As European markets climb to record levels, buoyed by a rally in technology stocks and expectations of lower U.S. borrowing costs, investors are increasingly looking towards small-cap opportunities that might benefit from these favorable conditions. In this dynamic environment, identifying a promising stock often involves assessing its potential for growth amid economic shifts and its ability to navigate the complexities of inflation and consumer confidence trends across the eurozone.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Rainbow Tours (WSE:RBW)

Simply Wall St Value Rating: ★★★★★★

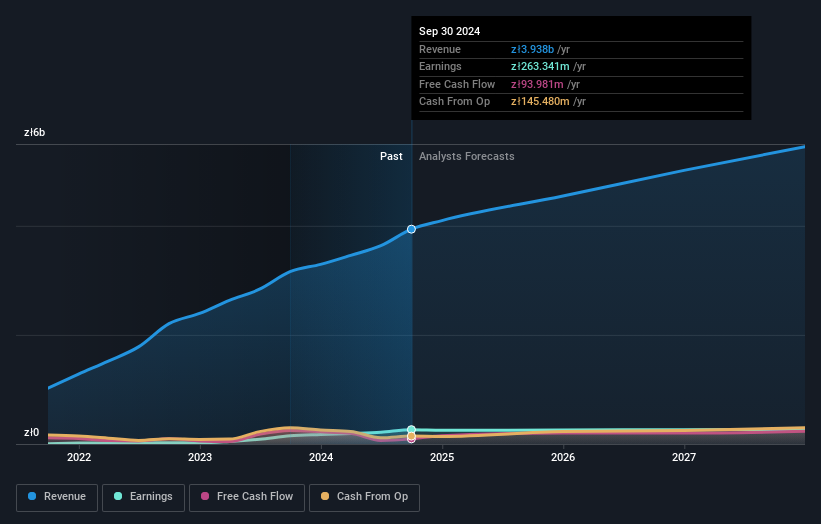

Overview: Rainbow Tours S.A. is a tour operator with operations in Poland, the Czech Republic, Greece, Spain, Turkey, Slovakia, Lithuania, and other international markets; it has a market cap of PLN1.87 billion.

Operations: Rainbow Tours generates most of its revenue from tour operator activities in Poland, amounting to PLN4.17 billion, with additional contributions from foreign tour operations at PLN173.96 million. Hotel segment revenues abroad contribute PLN65.65 million, while other activities in Poland add PLN4.93 million to the total revenue mix. The company's financial structure includes consolidation adjustments totaling -PLN153.52 million.

Rainbow Tours, a small player in the European market, has shown impressive financial resilience. Over the past five years, its debt-to-equity ratio dramatically decreased from 146.3% to 3.5%, indicating strong fiscal management. Despite a net income dip to PLN 84.56 million from PLN 97.13 million last year, earnings per share remained stable at PLN 5.81 due to high-quality earnings and effective cost control measures like reduced capital expenditure of -22.60 (PLN). The company's revenue is set to grow by an anticipated 11% annually, suggesting potential for future expansion despite forecasted earnings declines over the next three years.

- Dive into the specifics of Rainbow Tours here with our thorough health report.

Examine Rainbow Tours' past performance report to understand how it has performed in the past.

Voxel (WSE:VOX)

Simply Wall St Value Rating: ★★★★★★

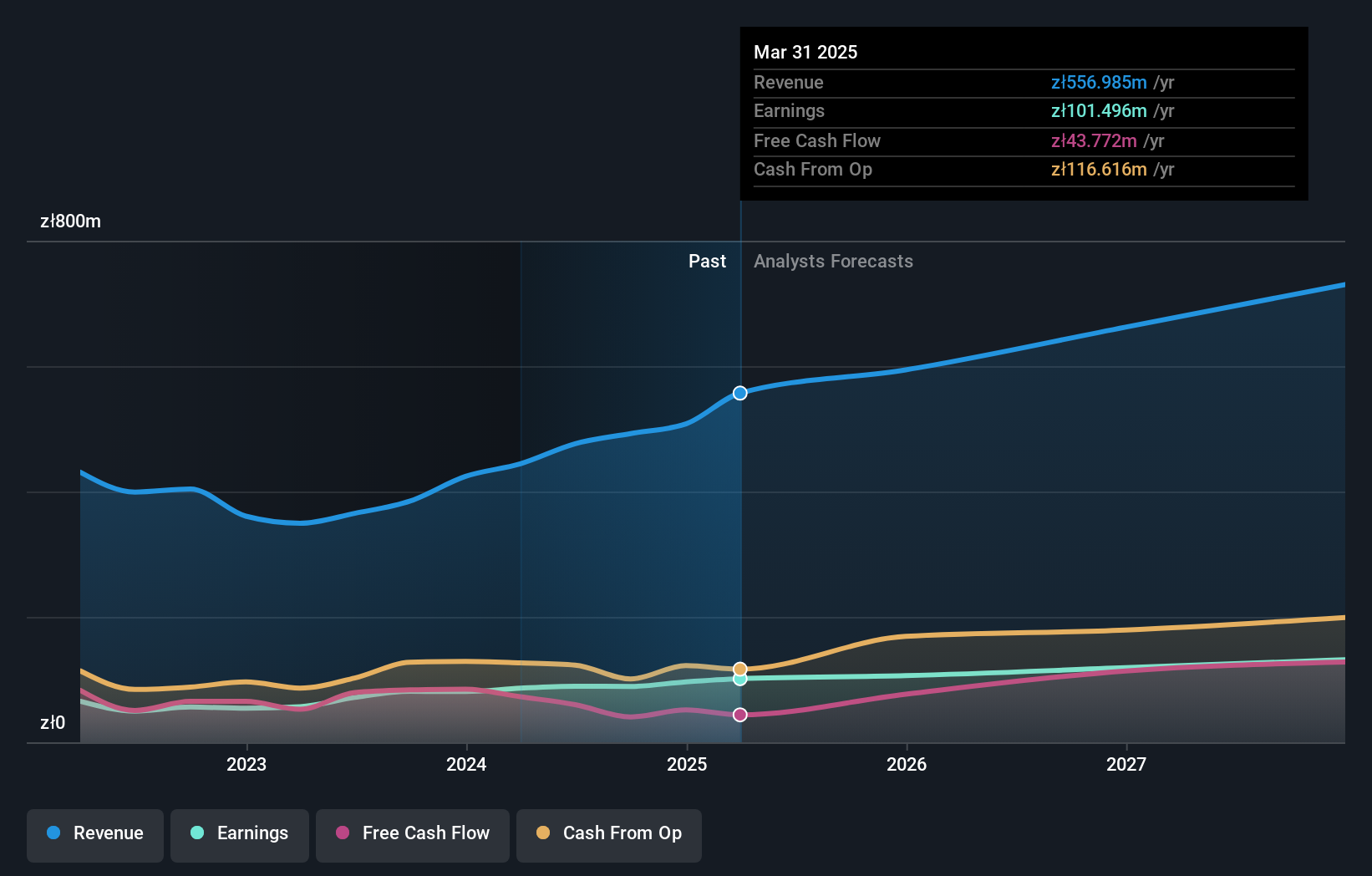

Overview: Voxel S.A. operates a network of diagnostic imaging laboratories in Poland with a market capitalization of PLN1.80 billion.

Operations: The company generates revenue primarily from diagnostics, including medical services and sales of radiopharmaceuticals (PLN407.38 million), and IT products and laboratory equipment (PLN168.27 million). Therapy through neuroradiosurgery contributes PLN14.27 million to its revenue stream.

Voxel's financials reveal a promising picture with earnings projected to grow 10.85% annually, while past earnings rose by 12.7%, outpacing the healthcare industry. The debt to equity ratio has impressively dropped from 59.4% to 1.6% over five years, indicating robust financial management and more cash than total debt suggests stability. Trading at a significant discount of 42.4% below estimated fair value, it presents an attractive investment opportunity amidst its high-quality earnings profile and strong interest coverage at 15 times EBIT. Recent results show sales climbing to PLN 285 million for six months, with net income reaching PLN 46 million compared to last year's PLN 42 million, reflecting steady growth despite slight fluctuations in quarterly figures like net income of PLN 21 million versus last year's PLN 23 million for Q2.

- Unlock comprehensive insights into our analysis of Voxel stock in this health report.

Gain insights into Voxel's past trends and performance with our Past report.

innoscripta (XTRA:1INN)

Simply Wall St Value Rating: ★★★★★☆

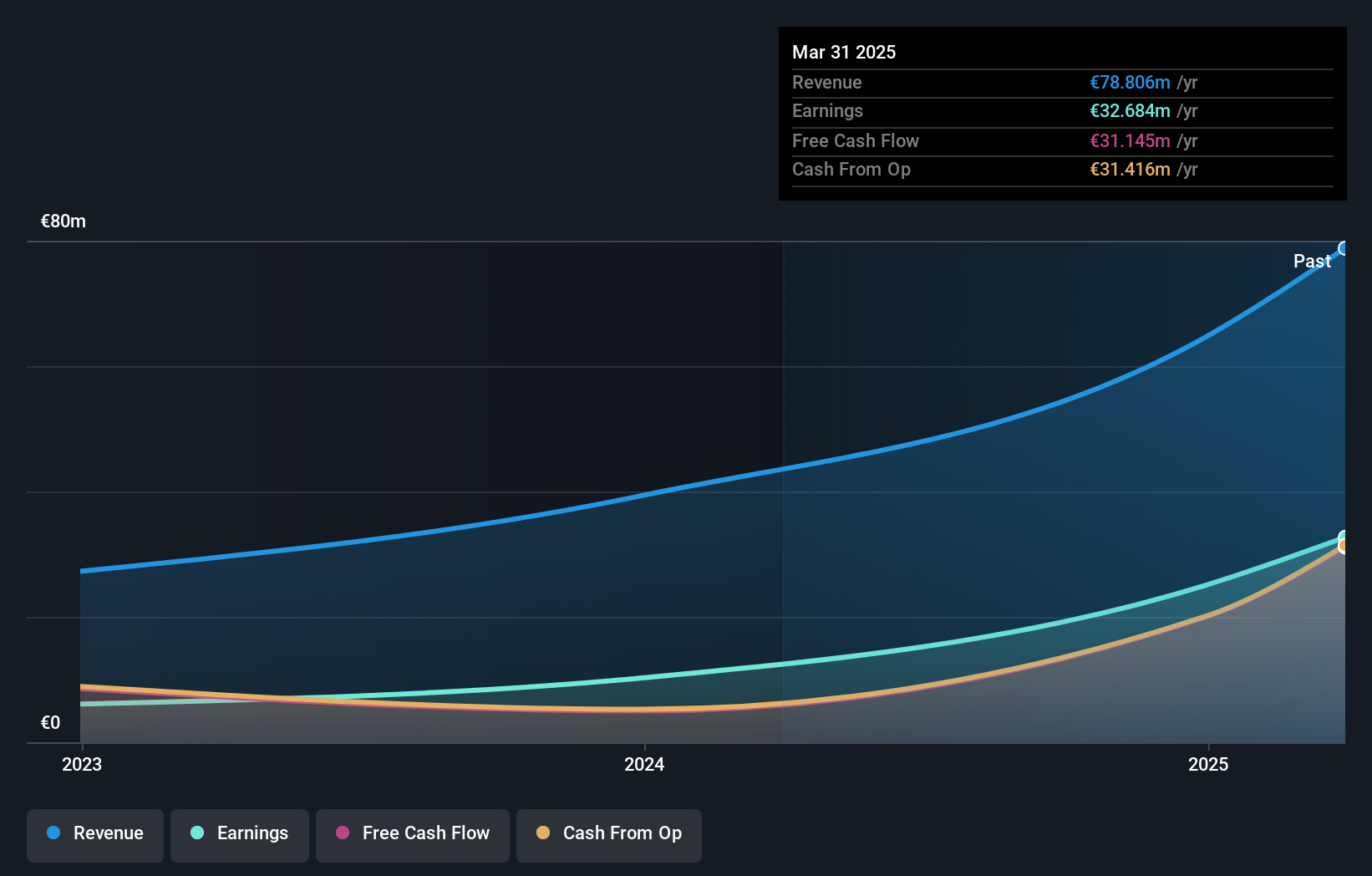

Overview: Innoscripta SE specializes in offering software-as-a-service solutions for managing R&D tax incentives and project management consulting in Germany, with a market capitalization of €1.17 billion.

Operations: The primary revenue stream for Innoscripta SE comes from its Internet Software & Services segment, generating €85.92 million.

Innoscripta, a nimble player in the software space, has seen its earnings skyrocket by 92.4% over the past year, outpacing the industry's 12.5% growth rate. This robust performance is bolstered by high-quality earnings and a positive free cash flow position of US$36.43 million as of October 2025. Trading at nearly 19% below its estimated fair value, Innoscripta seems to offer a compelling opportunity for those eyeing undervalued assets in Europe. With more cash than total debt and no concerns over interest coverage, this company is positioned well financially for future growth prospects forecasted at about 28% annually.

- Take a closer look at innoscripta's potential here in our health report.

Understand innoscripta's track record by examining our Past report.

Where To Now?

- Delve into our full catalog of 328 European Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if innoscripta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:1INN

innoscripta

Provides software-as-a-service for managing research and development (R&D) tax incentives and project management consulting in Germany.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives