- Germany

- /

- Transportation

- /

- BST:3WB

Imagine Owning Waberer's International Nyrt (BST:3WB) While The Price Tanked 54%

Even the best stock pickers will make plenty of bad investments. And unfortunately for Waberer's International Nyrt. (BST:3WB) shareholders, the stock is a lot lower today than it was a year ago. The share price is down a hefty 54% in that time. We wouldn't rush to judgement on Waberer's International Nyrt because we don't have a long term history to look at. The falls have accelerated recently, with the share price down 16% in the last three months.

See our latest analysis for Waberer's International Nyrt

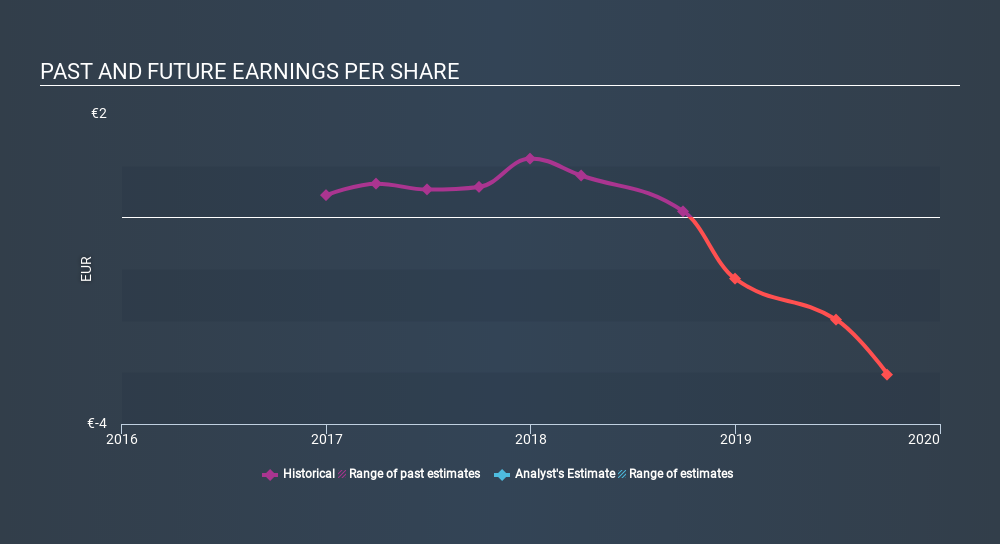

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Waberer's International Nyrt fell to a loss making position during the year. While this may prove temporary, we'd consider it a negative, so it doesn't surprise us that the stock price is down. Of course, if the company can turn the situation around, investors will likely profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Waberer's International Nyrt's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Waberer's International Nyrt shareholders are down 54% for the year, the market itself is up 18%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 16% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Waberer's International Nyrt that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BST:3WB

Waberer's International Nyrt

Provides transportation, forwarding, and logistics services in Europe and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives