As the European Central Bank continues its monetary easing with a second consecutive rate cut, Germany's DAX Index has seen a modest gain of 1.46%, reflecting positive investor sentiment amid expectations for further economic support. In this context, dividend stocks in Germany present an attractive opportunity for investors seeking steady income streams, especially when considering companies with strong fundamentals and consistent dividend payouts in a low-interest-rate environment.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.82% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.99% | ★★★★★★ |

| SAF-Holland (XTRA:SFQ) | 5.99% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.66% | ★★★★★☆ |

| Mensch und Maschine Software (XTRA:MUM) | 3.00% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.80% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.69% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.31% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.21% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen develops, manufactures, and distributes flatbed displays, monitors, electronic subassemblies, and information systems both in Germany and internationally with a market cap of €103.67 million.

Operations: DATA MODUL's revenue is primarily derived from its Displays segment, contributing €161.99 million, followed by the Systems segment with €96.65 million.

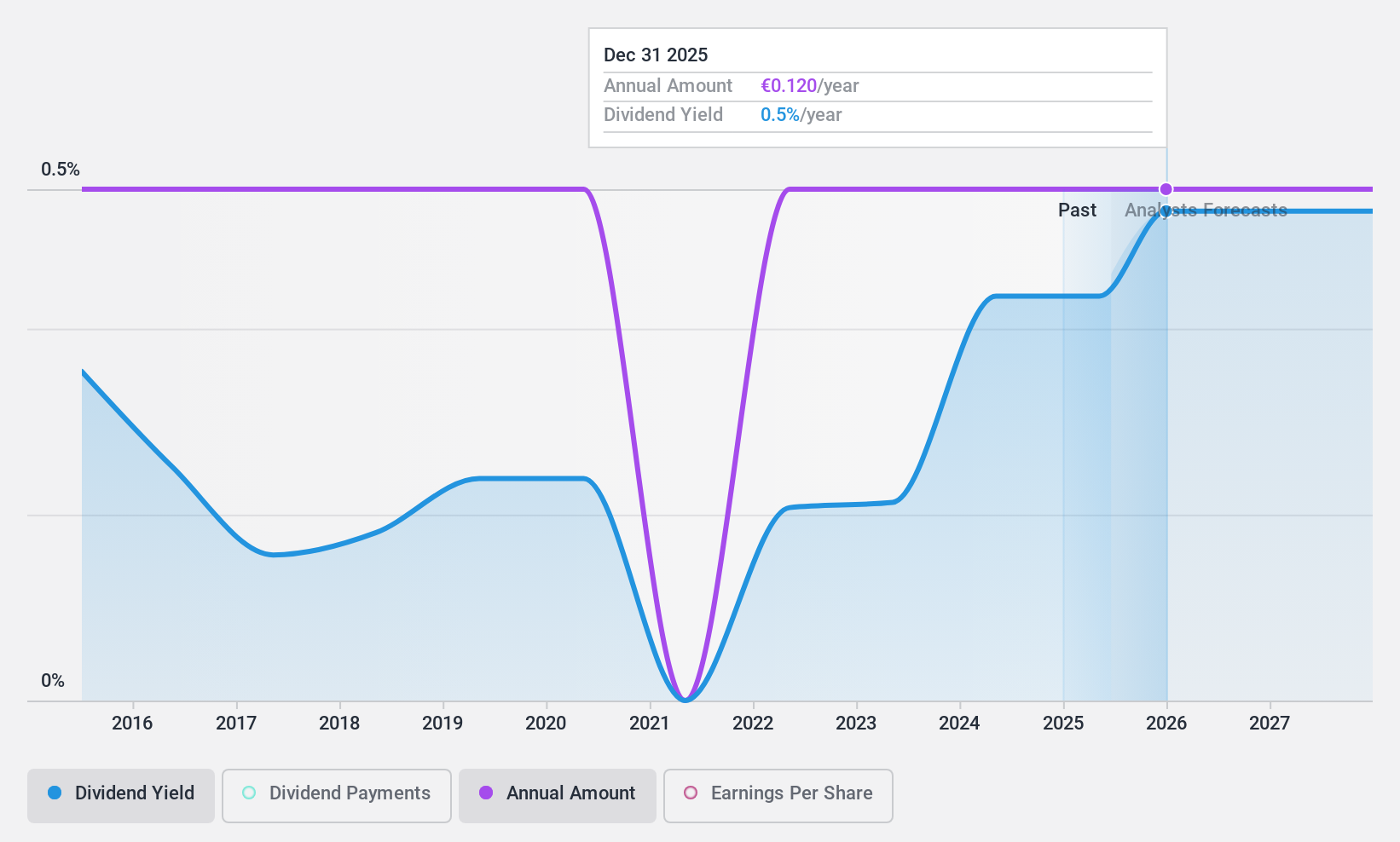

Dividend Yield: 6.8%

DATA MODUL's dividend yield is among the top 25% in Germany, but its dividend history has been volatile and unreliable over the past decade. Despite this, dividends are well-covered by both earnings and cash flows, with a payout ratio of 64% and a cash payout ratio of 19.5%. Recent earnings showed declines in sales and net income compared to last year, which may impact future dividend stability. The stock trades at a favorable price-to-earnings ratio relative to the German market.

- Click to explore a detailed breakdown of our findings in DATA MODUL Produktion und Vertrieb von elektronischen Systemen's dividend report.

- According our valuation report, there's an indication that DATA MODUL Produktion und Vertrieb von elektronischen Systemen's share price might be on the expensive side.

INDUS Holding (XTRA:INH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: INDUS Holding AG is a private equity firm focused on mergers, acquisitions, and corporate spin-offs, with a market cap of €539.13 million.

Operations: INDUS Holding AG generates revenue primarily from its Materials segment (€584.27 million), Engineering segment (€586.92 million), and Infrastructure segment (€567.79 million).

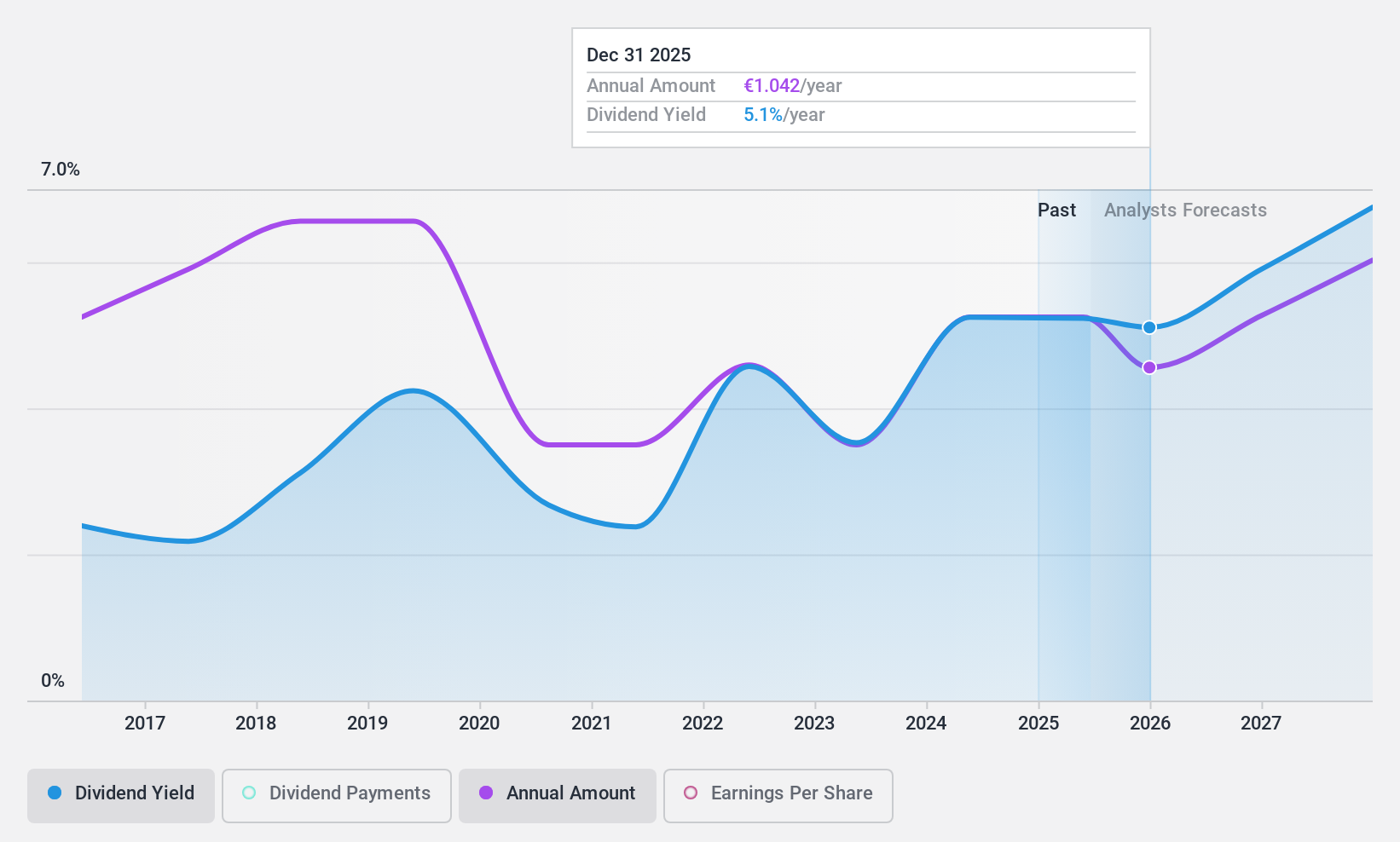

Dividend Yield: 5.7%

INDUS Holding's dividend yield ranks in the top 25% of German payers, yet its dividend history has been unstable over the past decade. Despite this volatility, dividends are well-covered by earnings and cash flows with a payout ratio of 47.1% and a cash payout ratio of 19%. The company recently completed a €25.3 million share buyback but lowered its sales and EBIT guidance for 2024 due to challenging macroeconomic conditions.

- Navigate through the intricacies of INDUS Holding with our comprehensive dividend report here.

- Our expertly prepared valuation report INDUS Holding implies its share price may be lower than expected.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling solutions in Germany and internationally, with a market cap of €934.61 million.

Operations: Mensch und Maschine Software SE's revenue is derived from its M+M Software segment, which generated €107.95 million, and its M+M Digitization segment, contributing €242.22 million.

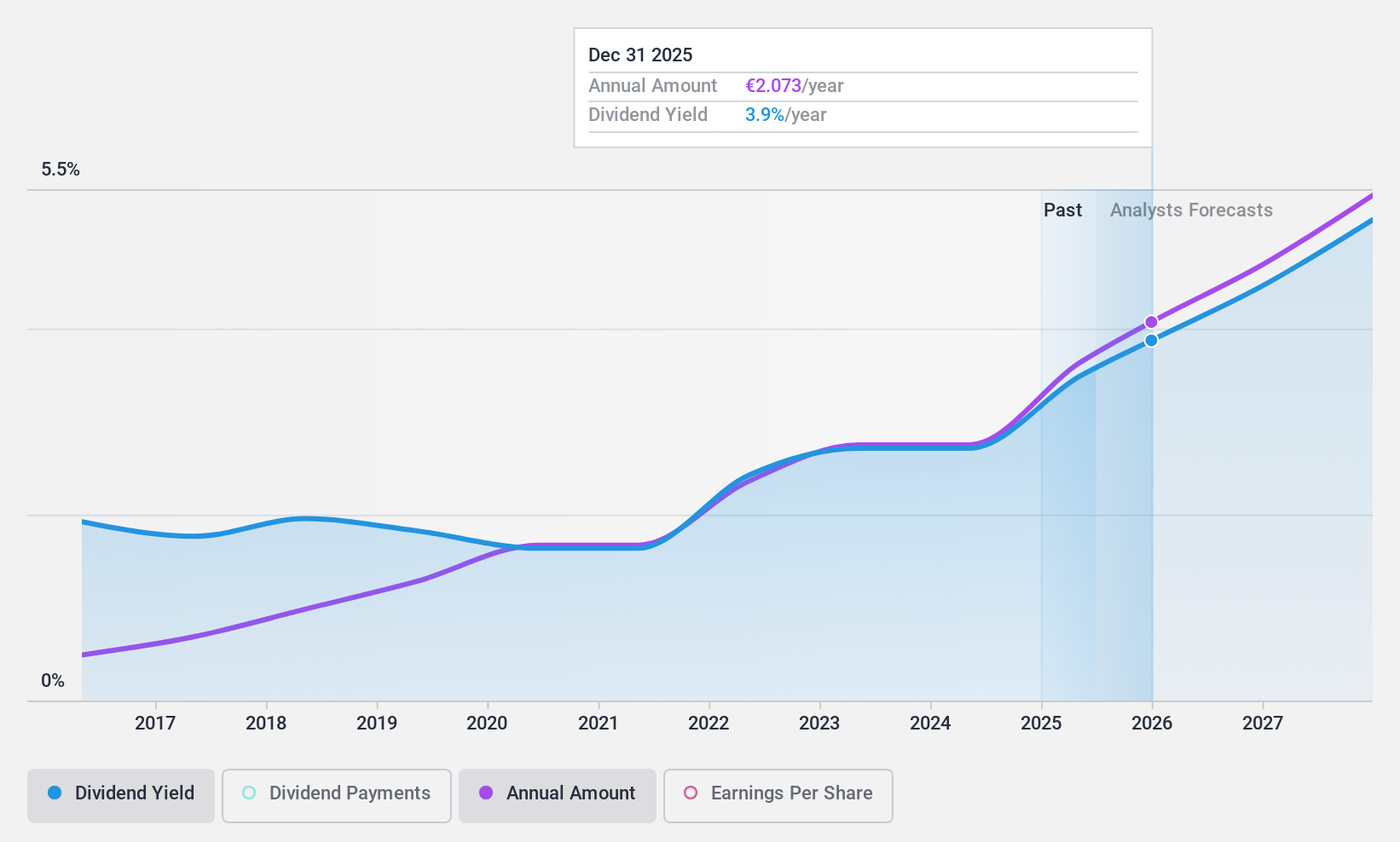

Dividend Yield: 3%

Mensch und Maschine Software offers a stable dividend, with payments covered by earnings (87.2% payout ratio) and cash flows (60.8% cash payout ratio). Despite a modest 3% yield, dividends have grown consistently over the past decade. Recent financial results show robust growth, with Q3 sales rising to €94.11 million from €67.84 million and net income increasing to €6.43 million from €4.89 million year-on-year, supporting its dividend sustainability amidst strong earnings growth forecasts of 13.96%.

- Click here and access our complete dividend analysis report to understand the dynamics of Mensch und Maschine Software.

- According our valuation report, there's an indication that Mensch und Maschine Software's share price might be on the cheaper side.

Summing It All Up

- Take a closer look at our Top German Dividend Stocks list of 32 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MUM

Mensch und Maschine Software

Provides computer aided design, manufacturing, and engineering (CAD/CAM/CAE), product data management, and building information modeling/management solutions in Germany and internationally.

Flawless balance sheet with solid track record and pays a dividend.