Is There More To The Story Than Mensch und Maschine Software's (ETR:MUM) Earnings Growth?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Mensch und Maschine Software's (ETR:MUM) statutory profits are a good guide to its underlying earnings.

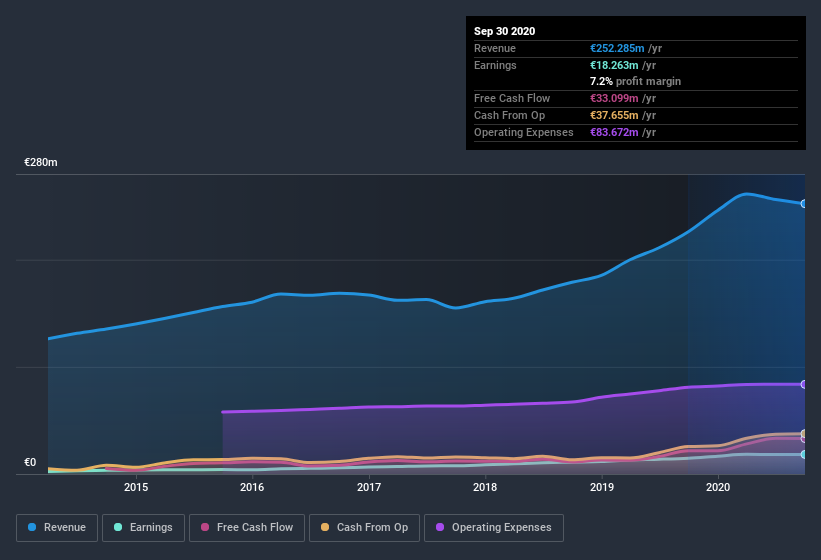

We like the fact that Mensch und Maschine Software made a profit of €18.3m on its revenue of €252.3m, in the last year. Happily, it has grown both its profit and revenue over the last three years, as you can see in the chart below.

See our latest analysis for Mensch und Maschine Software

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. As a result, we think it's well worth considering what Mensch und Maschine Software's cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against Mensch und Maschine Software's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Mensch und Maschine Software has an accrual ratio of -0.19 for the year to September 2020. That indicates that its free cash flow quite significantly exceeded its statutory profit. In fact, it had free cash flow of €33m in the last year, which was a lot more than its statutory profit of €18.3m. Mensch und Maschine Software shareholders are no doubt pleased that free cash flow improved over the last twelve months.

Our Take On Mensch und Maschine Software's Profit Performance

As we discussed above, Mensch und Maschine Software's accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Based on this observation, we consider it possible that Mensch und Maschine Software's statutory profit actually understates its earnings potential! And on top of that, its earnings per share have grown at an extremely impressive rate over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Mensch und Maschine Software as a business, it's important to be aware of any risks it's facing. You'd be interested to know, that we found 1 warning sign for Mensch und Maschine Software and you'll want to know about this.

This note has only looked at a single factor that sheds light on the nature of Mensch und Maschine Software's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Mensch und Maschine Software or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:MUM

Mensch und Maschine Software

Provides computer aided design, manufacturing, and engineering (CAD/CAM/CAE), product data management, and building information modeling/management solutions in Germany and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives