As European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index rising by 2.35%, investors are increasingly eyeing opportunities beyond the traditional blue-chip stocks. Penny stocks, although an older term, continue to capture interest due to their potential for growth and affordability. These smaller or newer companies can offer significant value when backed by strong financials; in this article, we explore three such penny stocks that stand out for their balance sheet resilience and growth potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.65 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.985 | €14.63M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.84 | €68.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.04 | €64.48M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.385 | €387.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.27 | €313.76M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.082 | €8.67M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.798 | €26.72M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Spinnova Oyj (HLSE:SPINN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Spinnova Oyj is a company that produces and sells natural fibre materials both in Finland and internationally, with a market cap of €22.20 million.

Operations: Spinnova Oyj generates its revenue primarily through its textile manufacturing segment, which accounts for €0.5 million.

Market Cap: €22.2M

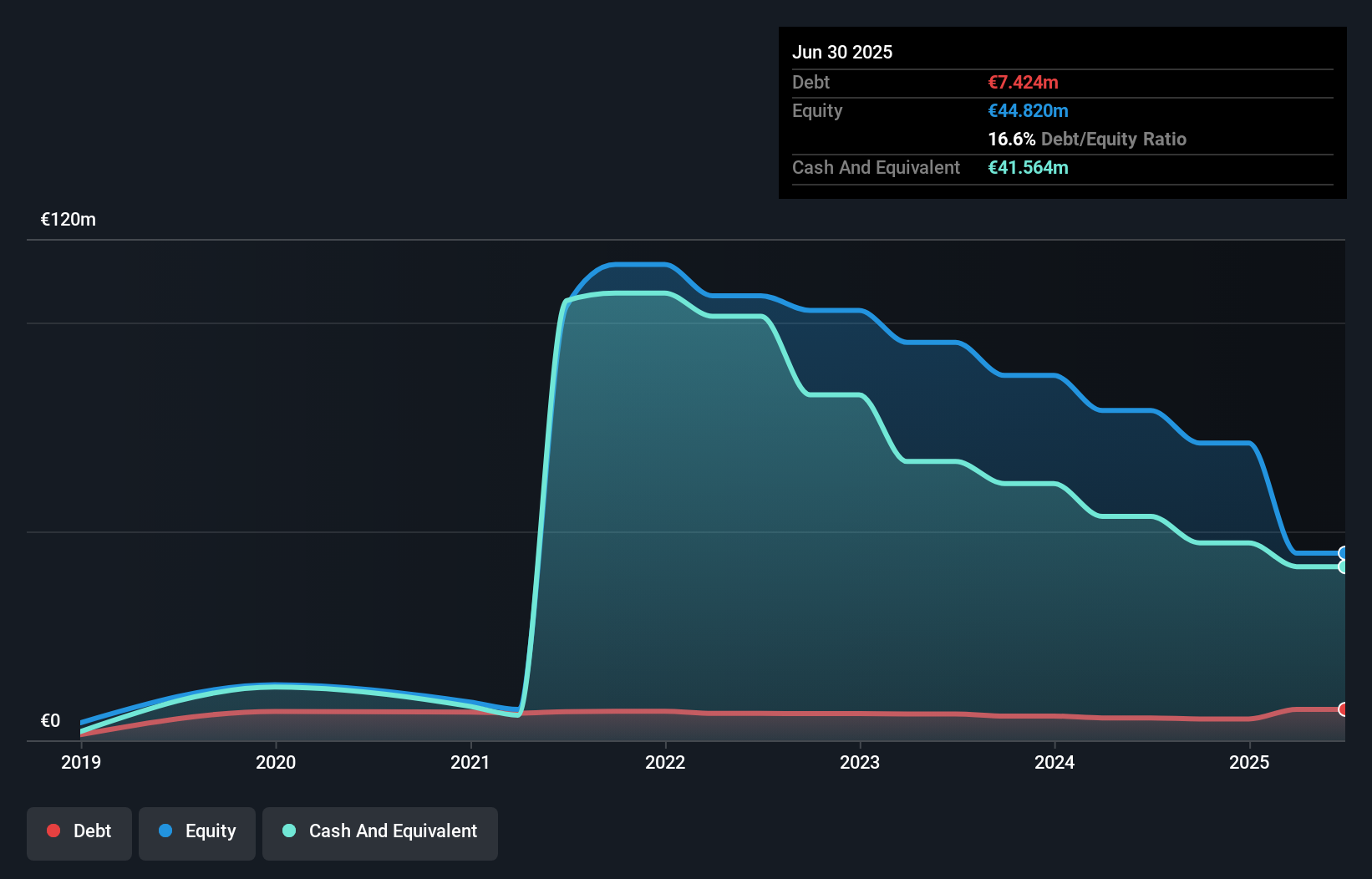

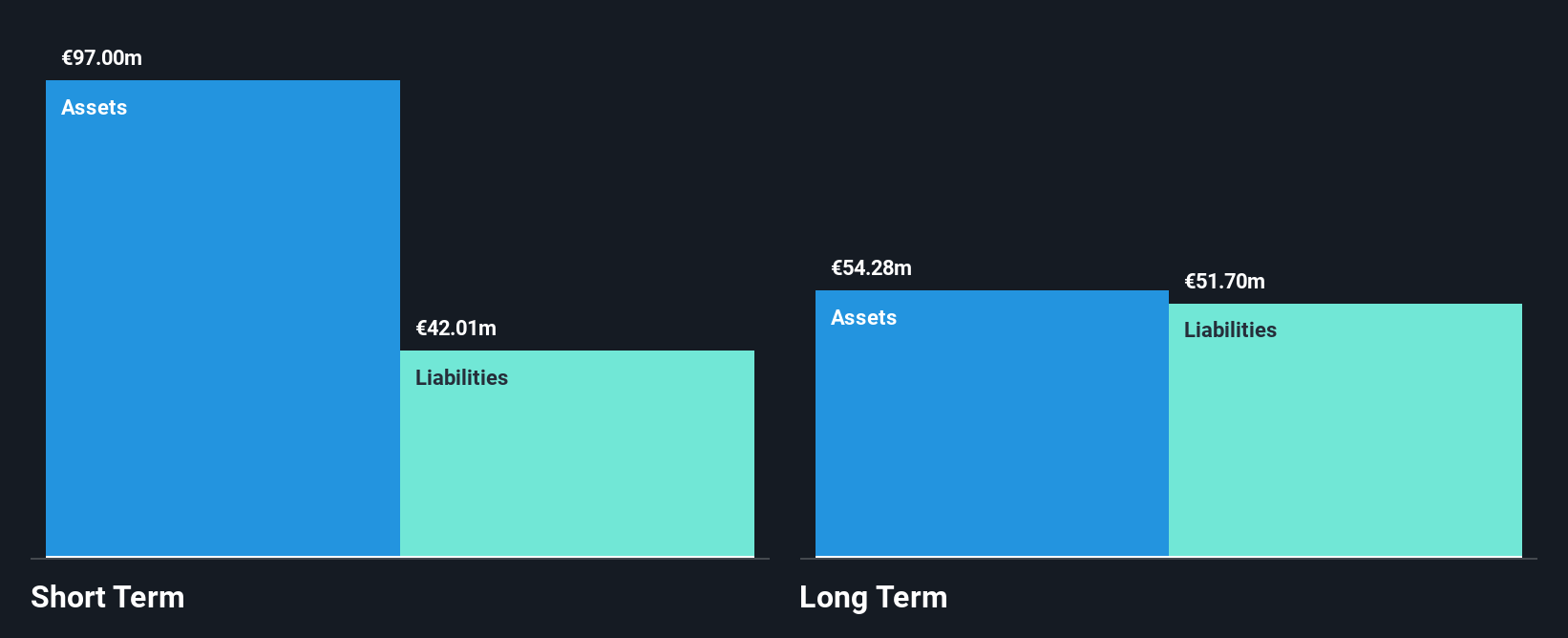

Spinnova Oyj, with a market cap of €22.20 million, is currently pre-revenue and unprofitable, generating only €0.5 million in revenue from its textile manufacturing segment. Despite this, the company maintains a strong financial position with short-term assets of €43 million exceeding both its short-term and long-term liabilities significantly. The management team and board are relatively new, which may impact strategic direction. Although Spinnova's share price has been highly volatile recently, it benefits from a sufficient cash runway exceeding three years even if free cash flow declines at historical rates. Revenue growth is forecasted at 55% annually.

- Jump into the full analysis health report here for a deeper understanding of Spinnova Oyj.

- Gain insights into Spinnova Oyj's future direction by reviewing our growth report.

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna (WSE:PRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating as SPARK VC S.A., is a publicly owned investment manager with a market capitalization of PLN112.56 million.

Operations: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, known as SPARK VC S.A., does not report specific revenue segments.

Market Cap: PLN112.56M

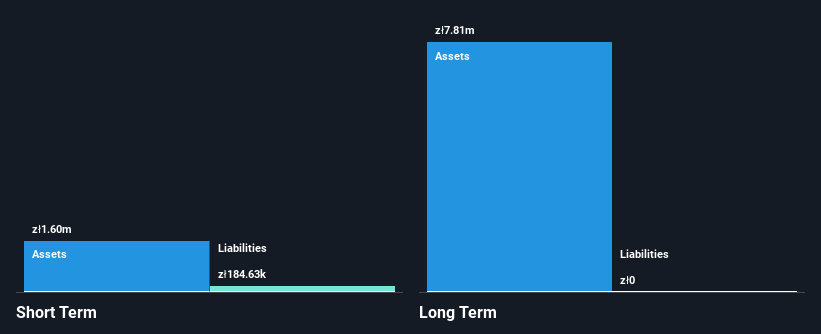

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating as SPARK VC S.A., is a pre-revenue entity with a market cap of PLN112.56 million and no significant revenue streams. Despite being unprofitable, the company has reduced its losses annually by 35.3% over five years and maintains a robust cash runway exceeding three years due to positive free cash flow growth. It is debt-free and has improved from a previous debt-to-equity ratio of 18%. However, the board's inexperience could affect governance, while short-term liabilities outweigh assets by PLN1.58 million, posing potential liquidity challenges amidst high share price volatility.

- Navigate through the intricacies of Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna with our comprehensive balance sheet health report here.

- Understand Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's track record by examining our performance history report.

Mister Spex (XTRA:MRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mister Spex SE is a retailer of optical products operating in Germany and internationally, with a market cap of €44.26 million.

Operations: The company generates €186.22 million in revenue from its online retail segment.

Market Cap: €44.26M

Mister Spex SE, with a market cap of €44.26 million, is navigating challenges as it reports declining revenues and persistent unprofitability. The company anticipates a significant revenue drop for 2025 and continues to operate with negative EBIT margins. Despite these hurdles, Mister Spex's cash reserves exceed its debt levels, providing a financial cushion. Recent management changes could bring fresh strategic perspectives; however, the new team lacks extensive tenure at the company. While its share price remains volatile and returns on equity are negative, Mister Spex's valuation appears below estimated fair value by nearly half.

- Click here to discover the nuances of Mister Spex with our detailed analytical financial health report.

- Explore Mister Spex's analyst forecasts in our growth report.

Key Takeaways

- Unlock our comprehensive list of 278 European Penny Stocks by clicking here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:SPINN

Spinnova Oyj

Produces and sells natural fibre materials in Finland and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026