- Germany

- /

- Renewable Energy

- /

- XTRA:RWE

RWE Aktiengesellschaft's (ETR:RWE) Business And Shares Still Trailing The Market

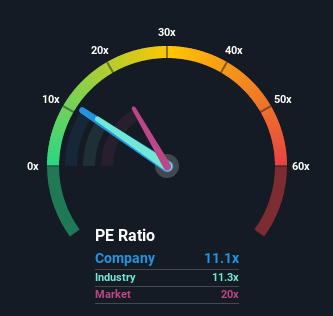

With a price-to-earnings (or "P/E") ratio of 11.1x RWE Aktiengesellschaft (ETR:RWE) may be sending bullish signals at the moment, given that almost half of all companies in Germany have P/E ratios greater than 20x and even P/E's higher than 39x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

RWE certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for RWE

Does Growth Match The Low P/E?

In order to justify its P/E ratio, RWE would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 169% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 23% each year during the coming three years according to the analysts following the company. That's not great when the rest of the market is expected to grow by 15% per annum.

In light of this, it's understandable that RWE's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From RWE's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of RWE's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for RWE (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:RWE

RWE

Generates and supplies electricity from renewable and conventional sources in Germany, the United Kingdom, rest of Europe, North America, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives