Allgeier (ETR:AEIN) Has Compensated Shareholders With A 157% Return On Their Investment

It's easy to feel disappointed if you buy a stock that goes down. But often it is not a reflection of the fundamental business performance. So while the Allgeier SE (ETR:AEIN) share price is down 47% in the last year, the total return to shareholders (which includes dividends) was 157%. That's better than the market which returned 4.5% over the last year. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 29% in three years. Unfortunately the last month hasn't been any better, with the share price down 77%.

View our latest analysis for Allgeier

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Allgeier managed to increase earnings per share from a loss to a profit, over the last 12 months.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action. But we may find different metrics more enlightening.

Allgeier managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

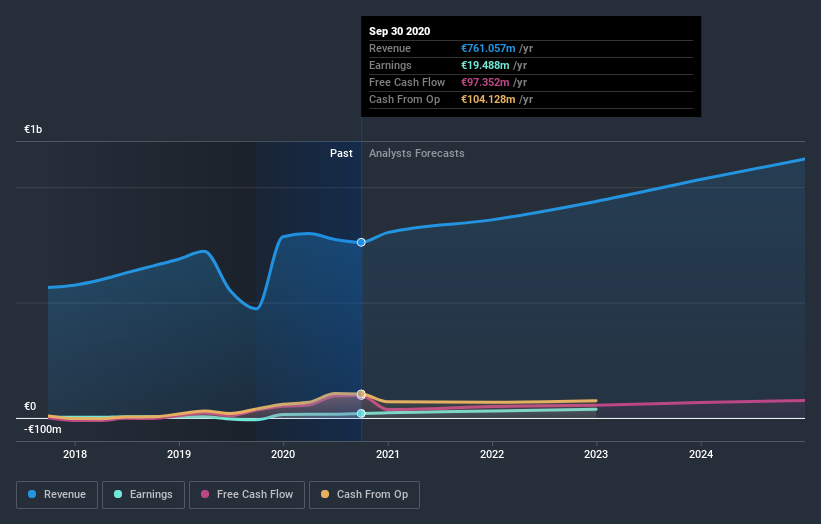

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Allgeier has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Allgeier's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Allgeier the TSR over the last year was 157%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Allgeier shareholders have gained 157% (in total) over the last year. And yes, that does include the dividend. So this year's TSR was actually better than the three-year TSR (annualized) of 53%. Given the track record of solid returns over varying time frames, it might be worth putting Allgeier on your watchlist. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 5 warning signs we've spotted with Allgeier .

Of course Allgeier may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you’re looking to trade Allgeier, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:AEIN

Allgeier

Provides information technology (IT) solutions and software services in Germany.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives