- Germany

- /

- Trade Distributors

- /

- XTRA:BNR

All for One Group And 2 Other Leading German Dividend Stocks

Reviewed by Simply Wall St

The German stock market has seen a notable surge recently, with the DAX index climbing over 4% amid hopes for economic stimulus and potential interest rate cuts. This positive momentum provides an opportune backdrop to explore some of Germany's leading dividend stocks. In this article, we will discuss All for One Group and two other prominent German dividend stocks that stand out in the current market environment.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.85% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.26% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.06% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.65% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.69% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.91% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.42% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.23% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.66% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top German Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

All for One Group (XTRA:A1OS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: All for One Group SE, with a market cap of €229.45 million, provides business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Operations: All for One Group SE's revenue segments include €77.01 million from LOB and €442.47 million from CORE.

Dividend Yield: 3.1%

All for One Group SE has shown stable and growing dividends over the past decade, with a current yield of 3.09%. The dividend is well-covered by both earnings (49% payout ratio) and free cash flow (19% cash payout ratio). Recent Q3 2024 earnings reported sales of €122.28 million and net income of €0.525 million, reflecting improved profitability. The company also completed a share buyback program, enhancing shareholder value further.

- Navigate through the intricacies of All for One Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that All for One Group's share price might be on the cheaper side.

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE operates by purchasing and supplying a wide range of industrial and specialty chemicals, as well as ingredients, across Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of €9.79 billion.

Operations: Brenntag SE generates revenue through its Brenntag Essentials segments, with €6.27 billion from North America, €3.30 billion from Europe, the Middle East & Africa (EMEA), €751.10 million from Asia Pacific (APAC), and €674 million from Latin America.

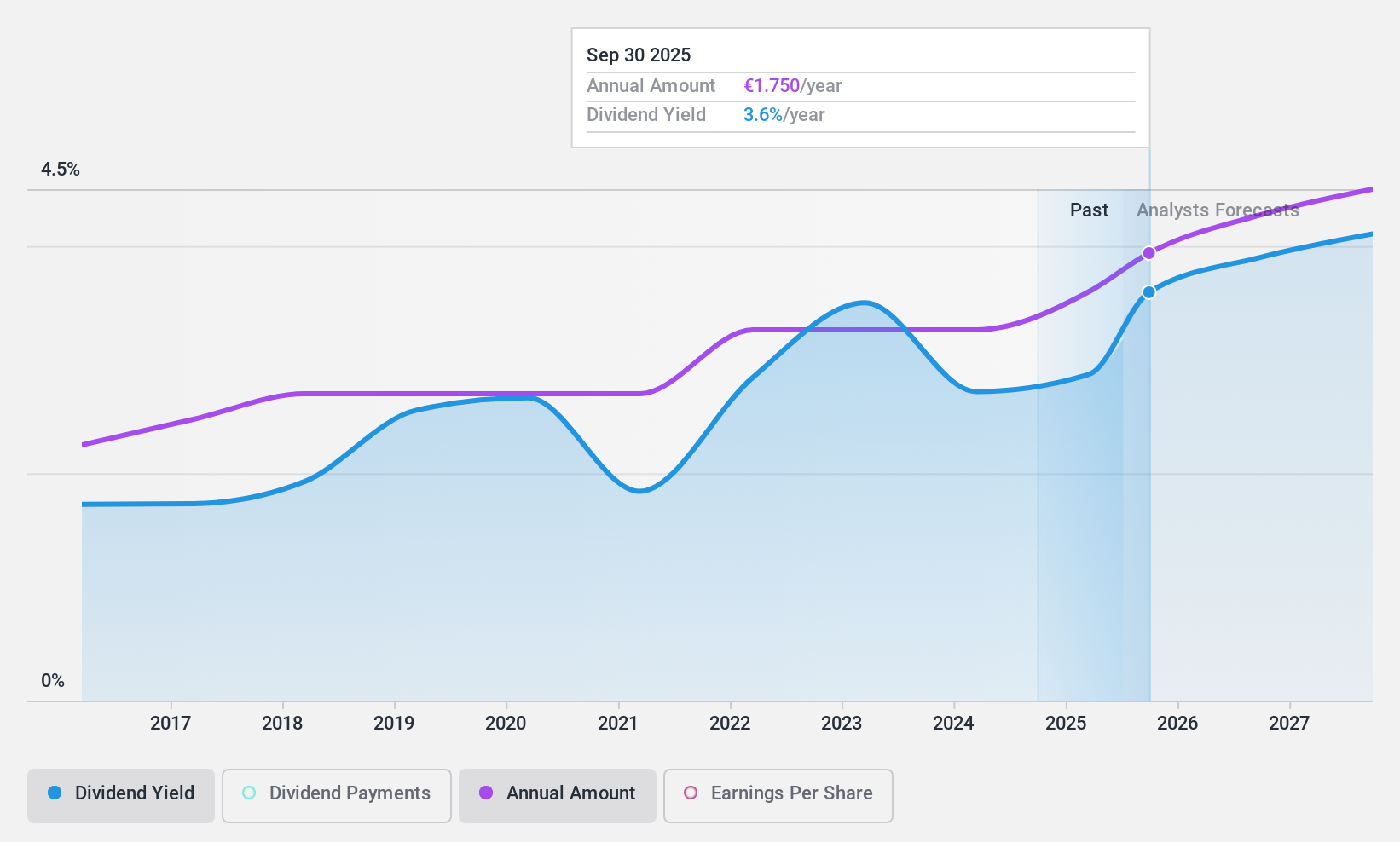

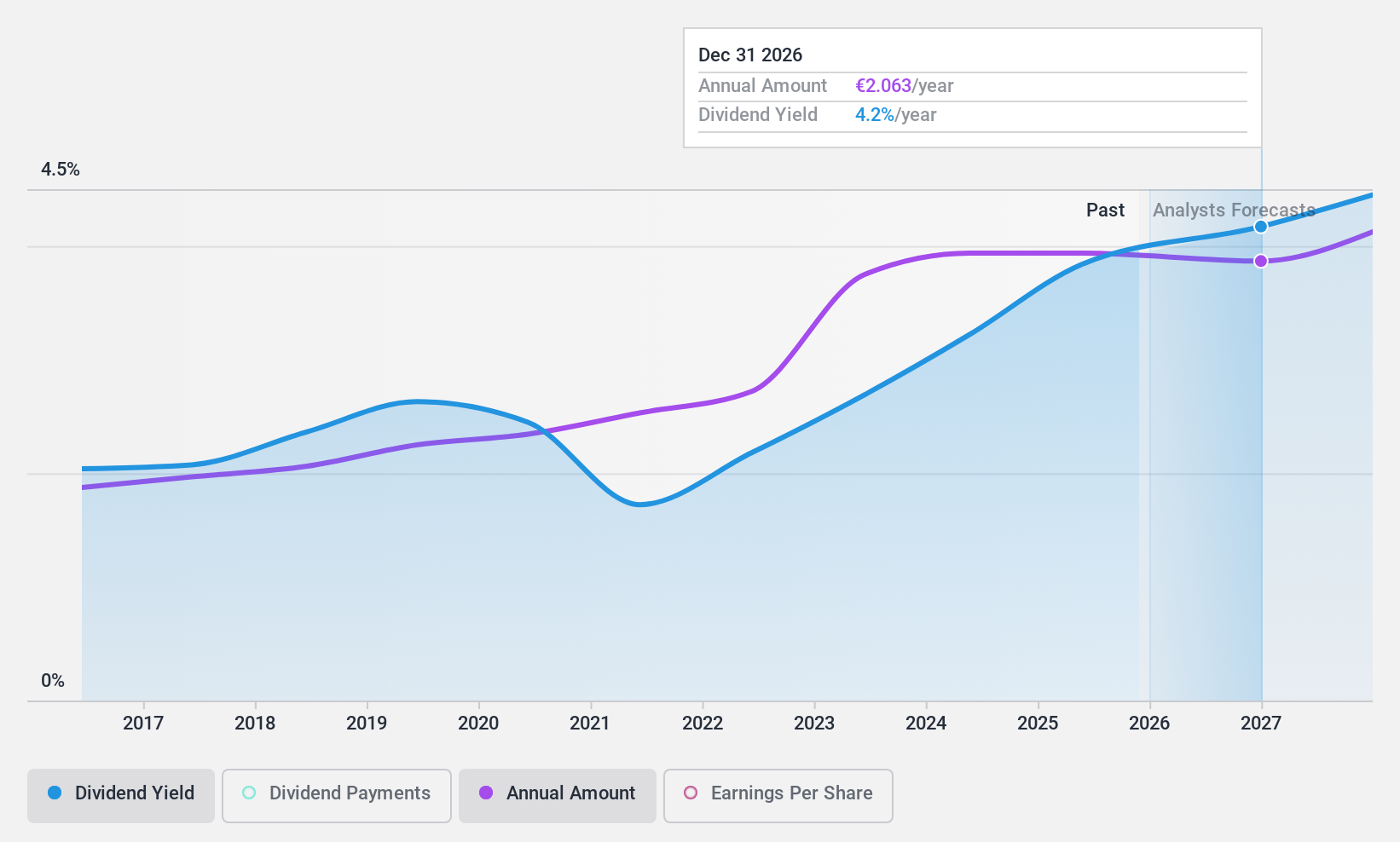

Dividend Yield: 3.1%

Brenntag SE's dividend yield stands at 3.1%, which is lower than the top 25% of German dividend payers. However, its dividends are well-covered by earnings (51.1% payout ratio) and cash flows (36.9% cash payout ratio), indicating sustainability. The company has a history of stable and growing dividends over the past decade. Recent earnings showed a decline in net income to €149.1 million for Q2 2024 from €186.9 million the previous year, but new strategic partnerships could bolster future growth.

- Click here and access our complete dividend analysis report to understand the dynamics of Brenntag.

- In light of our recent valuation report, it seems possible that Brenntag is trading behind its estimated value.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €500.64 million, offers commercial banking services to small and medium enterprises as well as private customers across Europe, South America, and Germany through its subsidiaries.

Operations: ProCredit Holding AG generates €422.15 million in revenue from its banking services segment.

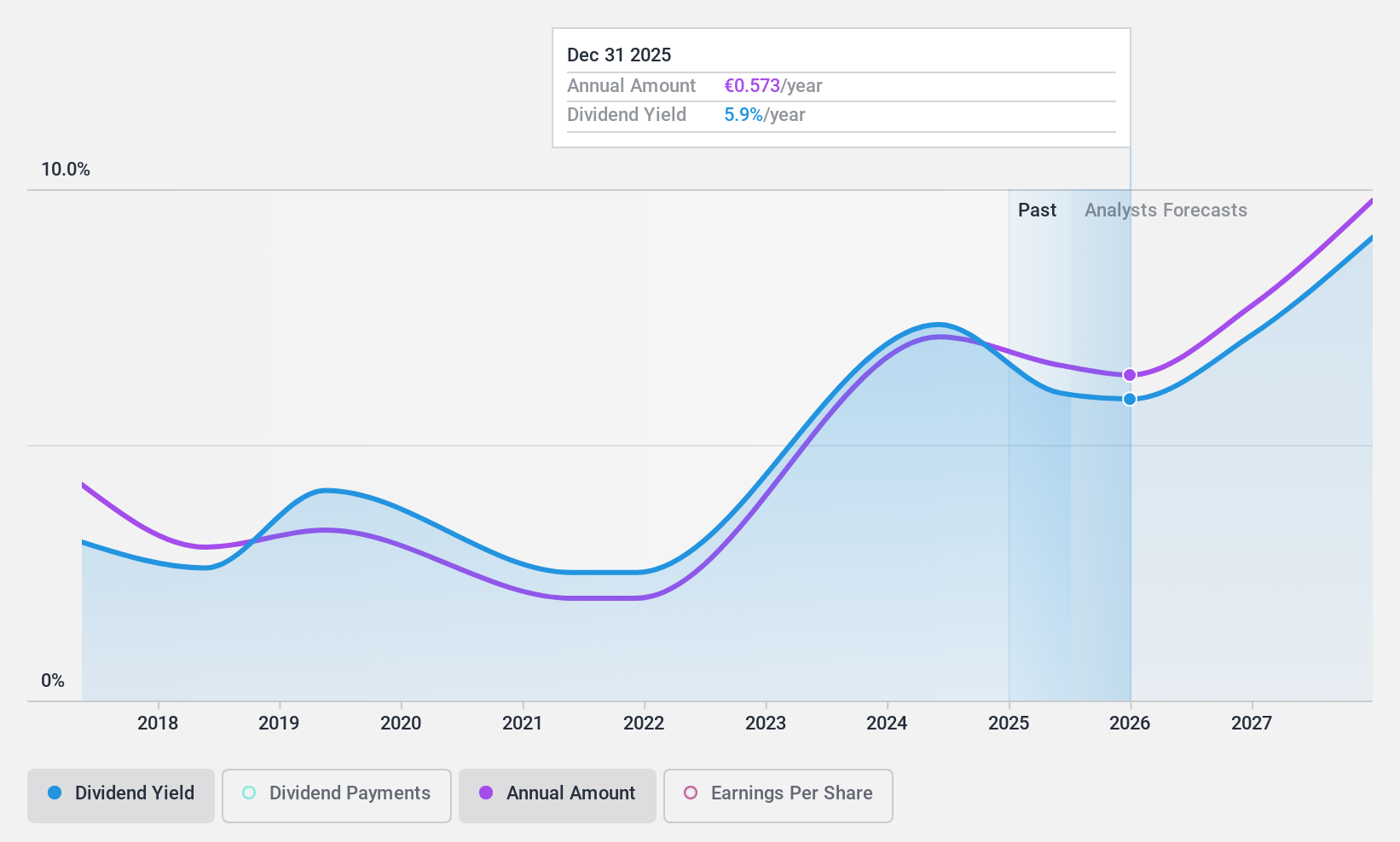

Dividend Yield: 7.5%

ProCredit Holding has a high dividend yield of 7.53%, placing it in the top 25% of German dividend payers, though its track record is less stable with only 7 years of payments and some volatility. Despite a recent decline in net income to €57.6 million for H1 2024 from €64.06 million last year, dividends are well-covered by earnings (35.3% payout ratio) and forecast to remain sustainable with future coverage at 37.2%.

- Dive into the specifics of ProCredit Holding here with our thorough dividend report.

- The valuation report we've compiled suggests that ProCredit Holding's current price could be quite moderate.

Make It Happen

- Unlock our comprehensive list of 34 Top German Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brenntag might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BNR

Brenntag

Brenntag SE purchases and supplies various industrial and specialty chemicals, and ingredients in Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Undervalued established dividend payer.