LPKF Laser & Electronics (XTRA:LPK): Five-Year Losses Worsen 35.4% Per Year as Profitability Eludes

Reviewed by Simply Wall St

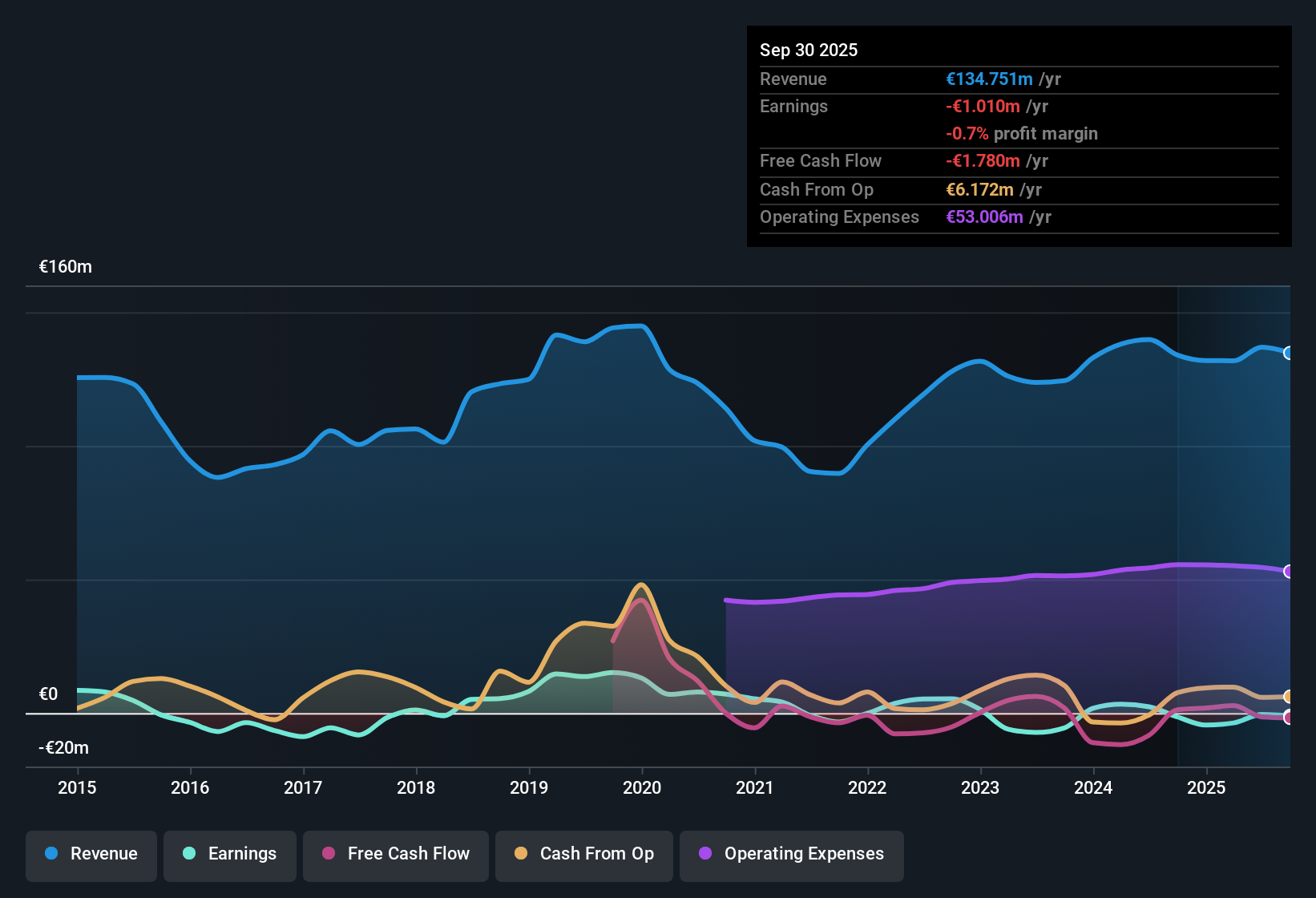

LPKF Laser & Electronics (XTRA:LPK) has remained unprofitable, with annual losses widening by 35.4% per year over the last five years and no signs of improvement in net profit margin. However, revenue is forecast to climb 11.6% per year, substantially outpacing the German market’s 6.1% average. Earnings are projected to increase by 123.34% annually as the company is expected to turn profitable within three years. With shares currently trading at €6.6, well below both the estimated fair value of €40.8 and the average analyst targets, investors are now weighing the potential upside if LPKF can deliver on these ambitious growth projections.

See our full analysis for LPKF Laser & Electronics.Next up, we’ll see how these headline numbers measure up against the market narratives that are shaping investor sentiment, and which expectations might need to be reset.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Deepen Despite High Revenue Growth

- Annual losses have grown by 35.4% per year while revenue is forecast to rise 11.6% annually. This sharp contrast shows LPKF's top-line momentum is not yet translating into bottom-line improvements.

- This heavily supports the prevailing bullish case that robust revenue forecasts set the stage for a turnaround, but continued losses challenge the assumption that profitability will come easily.

- With net profit margin showing no improvement to date, critics highlight that anticipated earnings growth of 123.34% per year depends on future operational changes rather than on any evidence of current profit improvement.

- Forecasts of a transition to profitability within three years excite bulls. However, the persistent loss trend means every forecasted improvement remains only potential, not a present reality.

Valuation Discount Raises Questions

- Shares are trading at €6.6, well below the DCF fair value of €40.80 and even under the analyst price target of €11.00. The price-to-sales multiple is 1.2x versus a peer average of 2.8x.

- The prevailing market view points out that this valuation gap can either signal an overlooked opportunity or a justified discount for a company still searching for profitability.

- Bulls are drawn to the low price-to-sales alongside higher revenue growth versus the market, viewing the gap as a buy signal.

- Despite these discounts, investors have not aggressively bid up the price, reflecting skepticism that forecasted growth will materialize seamlessly given recent widening losses.

Peer Comparison Highlights Industry Pressure

- LPKF’s price-to-sales ratio of 1.2x matches the European electronics industry average, even though the company is outpacing sector revenue growth at 11.6% per year compared to the German market average of 6.1%.

- The prevailing perspective contends that, even with a strong growth outlook, the market is hesitant to re-rate the stock until concrete profitability appears in future results.

- Critics stress that industry averages reflect both risk and execution challenges, limiting multiple expansion until LPKF proves its ability to sustain both growth and profitable operations over time.

- The lack of a premium multiple, even as forecasts point higher, highlights investors’ desire for evidence of fundamental turnaround before rewarding anticipated performance.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on LPKF Laser & Electronics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive revenue growth and strong forecasts, LPKF continues to report widening losses without concrete signs of sustained profitability in recent results.

If you want companies that consistently deliver steady performance instead of unproven rebounds, use our stable growth stocks screener (2100 results) to quickly spot those with reliable earnings and revenue expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LPK

LPKF Laser & Electronics

Develops, manufactures, and sells laser-based solutions for the technology industry worldwide.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives