- Germany

- /

- Marine and Shipping

- /

- HMSE:NEP

SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft's(HMSE:NEP) Share Price Is Down 19% Over The Past Three Years.

While it may not be enough for some shareholders, we think it is good to see the SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft (HMSE:NEP) share price up 21% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 19% in the last three years, falling well short of the market return.

View our latest analysis for SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft

While SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over three years, SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft grew revenue at 6.3% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. Indeed, the stock dropped 6% over the last three years. Shareholders will probably be hoping growth picks up soon. But ultimately the key will be whether the company can become profitability.

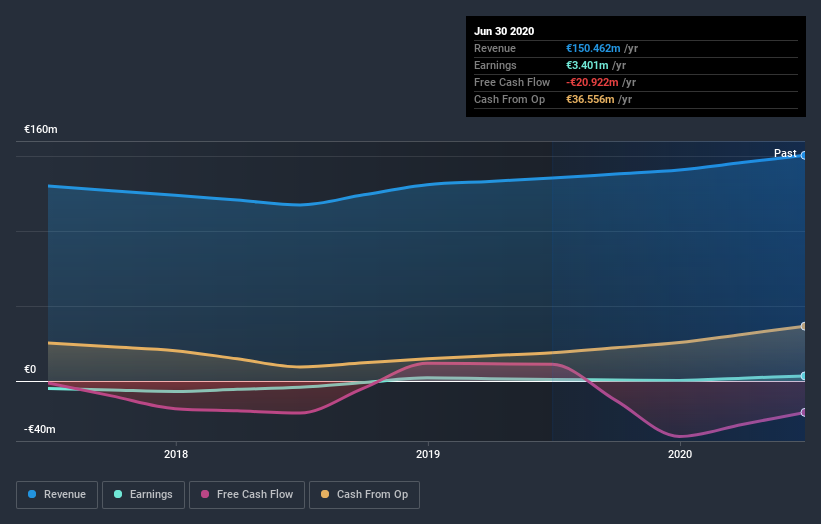

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft's TSR for the last 3 years was -15%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft shareholders are up 4.4% for the year (even including dividends). It's always nice to make money but this return falls short of the market return which was about 5.6% for the year. The silver lining is that the recent rise is far preferable to the annual loss of 5% that shareholders have suffered over the last three years. We hope the turnaround in fortunes continues. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft (2 can't be ignored!) that you should be aware of before investing here.

We will like SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you’re looking to trade SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HMSE:NEP

SLOMAN NEPTUN Schiffahrts-Aktiengesellschaft

Operates as a shipping company worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives