- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:NFN

Investors Continue Waiting On Sidelines For NFON AG (ETR:NFN)

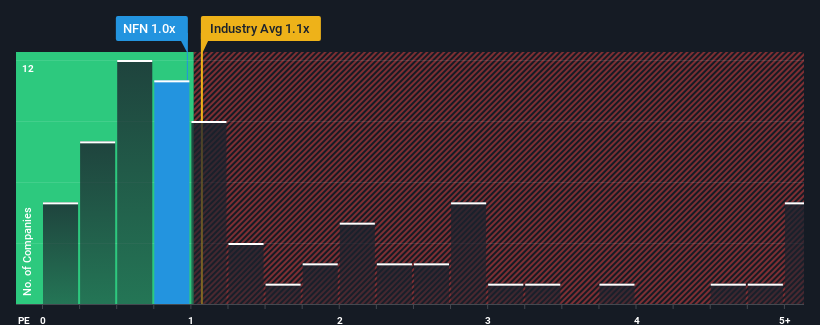

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Telecom industry in Germany, you could be forgiven for feeling indifferent about NFON AG's (ETR:NFN) P/S ratio of 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for NFON

How NFON Has Been Performing

There hasn't been much to differentiate NFON's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on NFON will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For NFON?

There's an inherent assumption that a company should be matching the industry for P/S ratios like NFON's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 15% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 8.2% as estimated by the four analysts watching the company. With the industry only predicted to deliver 0.5%, the company is positioned for a stronger revenue result.

In light of this, it's curious that NFON's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, NFON's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for NFON that you should be aware of.

If you're unsure about the strength of NFON's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NFON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NFN

NFON

Provides cloud-based telecommunication services to business customers in Germany, Austria, Italy, the United Kingdom, Spain, Italy, France, Poland, and Portugal.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives