What You Need To Know About The Allgeier SE (ETR:AEIN) Analyst Downgrade Today

The analysts covering Allgeier SE (ETR:AEIN) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

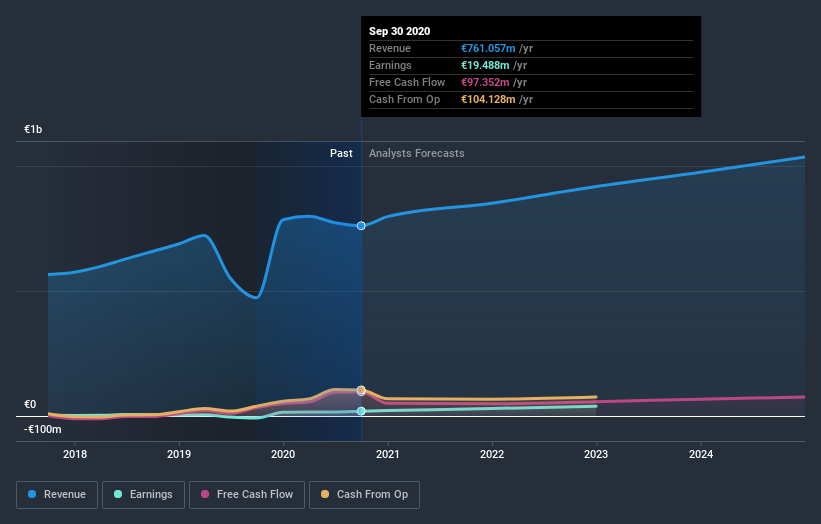

After the downgrade, the consensus from Allgeier's four analysts is for revenues of €690m in 2020, which would reflect an uneasy 9.3% decline in sales compared to the last year of performance. Prior to the latest estimates, the analysts were forecasting revenues of €797m in 2020. The consensus view seems to have become more pessimistic on Allgeier, noting the substantial drop in revenue estimates in this update.

View our latest analysis for Allgeier

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with the forecast 9.3% revenue decline a notable change from historical growth of 11% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 9.1% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Allgeier is expected to lag the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Allgeier this year. They also expect company revenue to perform worse than the wider market. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of Allgeier going forwards.

Worse, Allgeier is labouring under a substantial debt burden, which - if today's forecasts prove accurate - the forecast downgrade could potentially exacerbate. See why we're concerned about Allgeier's balance sheet by visiting our risks dashboard for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you decide to trade Allgeier, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:AEIN

Allgeier

Provides information technology (IT) solutions and software services in Germany.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives