- Germany

- /

- Specialty Stores

- /

- XTRA:WEW

Westwing Group SE's (ETR:WEW) Popularity With Investors Is Under Threat From Overpricing

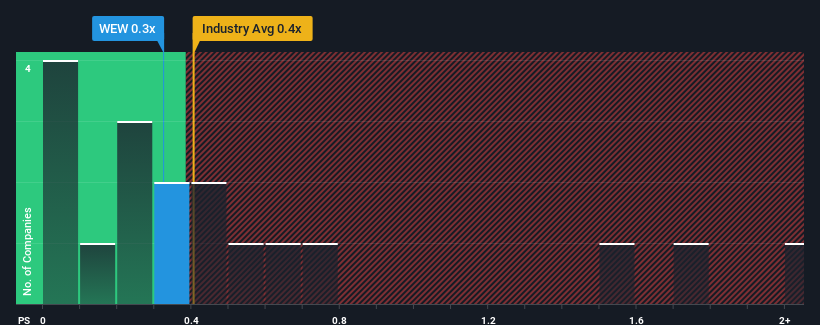

There wouldn't be many who think Westwing Group SE's (ETR:WEW) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Specialty Retail industry in Germany is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Westwing Group

What Does Westwing Group's Recent Performance Look Like?

Westwing Group could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Westwing Group.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Westwing Group would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.6%. Still, lamentably revenue has fallen 17% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.2% during the coming year according to the three analysts following the company. With the industry predicted to deliver 7.3% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Westwing Group's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Westwing Group's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Westwing Group's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Westwing Group with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Westwing Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:WEW

Westwing Group

Engages in the home and living e-commerce business in Germany, Switzerland, Austria, Spain, Italy, France, Poland, the Czech Republic, the Slovak Republic, Belgium, and the Netherlands.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives