Bechtle's (ETR:BC8) Shareholders Will Receive A Bigger Dividend Than Last Year

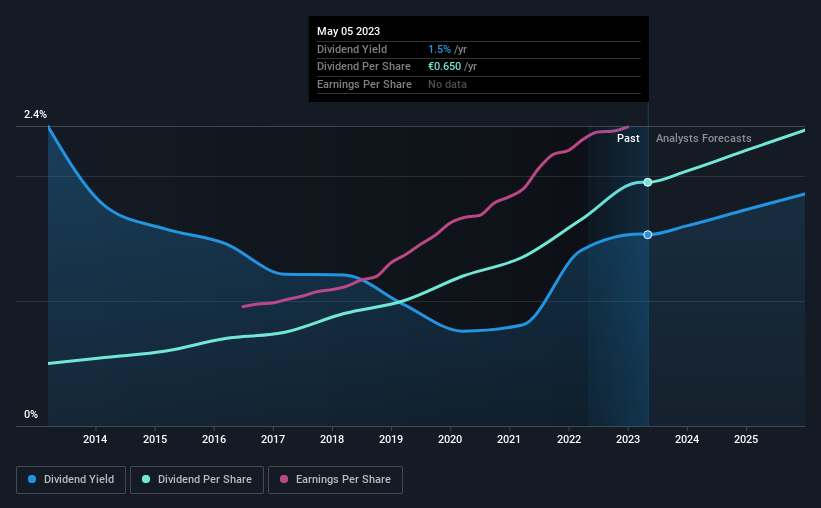

Bechtle AG's (ETR:BC8) dividend will be increasing from last year's payment of the same period to €0.65 on 31st of May. This takes the annual payment to 1.5% of the current stock price, which unfortunately is below what the industry is paying.

See our latest analysis for Bechtle

Bechtle's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Prior to this announcement, Bechtle's dividend was only 33% of earnings, however it was paying out 234% of free cash flows. The business might be trying to strike a balance between returning cash to shareholders and reinvesting back into the business, but this high of a payout ratio could definitely force the dividend to be cut if the company runs into a bit of a tough spot.

Over the next year, EPS is forecast to expand by 25.1%. If the dividend continues on this path, the payout ratio could be 30% by next year, which we think can be pretty sustainable going forward.

Bechtle Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of €0.167 in 2013 to the most recent total annual payment of €0.65. This means that it has been growing its distributions at 15% per annum over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. We are encouraged to see that Bechtle has grown earnings per share at 17% per year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Bechtle's prospects of growing its dividend payments in the future.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Bechtle's payments are rock solid. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Bechtle that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Bechtle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:BC8

Bechtle

Provides information technology (IT) services primarily in Europe.

Flawless balance sheet established dividend payer.