As global markets face challenges from rising U.S. Treasury yields and economic contraction in the eurozone, Germany's DAX index has not been immune, recently experiencing a decline of nearly 1%. Despite these headwinds, the tech sector in Germany continues to attract attention for its potential high growth opportunities, especially when considering stocks that demonstrate strong innovation capabilities and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.82% | ★★★★★☆ |

| Ströer SE KGaA | 7.50% | 29.71% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.18% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Northern Data | 31.58% | 73.23% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| Pantaflix | 20.93% | 113.65% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market capitalization of €373.32 million.

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, amounting to €235.67 million. It focuses on intelligent transportation systems for public transportation worldwide.

Init innovation in traffic systems SE, a German tech firm, has shown notable financial performance with a 16.9% growth in earnings over the past year, outpacing the software industry's average of 10.6%. Despite a slight decrease in net income and EPS in Q2 2024 compared to the same period last year, half-year figures reveal substantial increases with sales jumping from €89.63 million to €114.49 million and net income rising significantly from €1.34 million to €4.82 million. The company's commitment to R&D is evident as they continue investing heavily, aiming to innovate within the traffic system sector—a move likely enhancing long-term growth prospects amidst forecasts of revenue and earnings increasing annually by 12.5% and 21.6%, respectively.

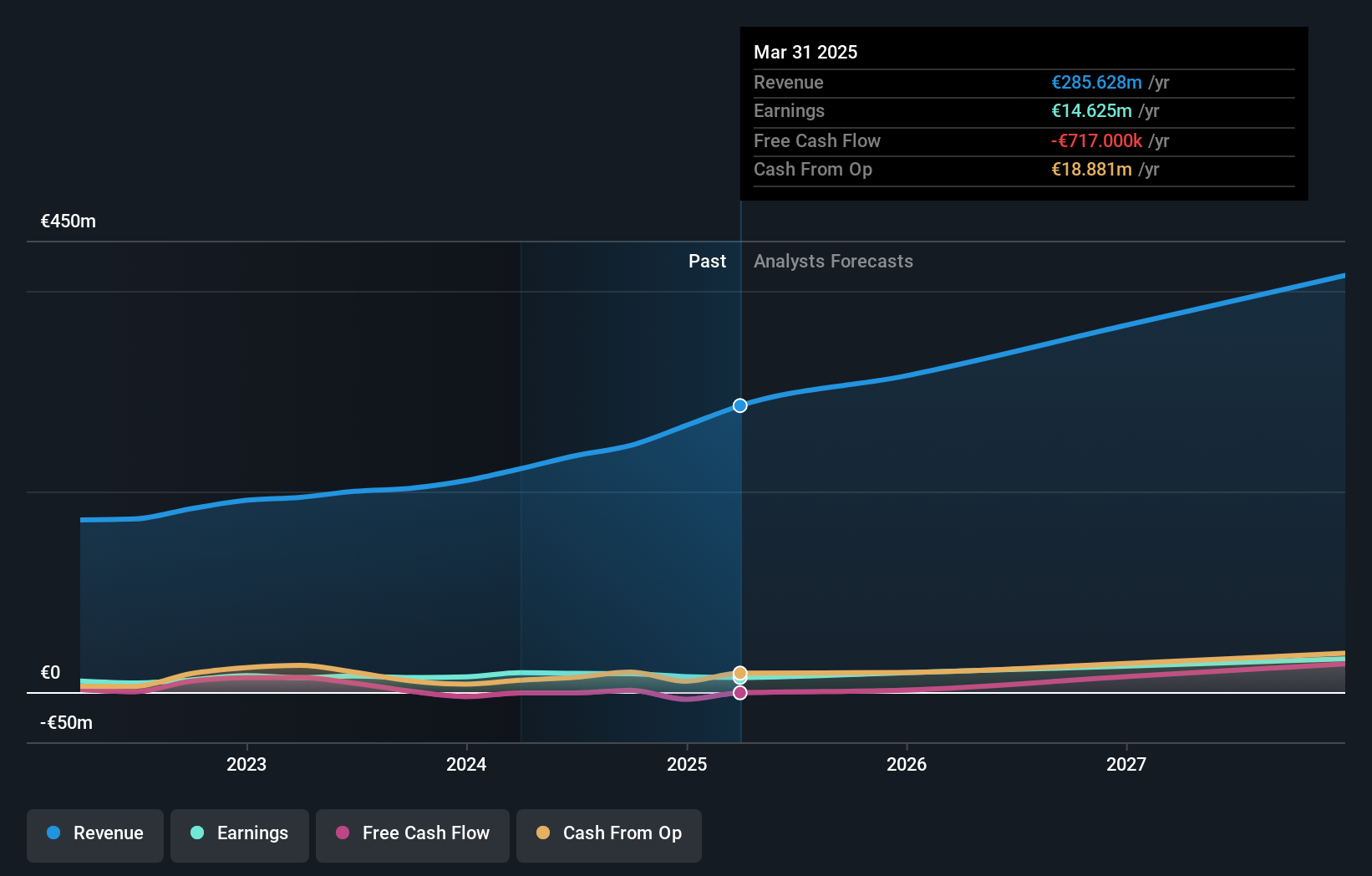

Stemmer Imaging (XTRA:S9I)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stemmer Imaging AG specializes in delivering machine vision technology for various industrial and non-industrial applications globally, with a market capitalization of €324.35 million.

Operations: The company generates revenue primarily from its machine vision technology segment, amounting to €126.23 million.

Stemmer Imaging, amidst a significant acquisition by MiddleGround Management, showcases robust future potential with a 13.3% forecasted annual revenue growth, outpacing the broader German market's 5.5%. This strategic move could enhance its market position significantly, offering an immediate premium of approximately 52% over its recent closing price. Despite a challenging past year with earnings down by 39.4%, projections indicate an impressive recovery with expected earnings growth of 23.2% annually. The company's focus on innovation is underscored by substantial R&D investments aimed at driving further advancements in imaging technology and expanding its competitive edge in this high-tech sector.

- Unlock comprehensive insights into our analysis of Stemmer Imaging stock in this health report.

Evaluate Stemmer Imaging's historical performance by accessing our past performance report.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology, and services on a global scale and has a market capitalization of approximately €257.16 billion.

Operations: The primary revenue stream for SAP is its Applications, Technology & Services segment, which generated approximately €33.27 billion. The company's operations are focused on providing comprehensive technological solutions to a diverse range of industries worldwide.

SAP SE, a stalwart in the software industry, recently uplifted its 2024 earnings guidance, reflecting robust demand for its cloud solutions with projected cloud and software revenue growth of 10.3%. This adjustment underscores a strategic pivot towards high-margin cloud services, which now anticipate generating €17.0 to €17.3 billion. The firm's commitment to innovation is evident from its R&D spending trends, which have consistently aligned with expanding its technological forefront—last year alone, R&D expenses constituted 14% of total revenue. In the latest quarter, SAP not only boosted its operational outlook but also actively returned value to shareholders through an aggressive share repurchase program totaling €750 million for Q3 2024. These moves highlight SAP's dual strategy of driving growth through technological leadership while simultaneously enhancing shareholder returns.

Taking Advantage

- Dive into all 39 of the German High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:S9I

Stemmer Imaging

Provides machine vision technology for industry and non-industry applications worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives