- Germany

- /

- Auto Components

- /

- XTRA:NVM

Three German Dividend Stocks Offering Up To 7.1% Yield

Reviewed by Simply Wall St

As European markets show signs of resilience, with Germany's DAX index recently marking a notable gain, investors are increasingly attentive to opportunities within the region. In this context, dividend stocks remain a compelling consideration for those looking to blend income generation with potential capital appreciation in a stabilizing economic environment.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.30% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.86% | ★★★★★★ |

| Brenntag (XTRA:BNR) | 3.24% | ★★★★★☆ |

| Talanx (XTRA:TLX) | 3.17% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 6.55% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 4.84% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.25% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.30% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.18% | ★★★★★☆ |

| ProCredit Holding (XTRA:PCZ) | 6.88% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Deutsche Telekom (XTRA:DTE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Deutsche Telekom AG, along with its subsidiaries, offers integrated telecommunication services and has a market capitalization of approximately €115.19 billion.

Operations: Deutsche Telekom AG generates its revenue primarily from three segments: Germany (€25.34 billion), the United States (€72.18 billion), and Europe (€11.97 billion), along with contributions from Systems Solutions (€3.94 billion) and Group Headquarters & Group Services (€2.27 billion).

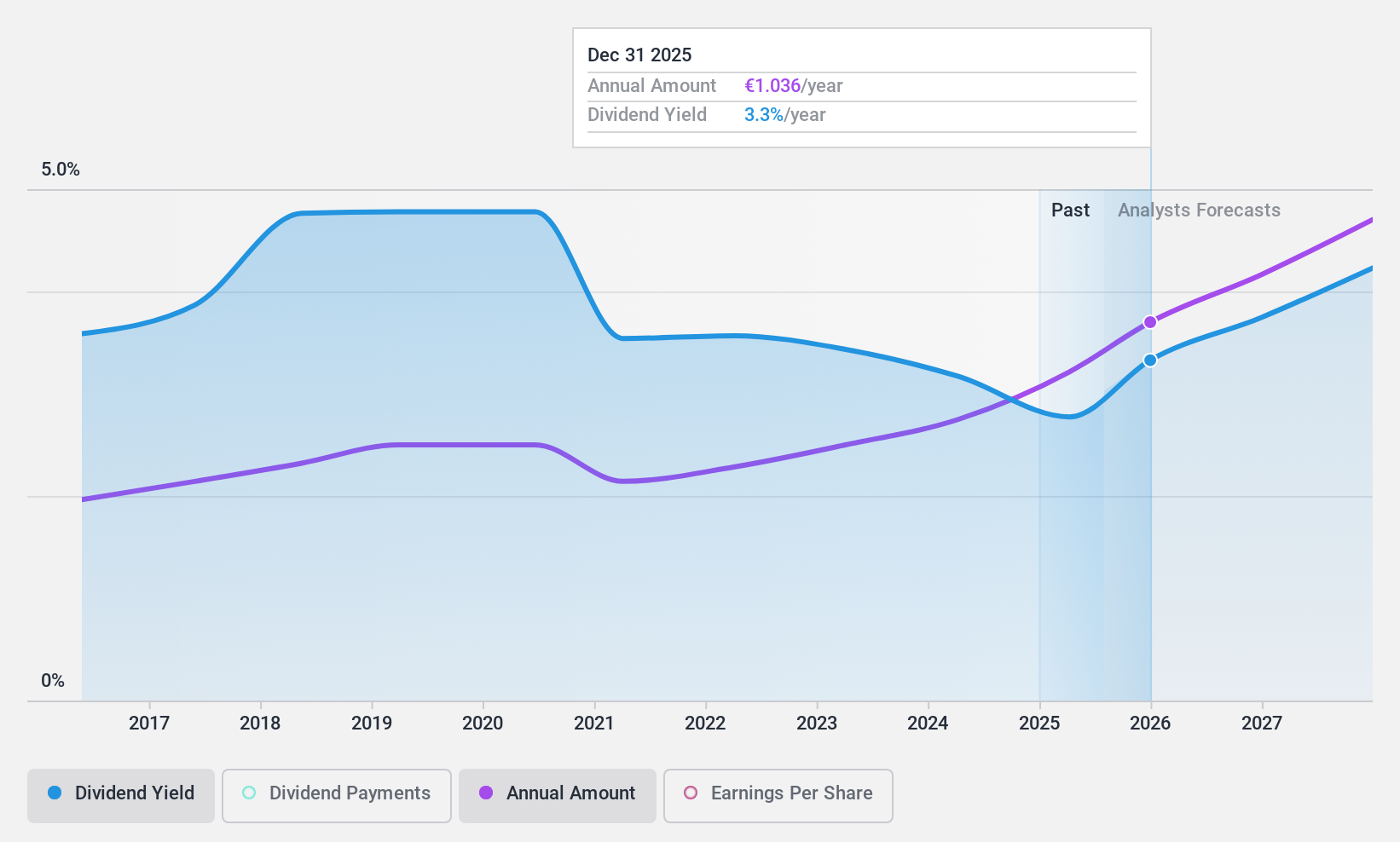

Dividend Yield: 3.3%

Deutsche Telekom offers a stable dividend, with payments growing over the past decade and a current yield of 3.3%, although this is below the top quartile in Germany's market at 4.72%. Its dividends are well-supported, covered by earnings with an 87% payout ratio and by cash flows with a 19.3% cash payout ratio. Recent activities include a €700 million share buyback and multiple global conference presentations, signaling active management and international engagement despite its high debt levels.

- Click here to discover the nuances of Deutsche Telekom with our detailed analytical dividend report.

- Our valuation report here indicates Deutsche Telekom may be undervalued.

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager with a market capitalization of approximately €152.27 million, focusing on asset and investment management services.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue primarily through Management Services (€30.83 million) and Transaction Services (€7.73 million).

Dividend Yield: 6.2%

MPC Münchmeyer Petersen Capital AG, trading at a significant discount to its estimated fair value, offers a 6.25% dividend yield, placing it in the top 25% of German dividend payers. Despite its recent initiation into dividend payments—only two years of history—the dividends are supported by both earnings and cash flows with payout ratios of 72.6% and 73.6%, respectively. Recent growth includes a notable increase in net income to €5.88 million from last year's €3.72 million for Q1, alongside leadership changes poised to take effect post-AGM on June 13, enhancing its management structure.

- Navigate through the intricacies of MPC Münchmeyer Petersen Capital with our comprehensive dividend report here.

- The analysis detailed in our MPC Münchmeyer Petersen Capital valuation report hints at an deflated share price compared to its estimated value.

Novem Group (XTRA:NVM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Novem Group S.A., based in Luxembourg, specializes in developing and supplying trim elements and decorative function elements for car interiors globally, with a market capitalization of €241.83 million.

Operations: Novem Group S.A. generates €635.50 million from its Auto Parts & Accessories segment.

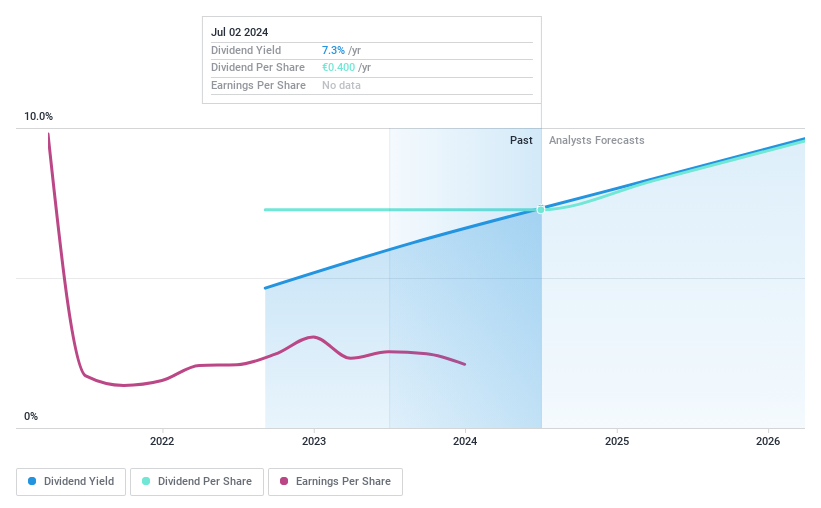

Dividend Yield: 7.1%

Novem Group S.A. experienced a decrease in annual sales to €635.5 million and net income to €34.8 million, reflecting a challenging fiscal year ended March 2024. Despite this, the company maintains a low payout ratio of 37.7%, ensuring dividends are well-covered by earnings and cash flows (cash payout ratio: 36.1%). However, Novem's dividend history is short and payments have been inconsistent over the past two years, indicating potential concerns about the sustainability of future dividends amidst its high debt levels.

- Dive into the specifics of Novem Group here with our thorough dividend report.

- Upon reviewing our latest valuation report, Novem Group's share price might be too pessimistic.

Next Steps

- Reveal the 30 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Novem Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Novem Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NVM

Novem Group

Develops and supplies trim elements and decorative function elements in car interiors for automotive industry in Luxembourg and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives