Slowing Rates Of Return At Bechtle (ETR:BC8) Leave Little Room For Excitement

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, the ROCE of Bechtle (ETR:BC8) looks decent, right now, so lets see what the trend of returns can tell us.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Bechtle is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = €374m ÷ (€3.7b - €1.2b) (Based on the trailing twelve months to June 2024).

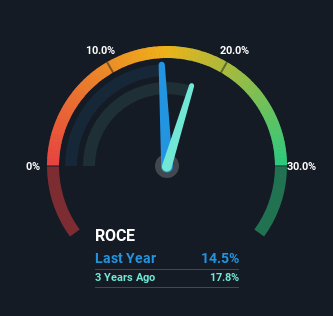

So, Bechtle has an ROCE of 15%. In absolute terms, that's a satisfactory return, but compared to the IT industry average of 9.6% it's much better.

View our latest analysis for Bechtle

In the above chart we have measured Bechtle's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Bechtle for free.

What Does the ROCE Trend For Bechtle Tell Us?

While the current returns on capital are decent, they haven't changed much. Over the past five years, ROCE has remained relatively flat at around 15% and the business has deployed 75% more capital into its operations. Since 15% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

In Conclusion...

To sum it up, Bechtle has simply been reinvesting capital steadily, at those decent rates of return. However, over the last five years, the stock hasn't provided much growth to shareholders in the way of total returns. For that reason, savvy investors might want to look further into this company in case it's a prime investment.

If you're still interested in Bechtle it's worth checking out our FREE intrinsic value approximation for BC8 to see if it's trading at an attractive price in other respects.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Bechtle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:BC8

Bechtle

Provides information technology (IT) services primarily in Europe.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.