As the European market navigates mixed performance across major indices and contemplates potential interest rate hikes by the European Central Bank, investors are closely watching how these dynamics might impact high-growth sectors like technology. In such an environment, a good tech stock to watch would likely be one that demonstrates resilience amid economic uncertainties and shows potential for sustainable growth despite broader market volatility.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Bonesupport Holding | 27.76% | 49.60% | ★★★★★★ |

| Pharma Mar | 19.32% | 41.01% | ★★★★★☆ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Kitron | 21.22% | 32.49% | ★★★★★★ |

| Gapwaves | 32.48% | 72.52% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Comet Holding | 11.47% | 37.33% | ★★★★★☆ |

| Waystream Holding | 17.38% | 66.50% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Stemmer Imaging (HMSE:S9I)

Simply Wall St Growth Rating: ★★★★☆☆

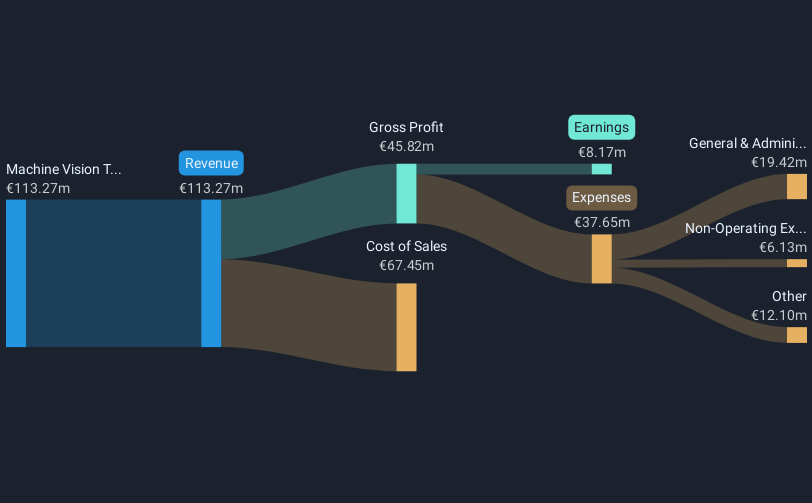

Overview: Stemmer Imaging AG functions as a value-added distributor in the global machine vision sector with a market cap of €388.70 million.

Operations: Stemmer Imaging AG generates revenue primarily from its machine vision technology segment, amounting to €102.14 million.

Stemmer Imaging (S9I) is navigating the high-growth tech landscape with a notable 16.4% annual revenue increase, outpacing Germany's average of 6.3%. Despite a challenging year with earnings contracting by 73.4%, future projections are robust, with an anticipated earnings growth of 57.8% per year, significantly above the market's 16.9%. This growth is underpinned by S9I's commitment to innovation and quality, as evidenced by their high-quality past earnings and strategic focus on sectors poised for expansion within Europe's tech industry.

- Get an in-depth perspective on Stemmer Imaging's performance by reading our health report here.

Examine Stemmer Imaging's past performance report to understand how it has performed in the past.

LINK Mobility Group Holding (OB:LINK)

Simply Wall St Growth Rating: ★★★★☆☆

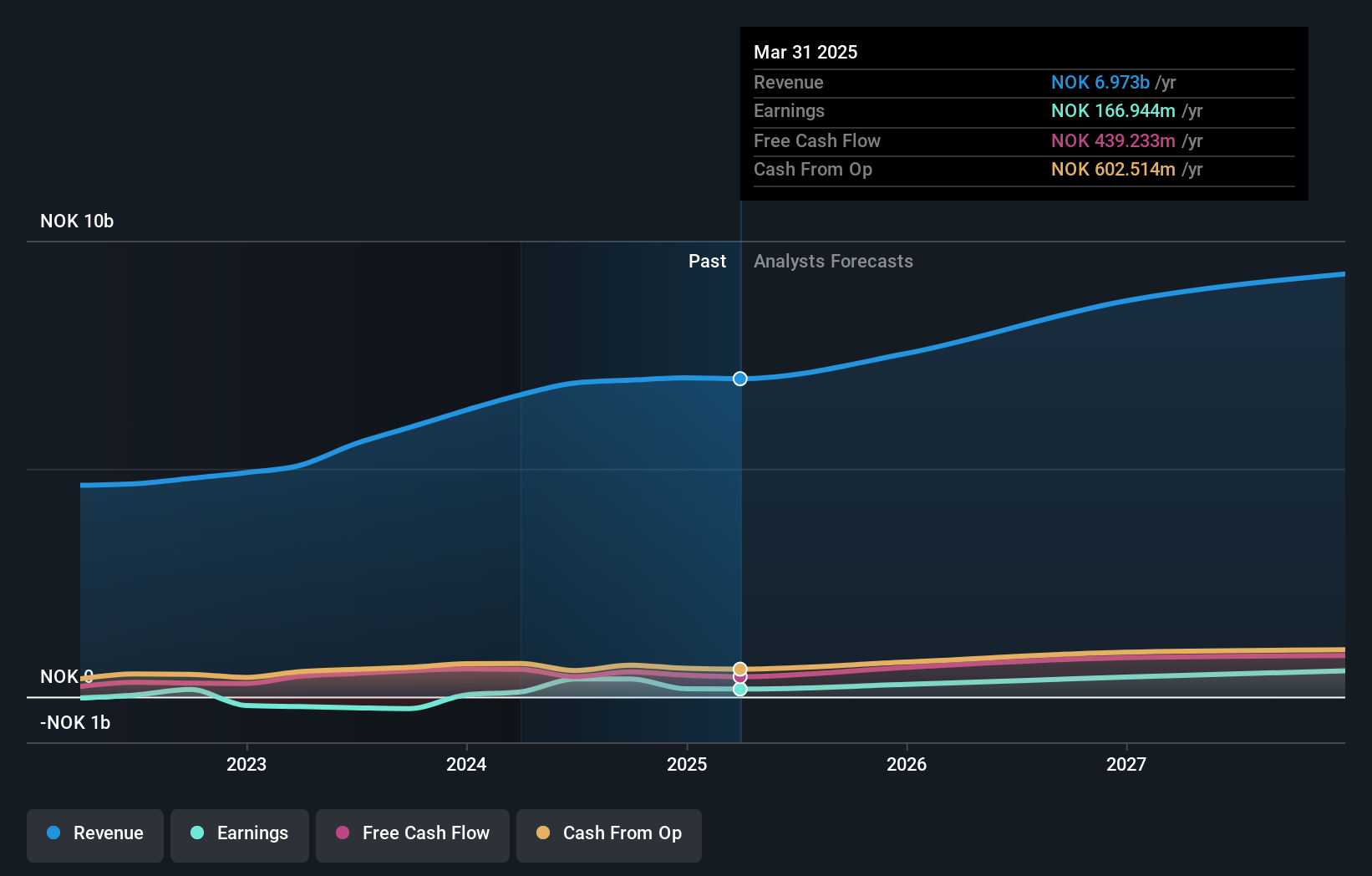

Overview: LINK Mobility Group Holding ASA, with a market cap of NOK9.17 billion, offers mobile and communication-platform-as-a-service solutions through its subsidiaries.

Operations: The company generates revenue through its regional segments: Central Europe (NOK1.67 billion), Western Europe (NOK2.37 billion), Northern Europe (NOK1.58 billion), and Global Messaging (NOK1.33 billion).

At the recent Pareto Securities' Nordic TechSaaS Conference, LINK Mobility Group Holding ASA showcased its strategic initiatives aimed at enhancing its tech offerings. Despite a slight dip in net income to NOK 17.11 million in Q3 2025 from NOK 20.72 million the previous year, LINK is poised for substantial growth with an expected annual earnings increase of 71%. This growth trajectory is supported by a robust R&D focus, with significant investment earmarked for innovation in mobile communications solutions—a sector experiencing rapid expansion due to increased demand for mobile connectivity and enterprise solutions.

- Delve into the full analysis health report here for a deeper understanding of LINK Mobility Group Holding.

Learn about LINK Mobility Group Holding's historical performance.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

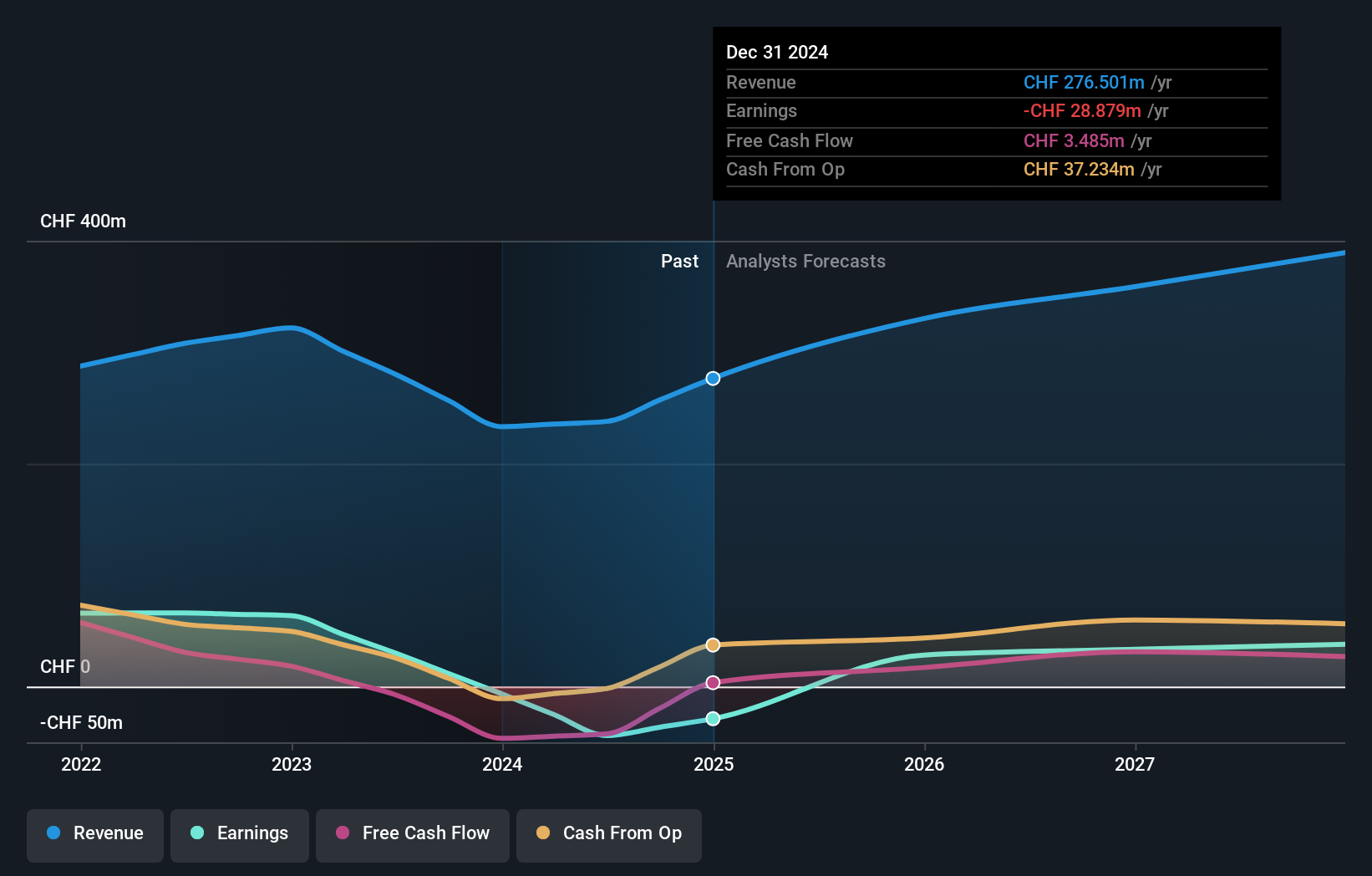

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components across various regions including the Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF916.08 million.

Operations: With a revenue of CHF333.08 million, Sensirion Holding AG focuses on the development, production, and sale of sensor systems, modules, and components globally.

Sensirion Holding AG, a leader in environmental sensor technologies, recently showcased its innovative SEN66 module in Ruuvi's new indoor air quality monitor. This collaboration highlights Sensirion's commitment to addressing critical environmental challenges through advanced sensor solutions. Additionally, the company's strategic expansion with a new production facility in Stafa underlines its dedication to technological advancement and job creation, ensuring long-term growth and reliability in supply chains. With an annual revenue growth of 7.1% and earnings expected to surge by 27.1% annually, Sensirion is effectively leveraging its R&D investments to stay ahead in the high-tech sensor market while also meeting evolving industry standards and customer needs.

Key Takeaways

- Delve into our full catalog of 50 European High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:LINK

LINK Mobility Group Holding

Provides mobile and communication-platform-as-a-service solutions.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion