- Germany

- /

- Semiconductors

- /

- XTRA:ELG

Elmos Semiconductor SE (ETR:ELG) Surges 28% Yet Its Low P/E Is No Reason For Excitement

Elmos Semiconductor SE (ETR:ELG) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

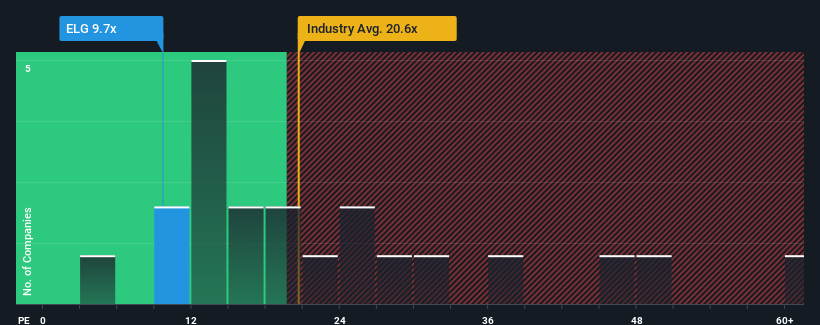

Although its price has surged higher, Elmos Semiconductor's price-to-earnings (or "P/E") ratio of 9.7x might still make it look like a buy right now compared to the market in Germany, where around half of the companies have P/E ratios above 19x and even P/E's above 38x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Elmos Semiconductor has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Elmos Semiconductor

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Elmos Semiconductor would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. The strong recent performance means it was also able to grow EPS by 179% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 1.2% each year during the coming three years according to the seven analysts following the company. Meanwhile, the broader market is forecast to expand by 17% each year, which paints a poor picture.

With this information, we are not surprised that Elmos Semiconductor is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Elmos Semiconductor's P/E

Despite Elmos Semiconductor's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Elmos Semiconductor maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Elmos Semiconductor with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Elmos Semiconductor, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Elmos Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ELG

Elmos Semiconductor

Develops, manufactures, and distributes microelectronic components and system parts, and technological devices for automotive industry in Germany, other European Union countries, the Americas, Asia/Pacific, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.