As European markets navigate the complexities of escalating global trade tensions, the pan-European STOXX Europe 600 Index recently saw a decline of 1.92%, reflecting broader concerns about economic growth and financial stability. In this environment, identifying high-growth tech stocks requires a keen focus on companies that demonstrate resilience through innovation and adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 20.52% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.54% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.76% | 91.18% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

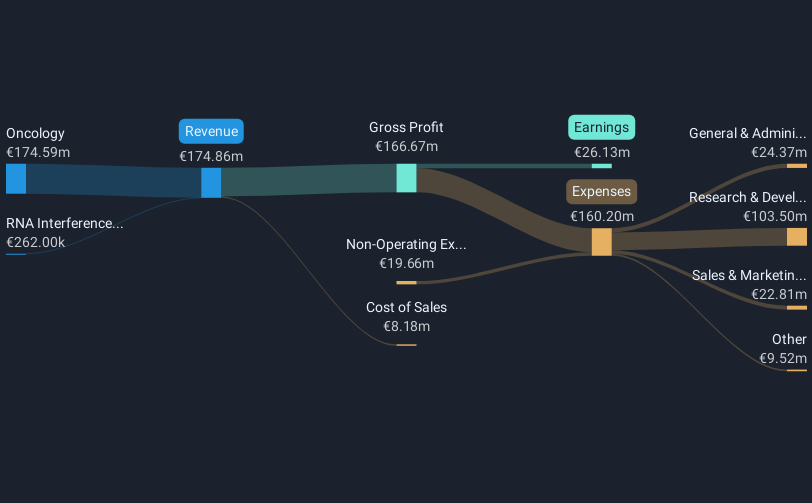

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various international markets, with a market cap of €1.29 billion.

Operations: The company generates revenue primarily from its oncology segment, which accounts for €174.59 million, while RNA Interference (RNAi) contributes a smaller portion at €0.26 million.

Pharma Mar has demonstrated a robust trajectory in the high-growth tech landscape of Europe, marked by a substantial earnings increase of 2197.7% over the past year, significantly outpacing the Biotechs industry's -3.8%. This surge is underpinned by an impressive annual revenue growth forecast at 24.2%, poised to exceed the broader Spanish market's 5.1%. Recently, Pharma Mar committed to enhancing shareholder returns, proposing a 23% dividend hike and showcasing its advancements at significant industry events like the European Lung Cancer Conference and Needham Virtual Healthcare Conference. These strategic moves underscore its commitment to growth amidst a volatile share price environment, reflecting both challenges and opportunities ahead.

- Dive into the specifics of Pharma Mar here with our thorough health report.

Review our historical performance report to gain insights into Pharma Mar's's past performance.

USU Software (HMSE:OSP2)

Simply Wall St Growth Rating: ★★★★☆☆

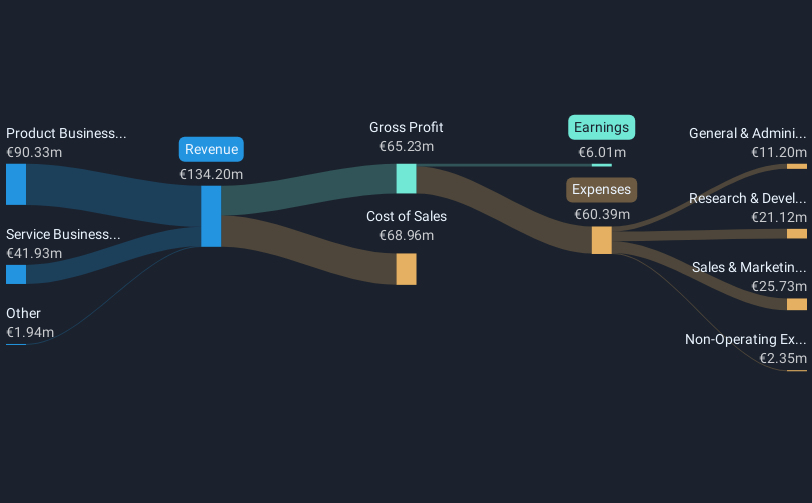

Overview: USU Software AG, along with its subsidiaries, offers software and service solutions for IT and customer service management both in Germany and globally, with a market cap of €220.80 million.

Operations: USU Software AG generates revenue primarily through its Product Business, contributing €90.33 million, and its Service Business, adding €41.93 million. The company operates in the IT and customer service management sectors across Germany and internationally.

USU Software AG is carving a niche in the high-growth tech sector, particularly through its recent innovations in quantum AI and cloud cost management. The company's AutoQML project, backed by the German Federal Ministry for Economic Affairs and Climate Action, merges automated machine learning with quantum computing to enhance efficiency—a significant leap forward for medium-sized enterprises seeking advanced yet accessible AI solutions. Additionally, USU's new FinOps solution addresses the critical need for better cloud expense management, promising enhanced transparency and control over financial operations. These strategic initiatives not only reflect USU’s commitment to technological advancement but also position it well within Europe’s competitive tech landscape, where annual earnings are expected to surge by 30.7%.

- Click to explore a detailed breakdown of our findings in USU Software's health report.

Gain insights into USU Software's historical performance by reviewing our past performance report.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★☆

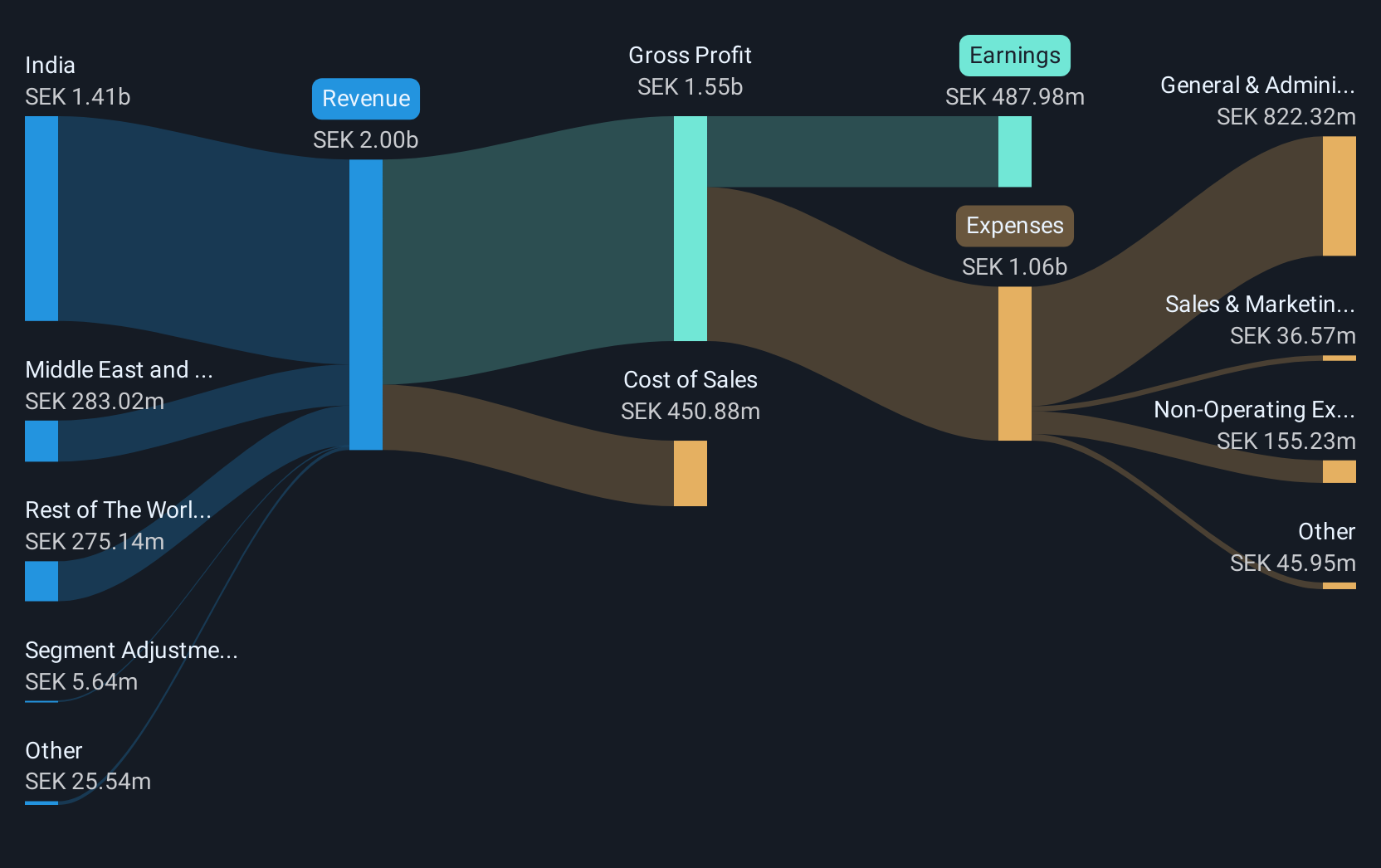

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally with a market capitalization of SEK22.37 billion.

Operations: The company generates revenue primarily from its communications software segment, amounting to SEK1.88 billion.

Truecaller is enhancing its market position in Europe's tech sector by focusing on innovative caller identification and spam protection solutions. With a strategic partnership with Telecom Egypt, Truecaller aims to redefine secure and personalized communication, evident from their recent introduction of Video Caller ID capabilities. This move aligns with the growing demand for reliable communication technologies in an era marked by privacy concerns. Financially, Truecaller reported a robust annual revenue growth of 19.9% and an earnings increase of 24.5%, underpinned by significant R&D investments amounting to SEK 250 million last year—about 13% of their total revenue—which underscores their commitment to continuous innovation in the tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Truecaller.

Understand Truecaller's track record by examining our Past report.

Key Takeaways

- Reveal the 228 hidden gems among our European High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PHM

Pharma Mar

A biopharmaceutical company, focuses on the research, development, production, and commercialization of bio-active principles for the use in oncology in Spain, Italy, Germany, Ireland, France, rest of the European Union, the United States, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives