Is SAP’s AI and Cloud Push Enough to Support Its Current Share Price?

Reviewed by Bailey Pemberton

- Wondering if SAP at around €210 is a bargain or a bubble? You are not alone, and this breakdown is going to tackle that value question head on.

- Over the last week the stock has inched up about 1.0%, but that is against a tougher backdrop of a 2.6% decline over 30 days and roughly 12.0% down year to date, after still being up more than 100% over three years.

- Recently, SAP has stayed in the spotlight as investors focus on its push to embed AI into its core enterprise software and its ongoing cloud migration strategy. Both of these themes have been reshaping expectations for long term growth. There have also been recurring headlines about strategic partnerships with major hyperscalers and large digital transformation wins with global clients, adding fuel to the debate about how much growth is already priced in.

- On our checks, SAP scores a 3/6 valuation score, which suggests it looks undervalued on some metrics but not across the board. We will walk through different valuation lenses next, and then finish with an even more intuitive way to think about what the stock is really worth.

Approach 1: SAP Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes SAP's expected future cash flows and discounts them back to what they are worth today, using a required rate of return. It is essentially asking what an investor should be willing to pay now for the cash the business can generate in the future.

SAP currently generates about €6.4 billion in free cash flow, and analyst forecasts plus Simply Wall St extrapolations point to this rising steadily over time, reaching roughly €17.0 billion by 2035. This trajectory is based on detailed annual projections for the next decade, which gradually slow from double digit growth towards more modest mid single digit increases as the business matures.

When all of those projected cash flows are discounted back to today, the DCF model yields an intrinsic value of around €250 per share. Compared with the current market price of about €210, that implies SAP is trading at roughly a 16.1% discount to its estimated fair value, suggesting the market is not fully pricing in its long term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SAP is undervalued by 16.1%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: SAP Price vs Earnings

For a mature, profitable software company like SAP, the Price to Earnings ratio is a practical way to judge valuation because it links what investors pay today directly to the profits the business is already generating. In general, faster and more reliable earnings growth, combined with lower perceived risk, justify a higher normal PE multiple, while slower growth or elevated risk argue for a lower one.

SAP currently trades on about 34.5x earnings, which is above the broader Software industry average of roughly 27.1x and modestly above the peer group average of about 31.2x. On the surface, that premium suggests the market is already paying up for SAP’s quality and growth profile, but it does not tell the full story.

Simply Wall St’s Fair Ratio framework estimates what PE multiple a company should command after adjusting for its earnings growth outlook, profitability, risk profile, size and industry. For SAP, this Fair Ratio comes out at around 38.0x, higher than both its current 34.5x and the peer and industry benchmarks. That implies the stock is pricing in less growth and quality than the model suggests is warranted, pointing to valuation upside on a multiples basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

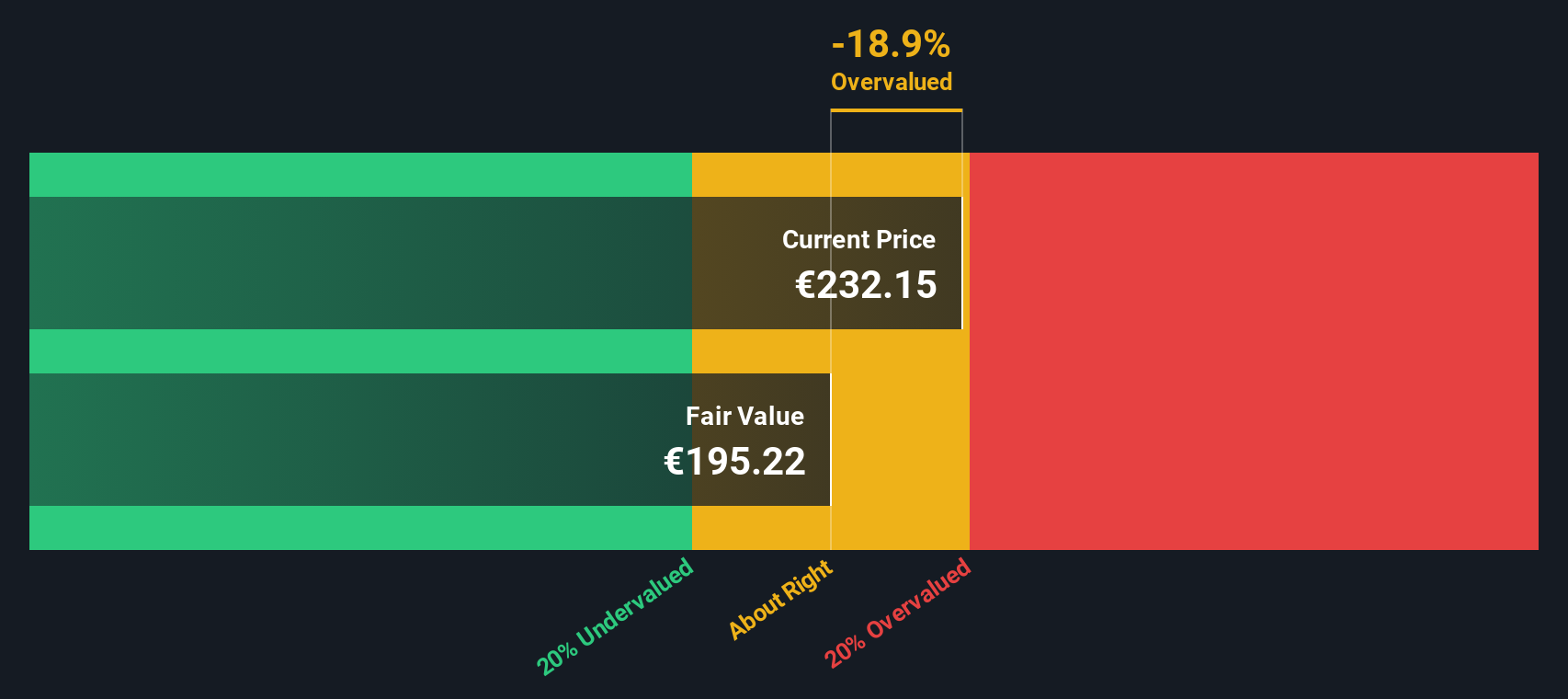

Upgrade Your Decision Making: Choose your SAP Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple, story driven frameworks on Simply Wall St’s Community page that let you connect your view of a company with explicit revenue, earnings and margin assumptions, link those to a fair value, and then see whether SAP looks like a buy or a sell at today’s price. Narratives update automatically when new news or earnings arrive and can reveal how some investors might, for example, build a more cautious SAP Narrative that points to fair value near €192 per share, while others, using more optimistic growth, profitability and multiple assumptions, land closer to €345. This gives you a clear sense of where your own view sits on the spectrum and how that should guide your next move.

Do you think there's more to the story for SAP? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026