- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:UTDI

Here's Why United Internet (ETR:UTDI) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies United Internet AG (ETR:UTDI) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for United Internet

What Is United Internet's Debt?

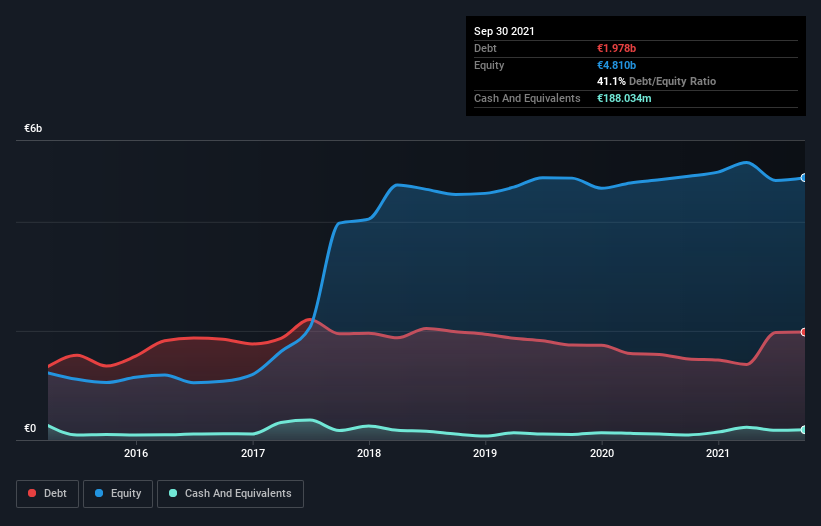

You can click the graphic below for the historical numbers, but it shows that as of September 2021 United Internet had €1.98b of debt, an increase on €1.49b, over one year. However, it also had €188.0m in cash, and so its net debt is €1.79b.

A Look At United Internet's Liabilities

The latest balance sheet data shows that United Internet had liabilities of €1.61b due within a year, and liabilities of €3.17b falling due after that. On the other hand, it had cash of €188.0m and €1.04b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €3.54b.

This is a mountain of leverage relative to its market capitalization of €5.60b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that United Internet's moderate net debt to EBITDA ratio ( being 1.6), indicates prudence when it comes to debt. And its commanding EBIT of 59.4 times its interest expense, implies the debt load is as light as a peacock feather. Also good is that United Internet grew its EBIT at 11% over the last year, further increasing its ability to manage debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if United Internet can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, United Internet recorded free cash flow worth 62% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

When it comes to the balance sheet, the standout positive for United Internet was the fact that it seems able to cover its interest expense with its EBIT confidently. However, our other observations weren't so heartening. For example, its level of total liabilities makes us a little nervous about its debt. Considering this range of data points, we think United Internet is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with United Internet , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade United Internet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:UTDI

United Internet

Through its subsidiaries, operates as an Internet service provider worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives