Why We're Not Concerned About CPU Softwarehouse AG's (FRA:CPU2) Share Price

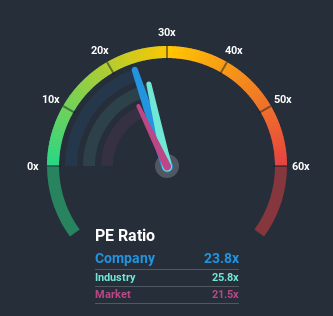

With a price-to-earnings (or "P/E") ratio of 23.8x CPU Softwarehouse AG (FRA:CPU2) may be sending bearish signals at the moment, given that almost half of all companies in Germany have P/E ratios under 21x and even P/E's lower than 12x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been quite advantageous for CPU Softwarehouse as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for CPU Softwarehouse

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as CPU Softwarehouse's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 83% gain to the company's bottom line. The latest three year period has also seen an excellent 495% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

In contrast to the company, the rest of the market is expected to decline by 5.0% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we can see why CPU Softwarehouse is trading at a high P/E compared to the market. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of CPU Softwarehouse revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Having said that, be aware CPU Softwarehouse is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than CPU Softwarehouse. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade CPU Softwarehouse, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About DB:CPU2

CPU Softwarehouse

Operates as an IT and consulting company in Germany and internationally.

Slight risk with weak fundamentals.

Market Insights

Community Narratives