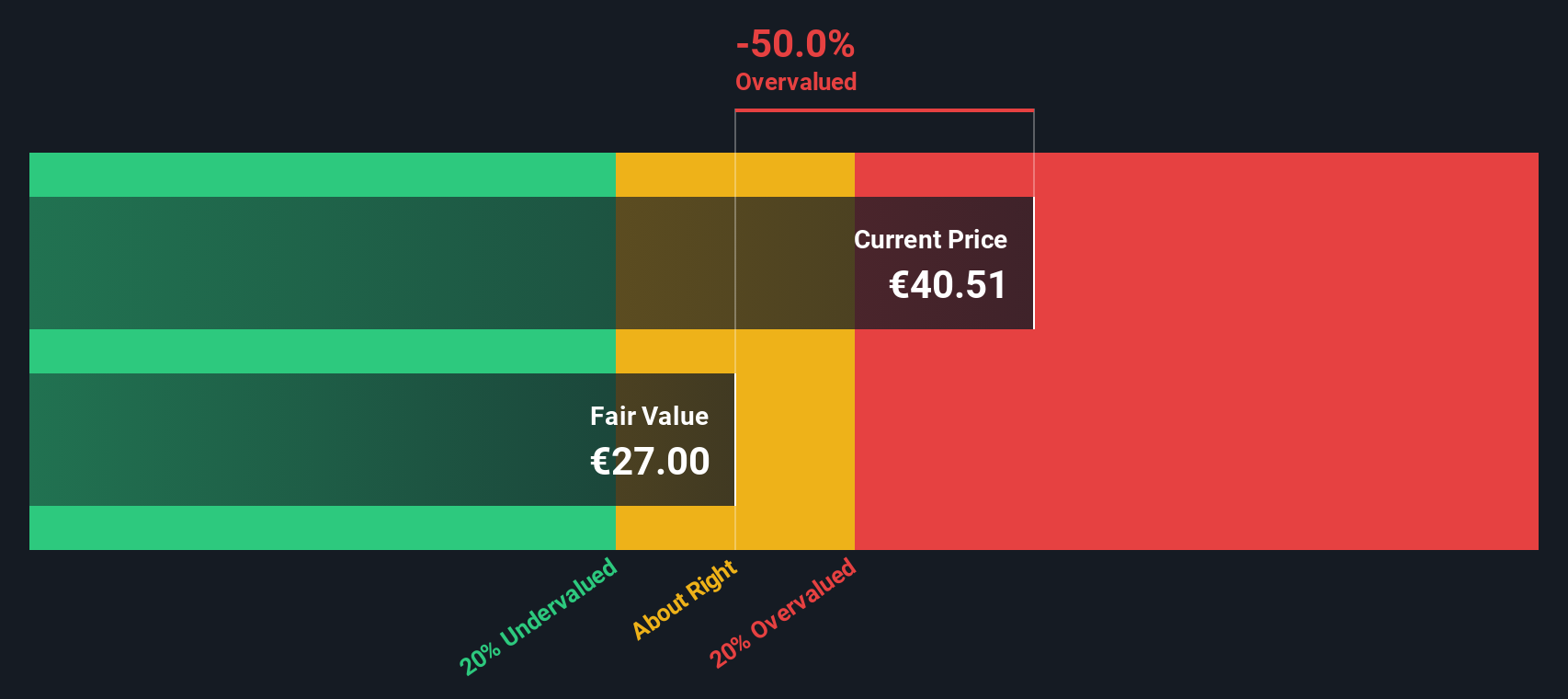

While analyst consensus suggests RWE shares are undervalued, our DCF model paints a more cautious picture. According to this method, RWE is actually trading above its estimated fair value of €26.99. This approach weighs projected cash flows against today’s price and raises the question of whether enthusiasm is running ahead of reality.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RWE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RWE Narrative

If you have a different perspective or want to dig deeper into the figures yourself, you can craft your own narrative in just minutes: Do it your way

A great starting point for your RWE research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize tomorrow’s opportunities by using the Simply Wall Street Screener to find stocks with the momentum and fundamentals you want on your radar. Don’t let the next big mover slip past you.

- Tap into the digital transformation by checking out these 25 AI penny stocks harnessing artificial intelligence for rapid growth and innovation.

- Secure steady portfolio income by exploring these 18 dividend stocks with yields > 3% with reliable yields that stand out even in unpredictable markets.

- Uncover compelling value with these 892 undervalued stocks based on cash flows, spotlighting strong businesses trading well below their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RWE

RWE

Generates and supplies electricity from renewable and conventional sources in Germany, the United Kingdom, rest of Europe, North America, and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives