Unpleasant Surprises Could Be In Store For InTiCa Systems SE's (ETR:IS7) Shares

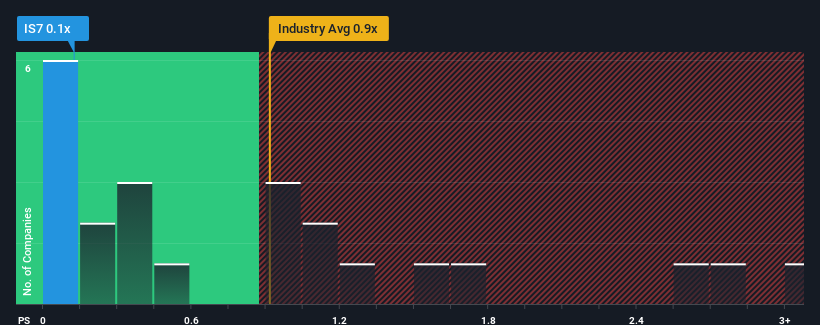

There wouldn't be many who think InTiCa Systems SE's (ETR:IS7) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Electronic industry in Germany is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for InTiCa Systems

What Does InTiCa Systems' P/S Mean For Shareholders?

InTiCa Systems hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on InTiCa Systems.Is There Some Revenue Growth Forecasted For InTiCa Systems?

The only time you'd be comfortable seeing a P/S like InTiCa Systems' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.5%. The last three years don't look nice either as the company has shrunk revenue by 15% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 5.0% per year as estimated by the one analyst watching the company. With the industry predicted to deliver 13% growth per annum, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that InTiCa Systems' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that InTiCa Systems' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 2 warning signs for InTiCa Systems (1 is potentially serious!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:IS7

InTiCa Systems

Develops, produces, and markets inductive components and systems, passive analog circuit technology, and mechatronic assemblies in Germany and internationally.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success