TeamViewer (XTRA:TMV) Margin Beat Reinforces Bullish Narratives Despite Share Price Discount

Reviewed by Simply Wall St

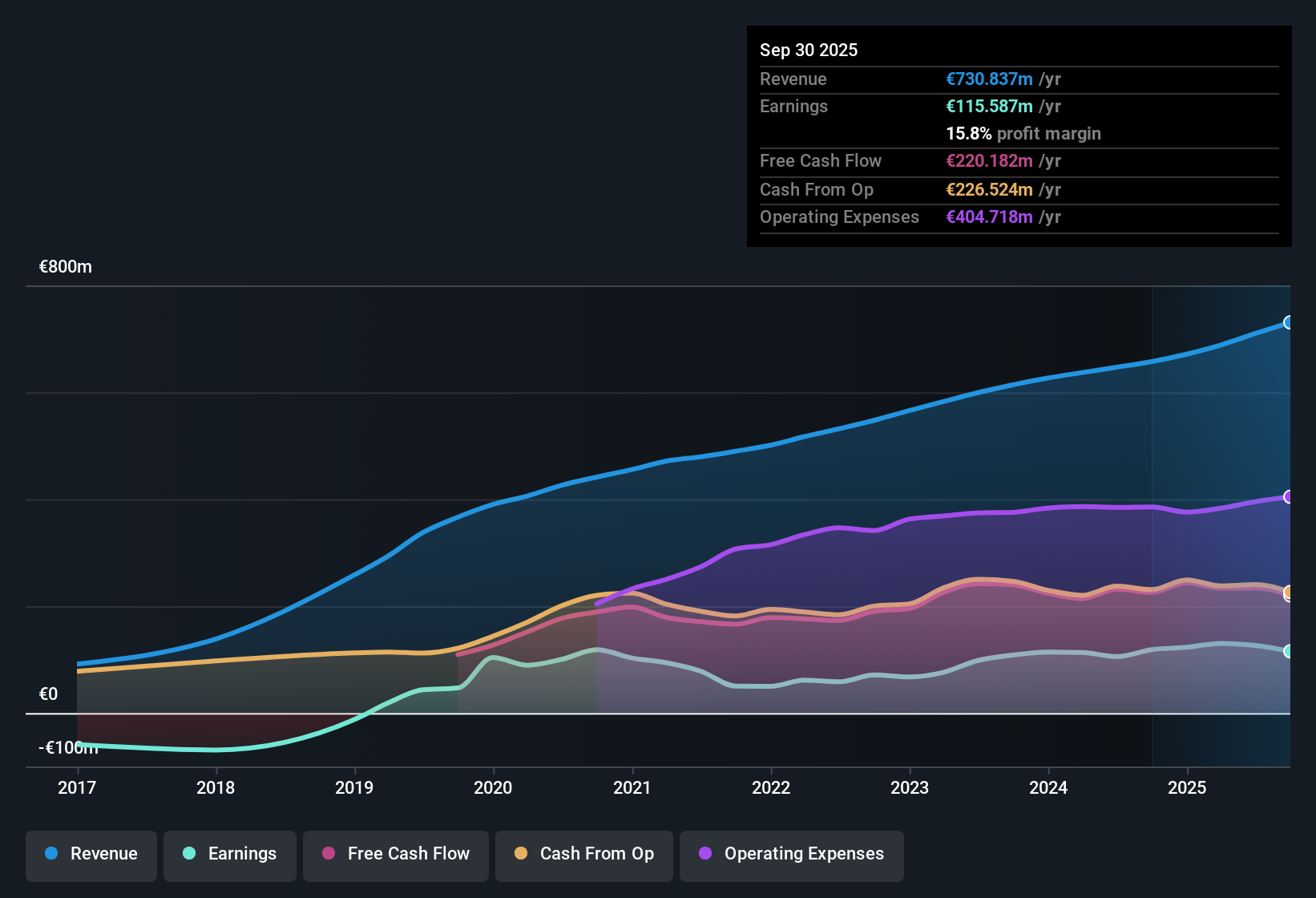

TeamViewer (XTRA:TMV) posted robust earnings, with net profit margins rising to 17.8% from 16.3% a year ago. Over the last five years, annual earnings have grown by 11.1%, while the most recent twelve months saw a 19.6% jump in earnings. With earnings forecast to grow by 14.1% per year and revenue expected to increase at 7.7% annually, outpacing the broader German market, investors have plenty of growth drivers to watch. At the same time, share price and financial stability risks remain part of the story.

See our full analysis for TeamViewer.Next, we will see how these headline results measure up against the current narratives circulating around TeamViewer, highlighting where the company’s story matches or surprises market expectations.

See what the community is saying about TeamViewer

Margins Climb Alongside Efficient Acquisitions

- Net profit margins have reached 17.8%, up from 16.3% last year. Analysts are projecting a further rise to 21.1% within three years.

- Analysts' consensus narrative highlights that post-merger integration with 1E moved faster than planned, unlocking operational synergies and streamlining processes. This is already lifting EBITDA margins to around 44%, with further room for net margin improvement as revenue growth resumes.

- This deepening margin improvement heavily supports the consensus bullish view that TeamViewer's consolidation efforts and platform integration are directly translating into higher profitability and predictable SaaS revenue streams.

- What stands out is that better contract stability and margin expansion echo analysts’ expectations for more resilient long-term earning potential. Integration and upselling advances are fueling optimism about TeamViewer's strategic direction.

- The consensus also notes the company’s ability to deepen enterprise relationships. Boosting multiyear contracts and recurring revenues through digital workplace management positioning are central to the improved outlook.

- By pairing new offerings like DEX Essentials with longstanding enterprise partnerships such as SAP and Siemens, TeamViewer establishes stickier client relationships and higher retention. This validates a core consensus narrative strength.

- These developments challenge any notion that TeamViewer’s earnings gains are merely cyclical upticks. Instead, they point to longer-lasting structural improvements driven by integration and operational efficiency.

SMB Exposure and Competitive Threats Remain

- The company relies heavily on the small and midsize business (SMB) segment, which is seeing a modest 1% annual growth in annual recurring revenue (ARR) and heightened churn risk according to the consensus narrative.

- Consensus narrative notes that competition and the slow ramp of new differentiated products like DEX Essentials represent key vulnerabilities for TeamViewer’s future growth and profitability.

- Bears argue that intensifying competition from larger tech rivals and the company’s pace of innovation, with only early traction on transformative offerings, could curb revenue momentum and dilute pricing power in critical market segments.

- Analysts also worry that exposure to uncertain U.S. federal sector budgets and macro pressures in regional markets could threaten sales pipelines and overall profitability, particularly for newly acquired 1E solutions.

PE Ratio and Share Price Far Below Peers

- TeamViewer trades at a price-to-earnings ratio of 8.2x, well below both its peer average of 27.8x and the European Software industry average of 28.8x. With a current share price of €6.65, the company sits at a considerable 55% discount to its DCF fair value of €24.71 and about 56% below the analyst target price of €15.03.

- Analysts' consensus view flags this unusually low valuation as a sign of disconnect. If margin expansion and top-line growth continue, TeamViewer has significant catch-up potential.

- The wide discount to both fair value and analyst targets, despite improving profitability and sector-beating growth rates, creates tension with cautionary market sentiment. This shows the market may be underpricing legitimate growth prospects.

- Investors should sense check their own assumptions and remain aware that valuation gaps can persist if financial or market risks, such as stability or competitive threats, are not convincingly addressed in the coming quarters.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TeamViewer on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Use your insight to quickly build your own narrative and share your unique outlook. Do it your way

A great starting point for your TeamViewer research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

TeamViewer’s reliance on its SMB segment and rising competition means future growth could be challenged by sluggish renewals and weaker resilience to market shifts.

Want more consistent earnings and less drama? Try finding companies with steady performance and safeguarded growth by starting with stable growth stocks screener (2095 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TeamViewer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TMV

Undervalued with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in