- Germany

- /

- Semiconductors

- /

- XTRA:M5Z

Manz (ETR:M5Z investor three-year losses grow to 89% as the stock sheds €9.6m this past week

As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Manz AG (ETR:M5Z), who have seen the share price tank a massive 89% over a three year period. That would certainly shake our confidence in the decision to own the stock. The more recent news is of little comfort, with the share price down 49% in a year. Even worse, it's down 23% in about a month, which isn't fun at all. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

After losing 16% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Manz

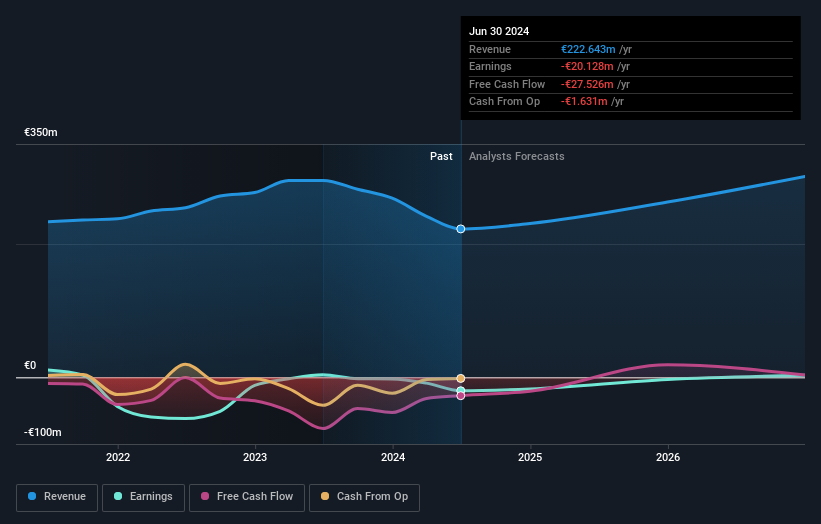

Given that Manz didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Manz saw its revenue grow by 2.5% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 24%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Manz stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in Manz had a tough year, with a total loss of 49%, against a market gain of about 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Manz better, we need to consider many other factors. Even so, be aware that Manz is showing 4 warning signs in our investment analysis , you should know about...

We will like Manz better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

If you're looking to trade Manz, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:M5Z

Manz

Operates as a high-tech mechanical engineering company that provides production equipment in Germany, rest of Europe, the United States, Taiwan, China, rest of Asia, and internationally.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives