- Romania

- /

- Aerospace & Defense

- /

- BVB:TBM

European Penny Stocks With Market Caps Over €8M To Watch

Reviewed by Simply Wall St

The European stock market recently experienced a slight downturn, with the pan-European STOXX Europe 600 Index snapping a ten-week streak of gains amid concerns over U.S. trade policy. Despite this, the focus on defense and infrastructure spending in Germany and the EU has helped moderate losses, offering some optimism for investors. In this context, penny stocks—often smaller or newer companies—remain intriguing options for those looking to explore beyond established names. While often seen as relics of past market eras, these stocks can offer significant growth potential when backed by solid financial fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.79 | SEK284.19M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.14 | SEK207.11M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.976 | €32.68M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK4.02 | SEK244.57M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.70 | €53.03M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.195 | €303.78M | ★★★★★★ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.40 | €24.25M | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.992 | SEK1.91B | ★★★★☆☆ |

| IMS (WSE:IMS) | PLN3.60 | PLN122.02M | ★★★★☆☆ |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.725 | RON844.44M | ★★★★★★ |

Click here to see the full list of 434 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Turbomecanica (BVB:TBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Turbomecanica SA manufactures and sells engines, mechanical assemblies, and equipment for aircraft and helicopters across Europe, Asia, and the United States with a market cap of RON162.55 million.

Operations: Turbomecanica SA does not report specific revenue segments.

Market Cap: RON162.55M

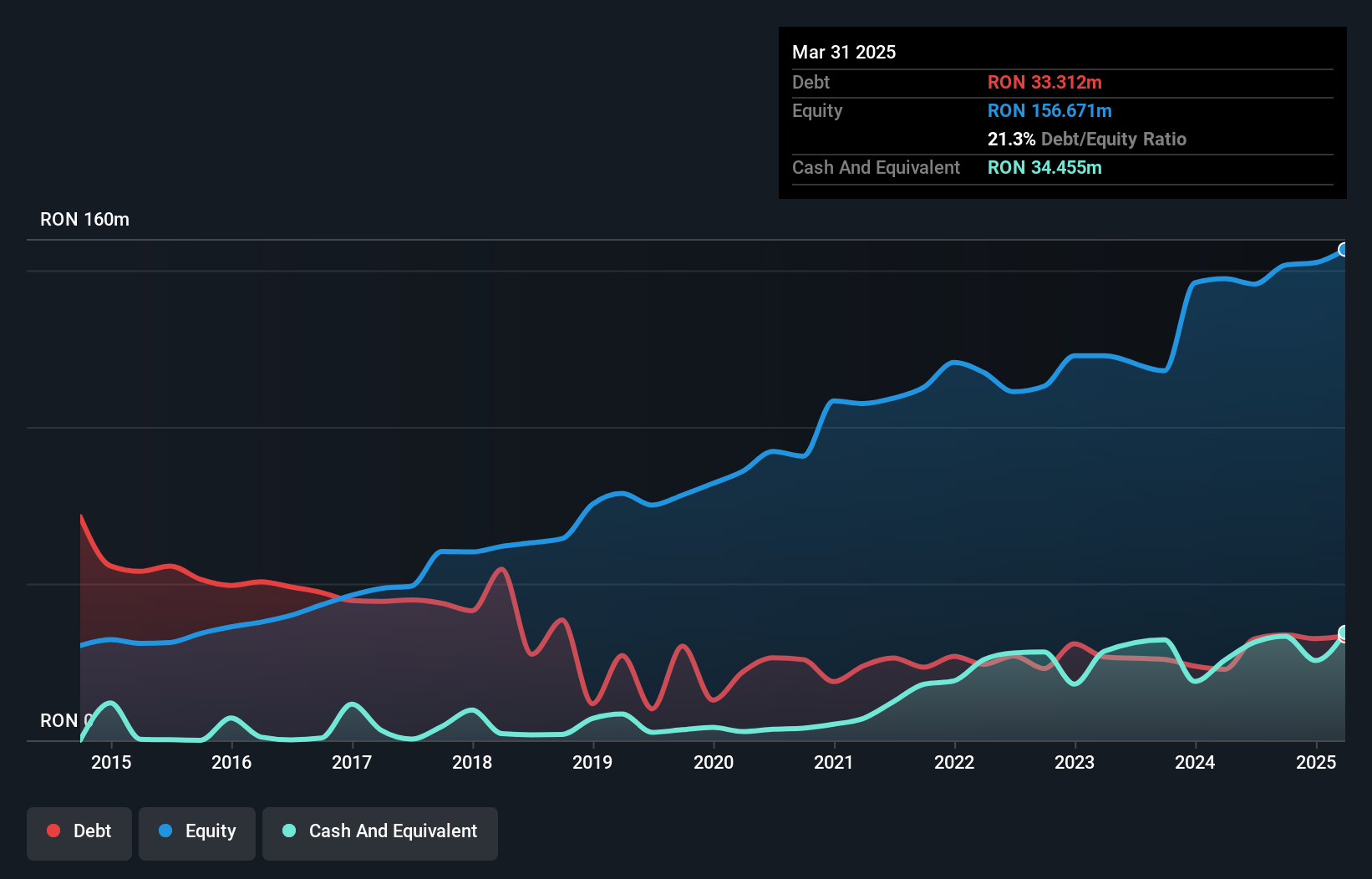

Turbomecanica SA, with a market cap of RON162.55 million, recently reported improved financial performance for 2024, with sales rising to RON142.5 million and net income increasing to RON12.23 million. The company maintains strong short-term asset coverage over liabilities and its debt is well-managed by operating cash flow at 73.9%. Despite a low Return on Equity of 8.2%, earnings growth has accelerated to 9.7% over the past year, surpassing its five-year average decline of 1.9%. However, dividend sustainability remains a concern as it is not well covered by free cash flows.

- Dive into the specifics of Turbomecanica here with our thorough balance sheet health report.

- Learn about Turbomecanica's historical performance here.

Xilam Animation (ENXTPA:XIL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xilam Animation is an integrated animation studio that creates, produces, and distributes original programs for children and adults in France and internationally, with a market cap of €14.45 million.

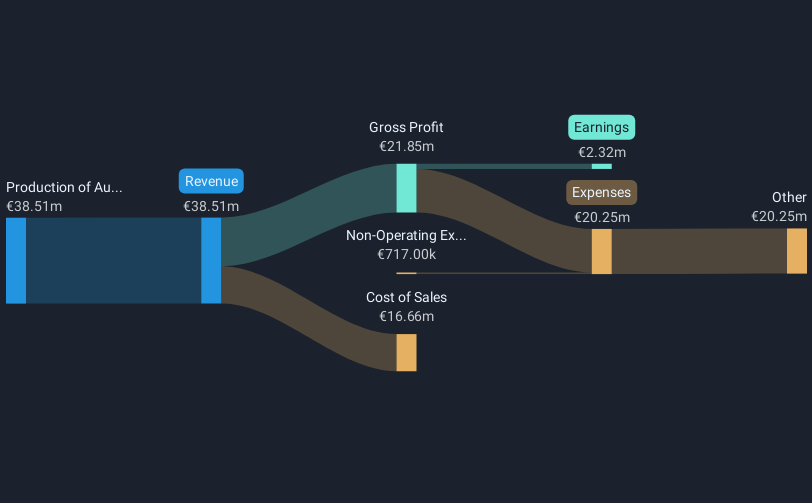

Operations: The company's revenue is primarily derived from the production of audiovisual works and related products, amounting to €38.51 million.

Market Cap: €14.45M

Xilam Animation, with a market cap of €14.45 million, has seen significant earnings growth of 541.7% over the past year, surpassing both its own five-year average decline and the Entertainment industry growth rate. The company's net profit margin improved to 6%, indicating higher quality earnings without shareholder dilution. Despite a low Return on Equity at 3%, its debt is well covered by operating cash flow, and short-term assets exceed long-term liabilities. However, challenges remain as short-term liabilities are not fully covered by assets and interest payments have limited coverage by EBIT. The stock trades at a favorable price-to-earnings ratio compared to the French market but exhibits high volatility.

- Get an in-depth perspective on Xilam Animation's performance by reading our balance sheet health report here.

- Gain insights into Xilam Animation's future direction by reviewing our growth report.

RealTech (XTRA:RTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RealTech AG is a company that offers IT service management and SAP automation solutions in Germany and the Asia Pacific, with a market cap of €8.13 million.

Operations: The company's revenue is derived from €6.45 million in Germany and €4.08 million in the Asia-Pacific region.

Market Cap: €8.13M

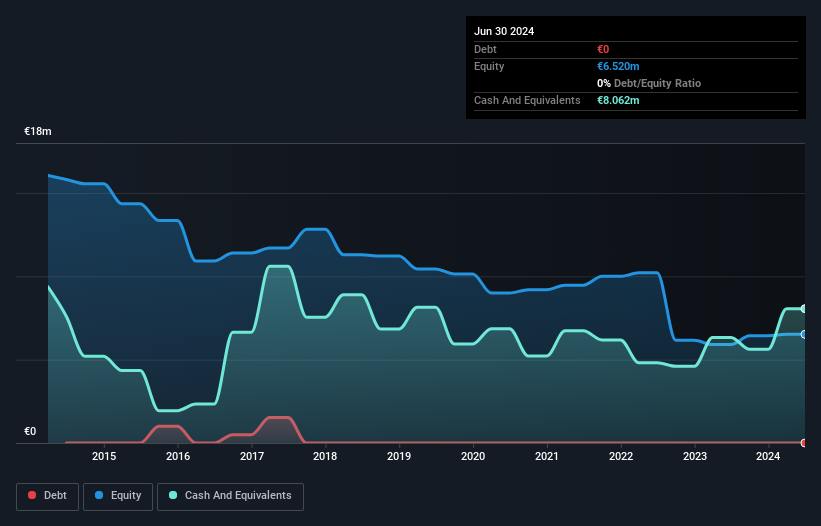

RealTech AG, with a market cap of €8.13 million, has recently turned profitable, making comparisons to past earnings growth challenging. The company operates without debt, alleviating concerns about interest payments and debt coverage. Its short-term assets of €9.5 million comfortably exceed both short-term liabilities (€3.4 million) and long-term liabilities (€121.4K). Despite high-quality earnings and no shareholder dilution in the past year, the stock remains highly volatile compared to most German stocks. Trading significantly below its estimated fair value could present an opportunity for investors mindful of volatility risks and low Return on Equity at 8%.

- Click here to discover the nuances of RealTech with our detailed analytical financial health report.

- Assess RealTech's previous results with our detailed historical performance reports.

Key Takeaways

- Gain an insight into the universe of 434 European Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turbomecanica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:TBM

Turbomecanica

Manufactures and sells engines, mechanical assemblies, and equipment for aircraft and helicopters in Europe, Asia, and the United States.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives