As of early July 2025, the European market has shown mixed returns with the pan-European STOXX Europe 600 Index remaining relatively flat, while inflation in the eurozone has reached the European Central Bank's target of 2%. In this context, identifying high-growth tech stocks involves looking for companies that can navigate economic fluctuations and leverage technological advancements to drive growth despite broader market uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 24.39% | 57.52% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| VusionGroup | 20.44% | 73.56% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Netcompany Group (CPSE:NETC)

Simply Wall St Growth Rating: ★★★★★☆

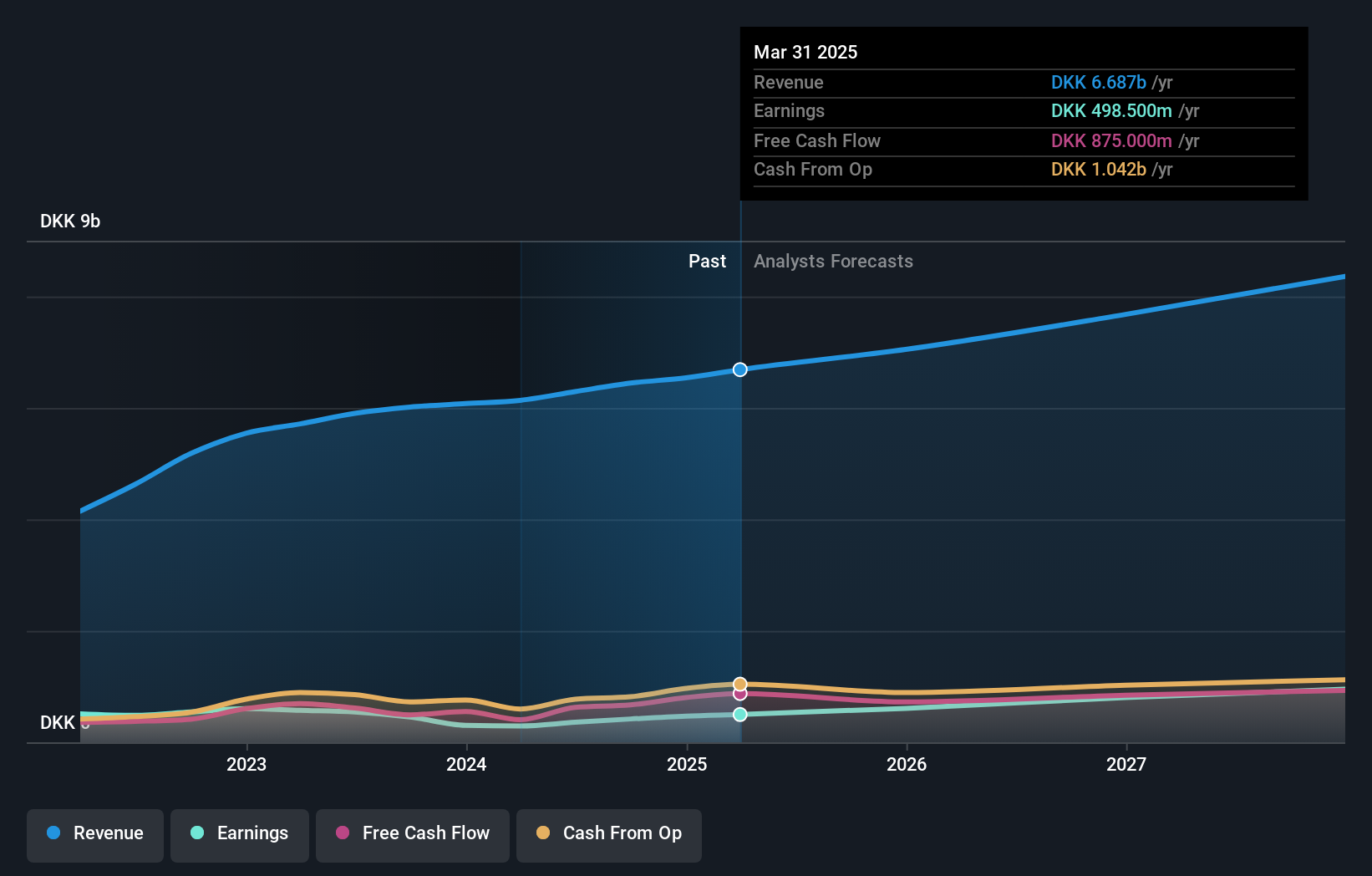

Overview: Netcompany Group A/S delivers business critical IT solutions to both private and public sectors across various countries including Denmark, Norway, the United Kingdom, and others, with a market cap of DKK12.85 billion.

Operations: The company generates revenue primarily from providing IT solutions to public and private sectors, with the public segment contributing DKK4.64 billion and the private sector adding DKK2.04 billion.

Netcompany Group is reshaping the landscape of IT modernization in Europe with its groundbreaking AI solution, Feniks AI, which significantly reduces the time and cost associated with overhauling outdated systems. Launched recently, this tool cuts traditional transformation timelines from years to months and is projected to slash IT costs by 30%, demonstrating its efficacy in Denmark's public sector. Financially, Netcompany reported a robust first quarter with sales rising to DKK 1.74 billion from DKK 1.60 billion year-over-year and net income increasing to DKK 121.7 million from DKK 93.4 million, reflecting a solid earnings per share growth from DKK 1.89 to DKK 2.58. These figures underscore Netcompany's strong market position and innovative edge in a critical area of digital infrastructure development.

- Delve into the full analysis health report here for a deeper understanding of Netcompany Group.

Evaluate Netcompany Group's historical performance by accessing our past performance report.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

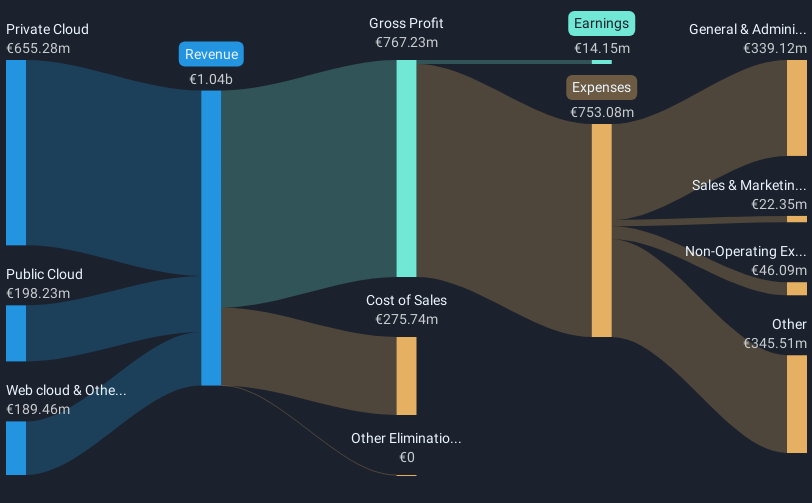

Overview: OVH Groupe S.A. offers a range of cloud services, including public and private cloud solutions, shared hosting, and dedicated servers on a global scale, with a market cap of approximately €1.62 billion.

Operations: The company generates revenue primarily from its Private Cloud segment, contributing €655.28 million, followed by Public Cloud at €198.23 million and Web Cloud & Other at €189.46 million.

OVH Groupe's recent partnership with Crayon underscores its strategic pivot towards enhancing cloud infrastructure across Europe, leveraging Crayon's extensive IT services to broaden its market reach. This collaboration is poised to fortify OVH's position in the cloud sector, particularly with offerings that emphasize sustainability and sovereignty—key selling points in today’s environmentally conscious market. Financially, the company has demonstrated robust growth with a third-quarter revenue increase to €271.9 million from €250.8 million year-over-year and a significant turnaround in profitability, reporting a net income of €7.21 million compared to a net loss previously. These figures reflect not only recovery but also an accelerating momentum in OVH’s operational and financial strategies, supported by an expected annual revenue growth of 9% to 11%.

- Dive into the specifics of OVH Groupe here with our thorough health report.

Gain insights into OVH Groupe's past trends and performance with our Past report.

innoscripta (XTRA:1INN)

Simply Wall St Growth Rating: ★★★★★★

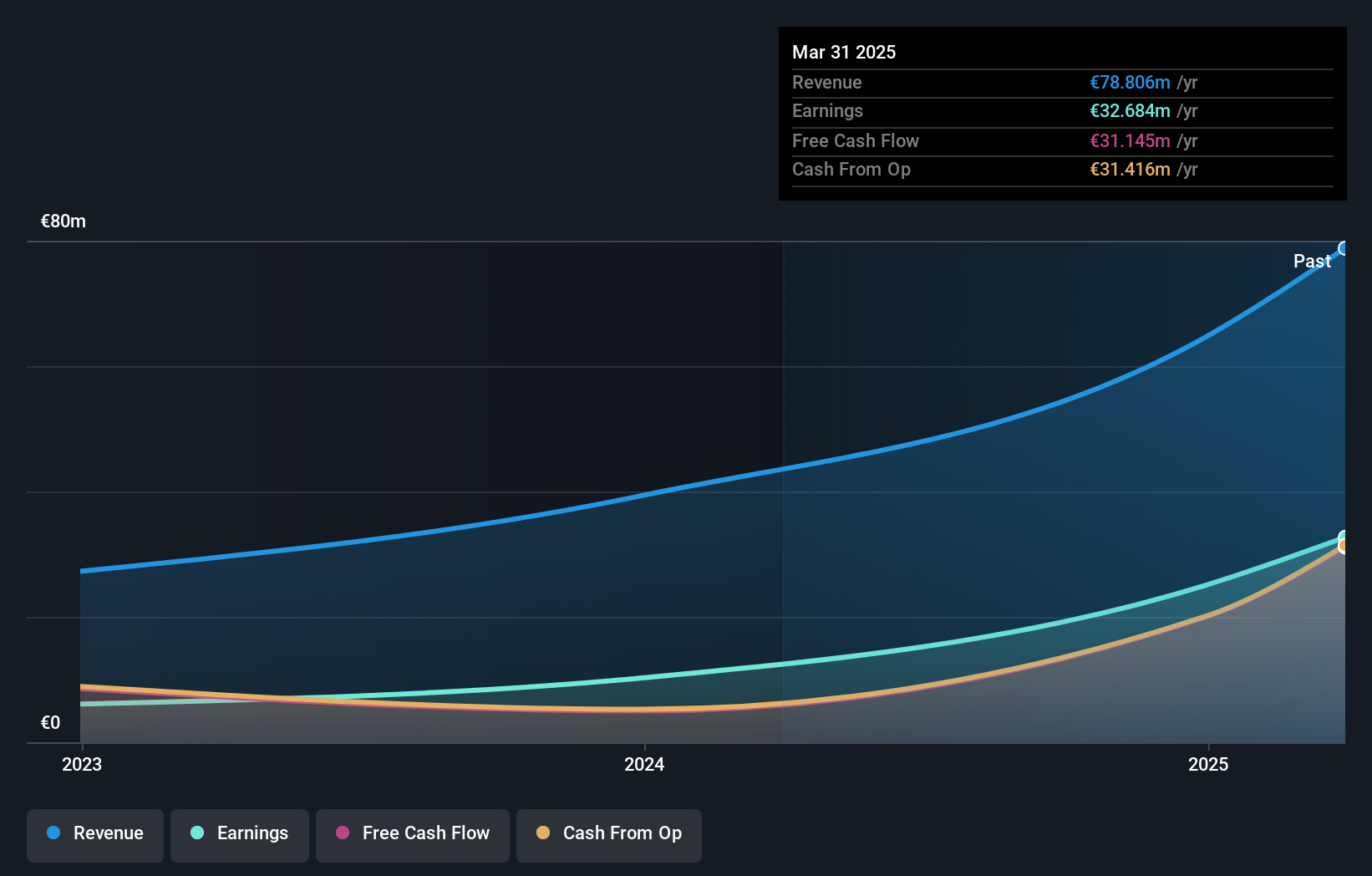

Overview: innoscripta SE offers software-as-a-service solutions for managing R&D tax incentives and project management consulting in Germany, with a market cap of €1.06 billion.

Operations: The company generates revenue primarily through its Internet Software & Services segment, amounting to €78.81 million. The focus is on providing software solutions for R&D tax incentive management and project management consulting within Germany.

Innoscripta SE, following its recent IPO which raised €223.6 million, is positioned intriguingly in the high-growth tech sector of Europe. The company's revenue and earnings growth projections outpace the broader German market significantly, with expected annual increases of 24.8% and 26.3%, respectively. This performance is bolstered by a robust return on equity forecast at an impressive 68.3% in three years, highlighting efficient capital utilization and profitability potential in its operations. Moreover, Innoscripta's strategic focus on software innovation could further solidify its market position as demand for advanced tech solutions continues to escalate across industries.

- Click here and access our complete health analysis report to understand the dynamics of innoscripta.

Gain insights into innoscripta's historical performance by reviewing our past performance report.

Make It Happen

- Take a closer look at our European High Growth Tech and AI Stocks list of 232 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netcompany Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NETC

Netcompany Group

Provides business critical IT solutions to private and public customers in Denmark, Norway, the United Kingdom, the Netherlands, Greece, Belgium, Luxembourg, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives