Exploring Three High Growth Tech Stocks For Dynamic Portfolios

Reviewed by Simply Wall St

As global markets experience a rally driven by expectations of growth and tax reforms following recent U.S. elections, small-cap stocks like those in the Russell 2000 Index have shown significant gains, reflecting investor optimism about potential economic support measures. In this dynamic environment, identifying high-growth tech stocks that can adapt to regulatory changes and capitalize on economic trends is crucial for building robust portfolios.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★★☆

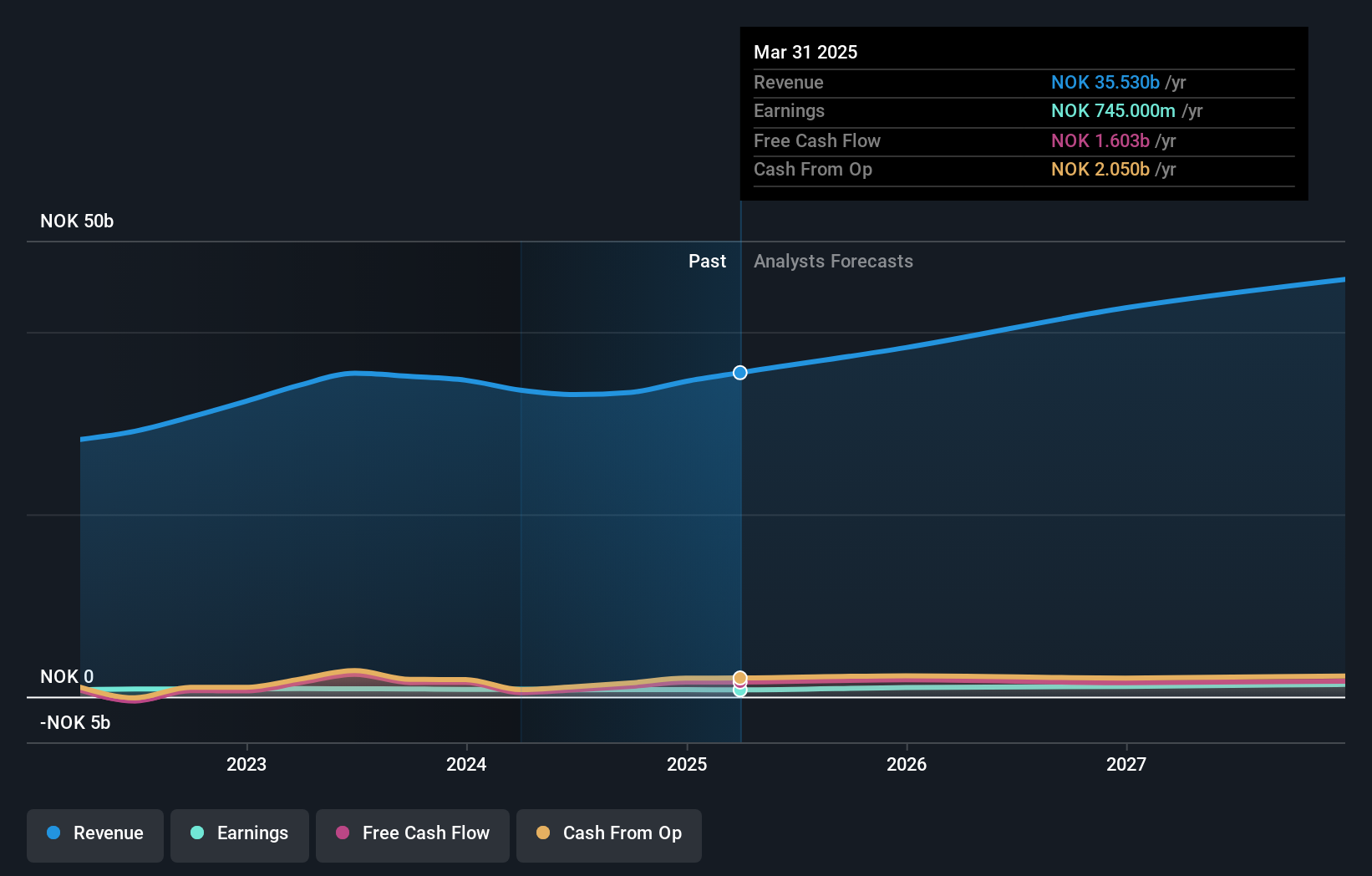

Overview: Atea ASA is a company that offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market capitalization of NOK15.32 billion.

Operations: Atea ASA generates revenue primarily from its operations in Norway, Sweden, Denmark, Finland, and the Baltics. The company reported revenues of NOK12.44 billion from Sweden and NOK8.28 billion from Norway. Group costs amounted to NOK9.30 billion while group shared services contributed NOK9.20 billion to its financial structure.

Atea's recent performance and strategic moves signal a robust potential in the tech sector, particularly highlighted by its 21.5% forecasted annual earnings growth, surpassing Norway's market average of 10%. This growth is complemented by an 8.3% expected revenue increase annually, also outpacing the broader market's 2.1%. Notably, Atea has initiated a share repurchase program, underscoring confidence in its financial health and commitment to delivering shareholder value. Moreover, securing a significant frame agreement with Tiera Oy not only boosts its standing in providing comprehensive tech solutions but also promises substantial revenue inflows over the next four years, potentially doubling the value of previous contracts. These developments collectively underscore Atea's proactive approach in strengthening its market position and enhancing investor appeal amidst competitive industry dynamics.

All for One Group (XTRA:A1OS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and other international markets with a market capitalization of approximately €246.05 million.

Operations: The company generates revenue primarily from its CORE segment, contributing €442.47 million, and the LOB segment, adding €77.01 million. The business focuses on delivering software solutions tailored to major platforms like SAP, Microsoft, and IBM across various European markets.

All for One Group has demonstrated a notable performance in the tech sector, with earnings growth outpacing its industry by 59.6% over the past year, significantly higher than the IT industry average of 16.8%. This growth trajectory is expected to continue, with projected annual earnings increases of 24.6%, surpassing Germany's market forecast of 20.5%. Additionally, their revenue is set to grow at 6.4% annually, slightly above the national average of 5.5%. These figures are supported by substantial R&D investments which enhance their competitive edge and innovation capacity in software solutions and services. Recently at the Baader Investment Conference in Munich, All for One Group showcased its strategic initiatives that align with these growth metrics. The company's commitment to reinvesting in technology and client solutions was evident, reflecting a robust plan to sustain and possibly accelerate its current growth rate into future fiscal periods—promising for stakeholders looking for companies with solid foundations and clear expansion strategies.

- Click here and access our complete health analysis report to understand the dynamics of All for One Group.

Examine All for One Group's past performance report to understand how it has performed in the past.

PSI Software (XTRA:PSAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PSI Software SE specializes in developing and integrating software solutions to optimize energy and material flows for utilities and industries globally, with a market capitalization of €332.99 million.

Operations: With a focus on optimizing energy and material flows, PSI Software SE generates revenue primarily from its Energy Management (€132.55 million) and Production Management (€134.45 million) segments.

PSI Software, amidst a challenging fiscal year marked by a cyberattack and subsequent revenue setbacks, remains poised for recovery with strategic adjustments and innovative thrusts. Despite recent earnings reports indicating a net loss—EUR 24.14 million over nine months—PSI's commitment to R&D is unwavering, as evidenced by their substantial investment in this area, aligning with industry benchmarks that suggest strong future competitiveness. The company's focus on evolving its software solutions could potentially harness the forecasted 9.1% annual revenue growth, outpacing the German market average of 5.5%. Moreover, PSI's anticipated transition to profitability within three years showcases an adaptive strategy geared towards leveraging technological advancements and market opportunities effectively.

- Unlock comprehensive insights into our analysis of PSI Software stock in this health report.

Review our historical performance report to gain insights into PSI Software's's past performance.

Where To Now?

- Take a closer look at our High Growth Tech and AI Stocks list of 1281 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:A1OS

All for One Group

Provides business software solutions for SAP, Microsoft, and IBM in Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives