- Germany

- /

- Semiconductors

- /

- XTRA:TPE

PVA TePla (ETR:TPE) Shareholders Have Enjoyed A Whopping 809% Share Price Gain

Long term investing can be life changing when you buy and hold the truly great businesses. While the best companies are hard to find, but they can generate massive returns over long periods. Don't believe it? Then look at the PVA TePla AG (ETR:TPE) share price. It's 809% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 91% in about a quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for PVA TePla

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

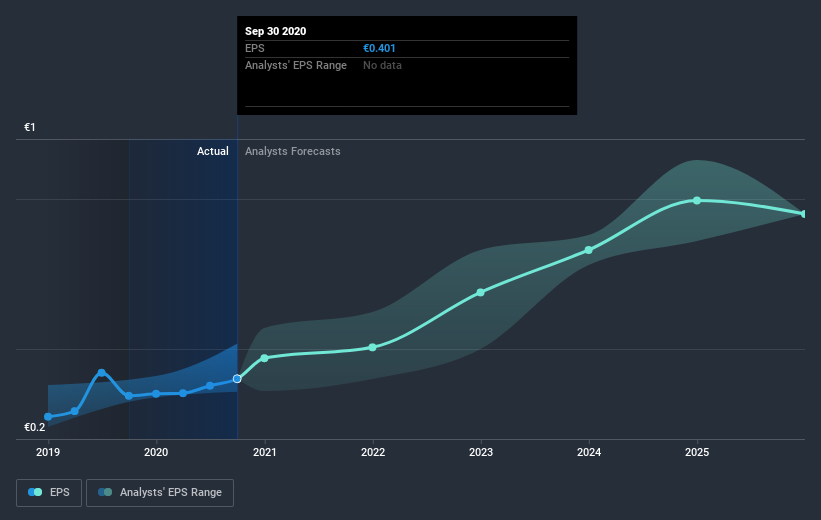

During the last half decade, PVA TePla became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the PVA TePla share price is up 77% in the last three years. During the same period, EPS grew by 38% each year. This EPS growth is higher than the 21% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days. Having said that, the market is still optimistic, given the P/E ratio of 62.37.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that PVA TePla has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that PVA TePla shareholders have received a total shareholder return of 72% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 55% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with PVA TePla (including 1 which can't be ignored) .

Of course PVA TePla may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

When trading PVA TePla or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:TPE

PVA TePla

Develops and produces process in areas of semiconductor, metal, electrical/electronics, and optical sectors worldwide.

Excellent balance sheet and good value.