- Germany

- /

- Electric Utilities

- /

- XTRA:EBK

How State Control Shift Will Impact EnBW Energie Baden-Württemberg (XTRA:EBK) Investors

Reviewed by Sasha Jovanovic

- EnBW Energie Baden-Württemberg AG recently announced a significant change in its governance, with the State of Baden-Württemberg now attributed approximately 93.99% of voting rights via direct holdings and instruments following a new shareholders' agreement.

- This consolidation marks a major shift in control dynamics for EnBW, highlighting the strengthened influence of the state in the company's decision-making processes.

- With this dramatic realignment in shareholder control, we'll explore how EnBW's investment narrative might be influenced moving forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is EnBW Energie Baden-Württemberg's Investment Narrative?

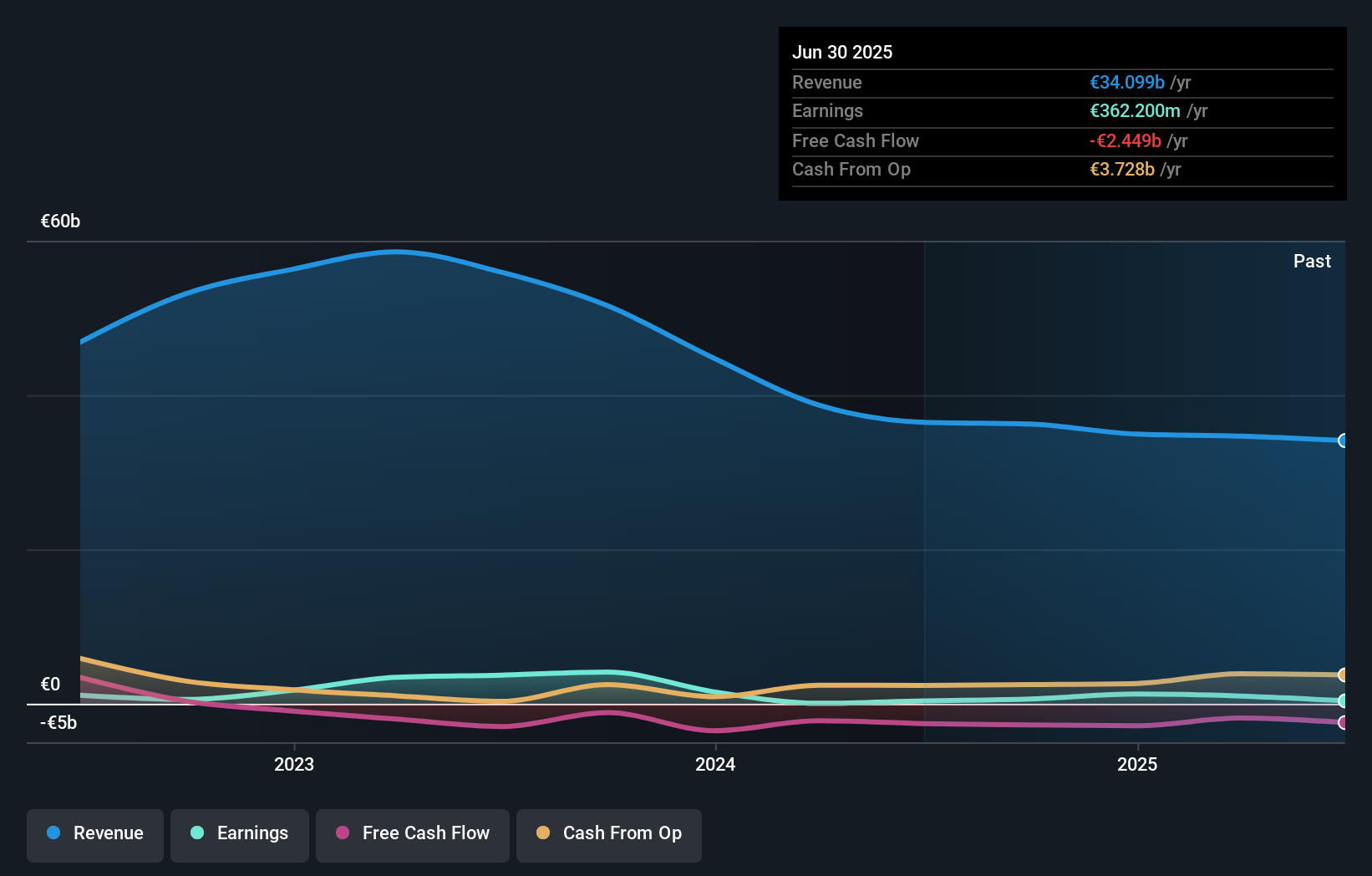

The big picture for EnBW Energie Baden-Württemberg has shifted with the State of Baden-Württemberg’s control jumping to 93.99% of voting rights after the latest shareholders’ agreement. Previously, most short-term catalysts focused on EnBW’s upcoming financial results, the ongoing expansion in renewable energy projects such as their floating wind partnership, and possible proceeds from transmission asset sales. These catalysts remain relevant, but the state’s substantial influence now dominates the narrative. This tighter state grip may reinforce stability in capital decisions and project funding but raises new questions about the board’s independence and direction, which could influence the pace or sequencing of strategic moves. At the same time, weak earnings growth, expensive valuation multiples compared to sector peers, and issues covering debt and dividends remain pressing risks. Investors should watch for changes in future guidance or capital allocation as state priorities may now guide decisions more directly.

But with governance shifting, questions around board independence can matter more than before. EnBW Energie Baden-Württemberg's share price has been on the slide but might be up to 41% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 3 other fair value estimates on EnBW Energie Baden-Württemberg - why the stock might be worth 29% less than the current price!

Build Your Own EnBW Energie Baden-Württemberg Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EnBW Energie Baden-Württemberg research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free EnBW Energie Baden-Württemberg research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EnBW Energie Baden-Württemberg's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnBW Energie Baden-Württemberg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EBK

EnBW Energie Baden-Württemberg

Operates as an integrated energy company in Germany, Rest of Europe, and internationally.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives