- Germany

- /

- Renewable Energy

- /

- DUSE:ABO

Clearwise AG Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

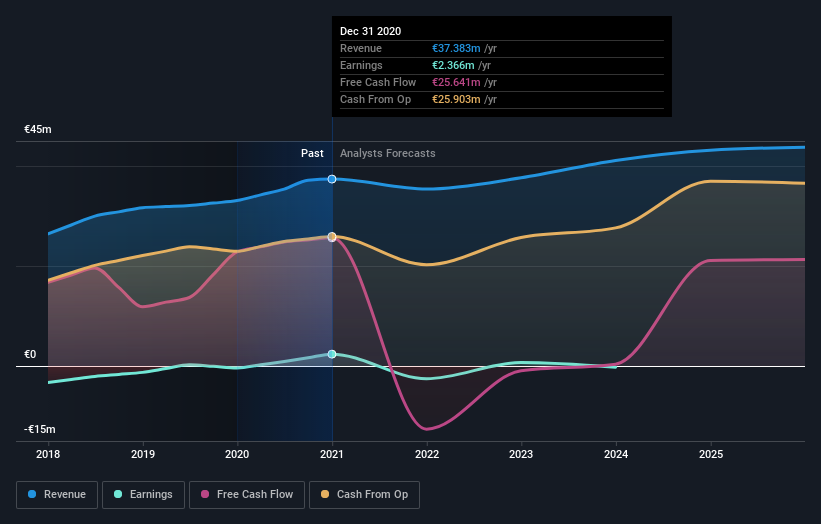

Clearwise AG (DUSE:ABO) defied analyst predictions to release its yearly results, which were ahead of market expectations. It was overall a positive result, with revenues beating expectations by 3.1% to hit €37m. Clearwise also reported a statutory profit of €0.05, which was an impressive 25% above what the analysts had forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Clearwise

Following the recent earnings report, the consensus from four analysts covering Clearwise is for revenues of €35.4m in 2021, implying a perceptible 5.4% decline in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 511% (on a statutory basis) to €0.05. In the lead-up to this report, the analysts had been modelling revenues of €35.0m and earnings per share (EPS) of €0.01 in 2021. While the analysts have made no real change to their revenue estimates, we can see that the consensus is now modelling a loss next year - a clear dip in sentiment compared to the previous outlook of a profit.

As a result, there was no major change to the consensus price target of €3.25, with the analysts implicitly confirming that the business looks to be performing in line with expectations, despite higher forecast losses. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Clearwise, with the most bullish analyst valuing it at €3.50 and the most bearish at €2.61 per share. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Clearwise's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 5.4% by the end of 2021. This indicates a significant reduction from annual growth of 5.7% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.5% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Clearwise is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that the analysts are expecting Clearwise to become unprofitable next year. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Clearwise's revenues are expected to perform worse than the wider industry. The consensus price target held steady at €3.25, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Clearwise going out to 2025, and you can see them free on our platform here.

Before you take the next step you should know about the 2 warning signs for Clearwise that we have uncovered.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if clearvise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DUSE:ABO

clearvise

Operates as an independent electricity producer from renewable energies in Europe.

Fair value with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026