In the current global market landscape, uncertainties surrounding policy changes and economic indicators have led to a mixed performance across various sectors, with notable fluctuations in U.S. stocks and a cautious stance from the Federal Reserve on interest rates. Amidst these dynamics, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those looking to enhance their portfolios in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.68% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.83% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.55% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

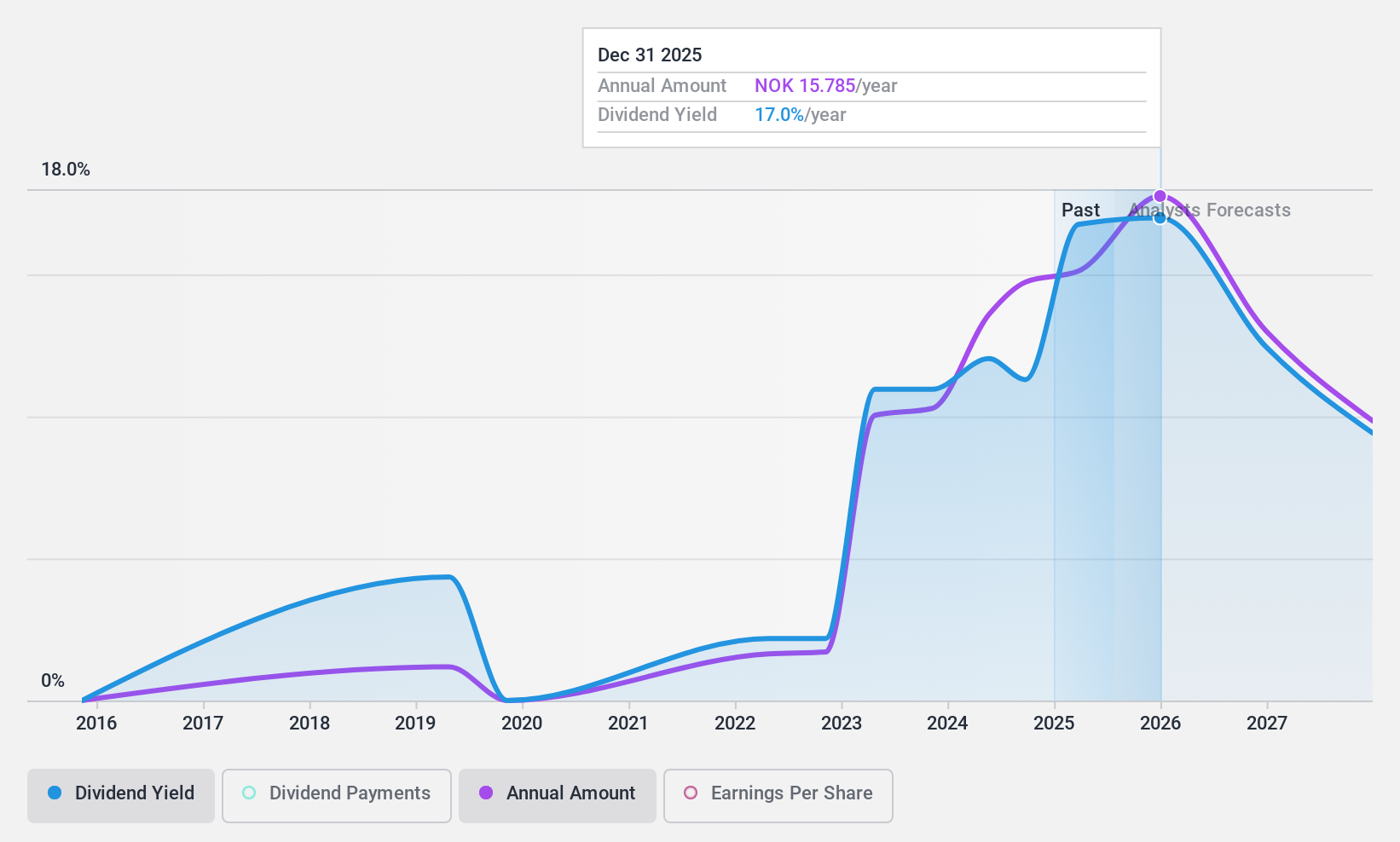

Wallenius Wilhelmsen (OB:WAWI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wallenius Wilhelmsen ASA, along with its subsidiaries, operates in the global logistics and transportation sector with a market capitalization of NOK46.07 billion.

Operations: Wallenius Wilhelmsen ASA generates its revenue from three main segments: Shipping Services ($3.90 billion), Logistics Services ($1.21 billion), and Government Services ($397 million).

Dividend Yield: 10%

Wallenius Wilhelmsen's dividend payments are well covered by cash flows, with a low cash payout ratio of 25.5%, but earnings coverage is tighter at 89.5%. Despite its high yield in the Norwegian market, the dividend history has been volatile over the past decade. Recent multi-year contracts, including a US$580 million deal with an automotive manufacturer and a US$766 million agreement with an equipment manufacturer, may bolster future financial stability and dividend sustainability.

- Take a closer look at Wallenius Wilhelmsen's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Wallenius Wilhelmsen is trading behind its estimated value.

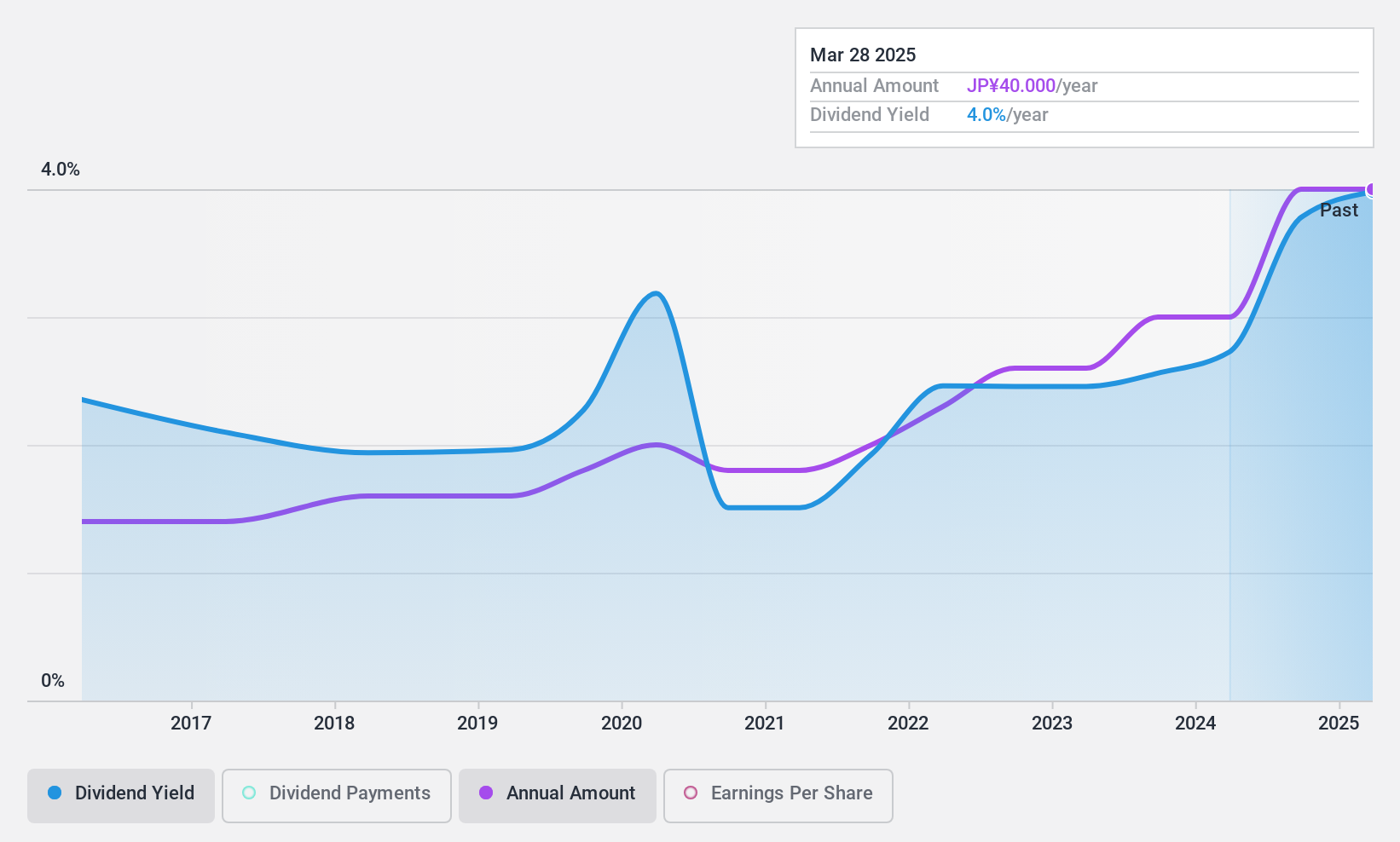

Cube System (TSE:2335)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cube System Inc. offers a range of technological services both in Japan and internationally, with a market cap of ¥15.75 billion.

Operations: Cube System Inc.'s revenue segments include various technological services provided domestically and internationally.

Dividend Yield: 3.8%

Cube System's dividend yield of 3.81% ranks in the top 25% of JP market payers, yet its payments have been volatile and unreliable over the past decade. The company's low payout ratio of 24.6% indicates dividends are well covered by earnings, but a high cash payout ratio of 240% reveals insufficient cash flow coverage, raising sustainability concerns. Recent earnings growth may support future stability if maintained amidst current financial challenges.

- Unlock comprehensive insights into our analysis of Cube System stock in this dividend report.

- Our valuation report here indicates Cube System may be overvalued.

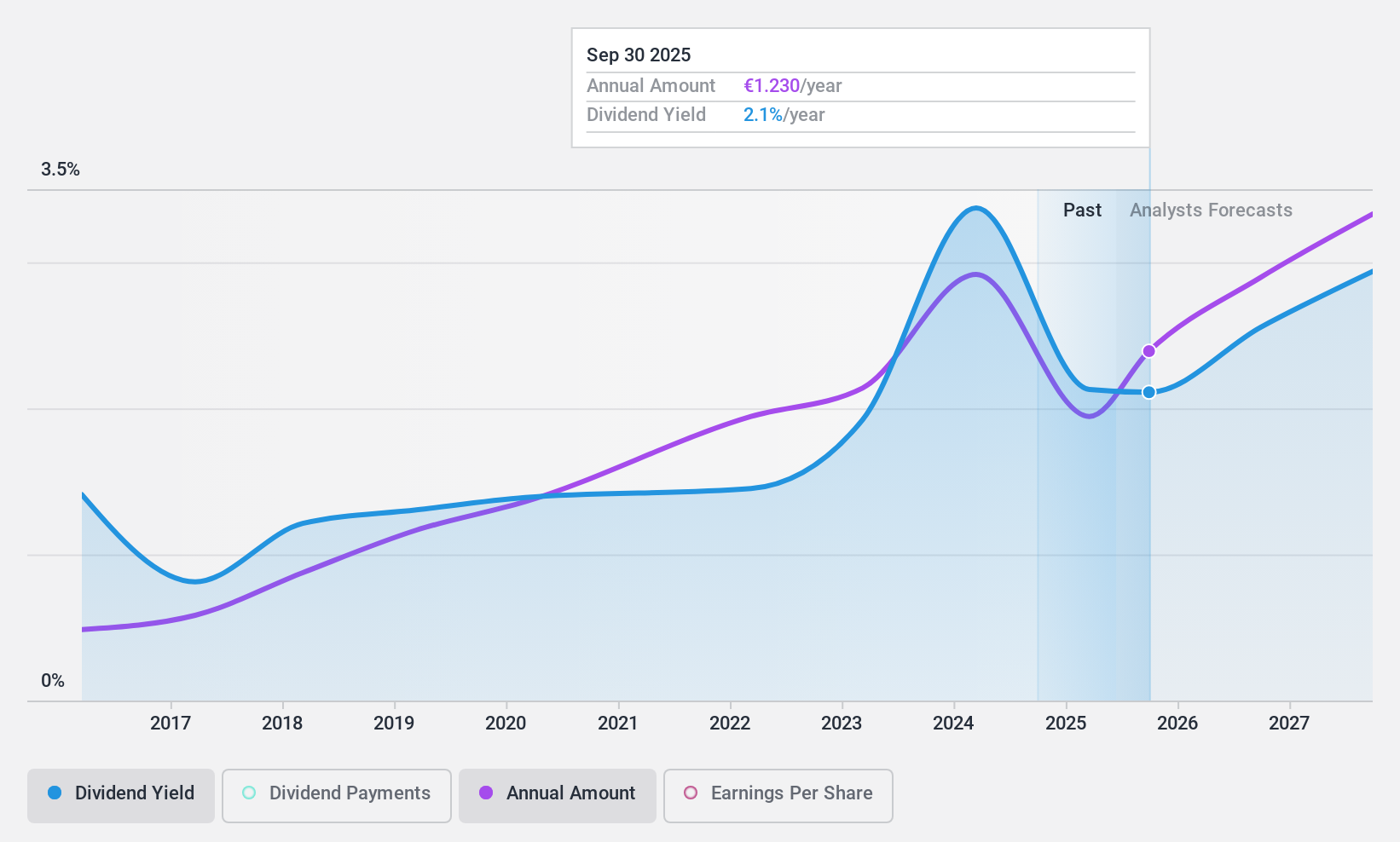

DATAGROUP (XTRA:D6H)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATAGROUP SE provides IT solutions in Germany and internationally, with a market cap of €321.59 million.

Operations: DATAGROUP SE generates revenue from its Services segment, which accounts for €456.25 million, and its Solutions & Consulting segment, contributing €77.59 million.

Dividend Yield: 3.5%

DATAGROUP's dividend yield of 3.46% falls short compared to the top German market payers, and its dividend history has been volatile over the past decade. However, dividends are well covered by both earnings and cash flows, with payout ratios of 48.1% and 28.2%, respectively. The stock trades significantly below estimated fair value, suggesting potential upside if financial performance continues positively. Recent inclusion in the S&P Global BMI Index may enhance visibility among investors.

- Dive into the specifics of DATAGROUP here with our thorough dividend report.

- Upon reviewing our latest valuation report, DATAGROUP's share price might be too pessimistic.

Where To Now?

- Navigate through the entire inventory of 1962 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:D6H

DATAGROUP

Provides information technology (IT) solutions in Germany and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives