- Germany

- /

- Specialty Stores

- /

- XTRA:CEC

Ceconomy (XTRA:CEC) Q3: 0.01% Net Margin Weakens Omnichannel Profitability Narrative

Reviewed by Simply Wall St

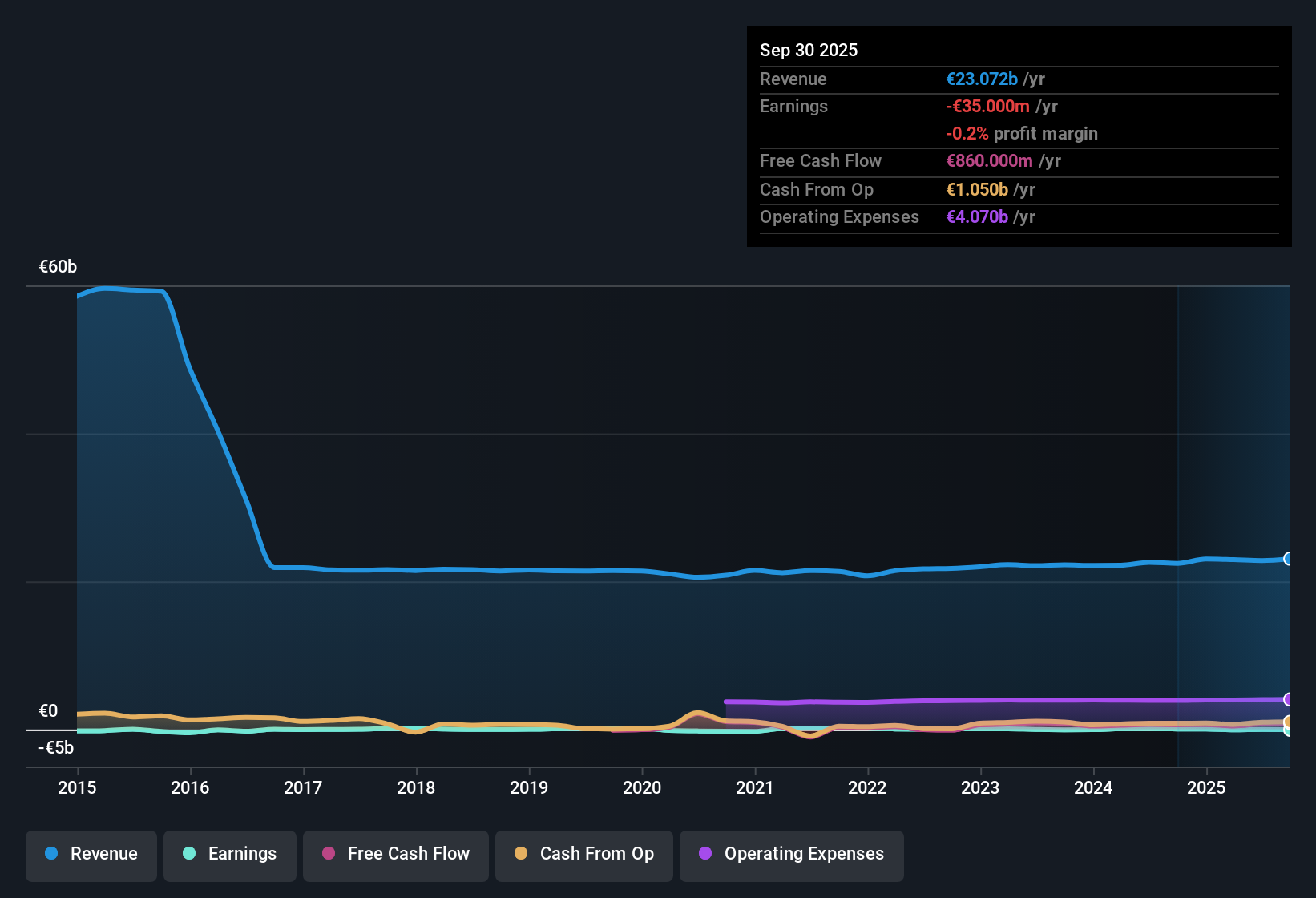

Ceconomy (XTRA:CEC) has just put out its FY 2025 third quarter scorecard, posting revenue of €4.8 billion with basic EPS of -€0.24 and net income of -€114 million, while same store sales growth landed at 4.4%. Looking back over recent quarters, the company has seen revenue move from €5.2 billion and EPS of -€0.33 in Q3 2024 to €4.8 billion and EPS of -€0.24 in Q3 2025. Trailing twelve month EPS is sitting close to breakeven at €0.006358 as net profit margin holds around 0.01%. Taken together, the latest numbers point to thin profitability and compressed margins, which puts the spotlight on how sustainable the current operating model is for investors.

See our full analysis for Ceconomy.With the headline figures on the table, the next step is to weigh these results against the dominant market and community narratives around Ceconomy and see which stories still hold up and which ones the latest margins start to challenge.

See what the community is saying about Ceconomy

Margins Barely Positive At 0.01%

- On a trailing 12 month basis, Ceconomy earned €3 million of net income on €22.8 billion of revenue, which works out to a net margin of just 0.01%, down from 0.6% a year earlier.

- The consensus narrative expects structurally better profitability from omnichannel and services. However, today's thin margin shows that improvement is still to come rather than already visible.

- Services and Solutions and newer offerings like retail media are described as high margin, but the 0.01% margin for the last 12 months indicates these segments are not yet lifting group profitability in a big way.

- Management is targeting margin gains as digital and loyalty programs scale, so the gap between 0.01% today and the consensus expectation of higher future margins is what investors need to watch most closely.

Revenue Growth Trails Market Benchmark

- Ceconomy’s trailing 12 month revenue has been growing at about 0.5% per year, well below the 6.3% per year benchmark for the German market.

- The consensus narrative highlights strong omnichannel expansion and sustainability demand as topline drivers. However, the modest 0.5% growth rate suggests those growth engines are only partly offsetting softer consumer demand and competition.

- Same store sales have swung from 7.8% growth in Q1 2025 to 0.8% in Q2 and 4.4% in Q3, which fits the narrative that demand is "stable but subdued" in key regions rather than consistently strong.

- Analysts still model revenue growing 2.8% annually over the next three years, so current 0.5% trailing growth leaves execution work to close that gap.

Deep Value Case Versus Analyst Targets

- At a share price of €4.40 and a price to sales ratio of 0.1 times versus peers at 0.5 times, Ceconomy screens cheaply, and the DCF fair value of €24.29 sits far above both the current price and the analyst price target of €4.53.

- The consensus narrative effectively sides with caution, as the small spread between €4.40 and the €4.53 analyst target contrasts with the much higher DCF fair value and underlines how weak earnings and interest coverage are pulling valuation multiples down.

- Trailing five year earnings growth of 7.7% per year and a return to profitability provide some support for a bullish long term view, but the razor thin 0.01% margin and poor interest coverage keep analysts from fully embracing the DCF upside.

- Forecasts for earnings to reach €457.8 million and EPS of €0.97 by 2028 imply a much stronger business than today, so the current low multiples reflect the risk that these improvements take longer or come in below plan.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ceconomy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that challenges the consensus? Use that insight to shape your own view in just a few minutes, Do it your way.

A great starting point for your Ceconomy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Ceconomy’s razor thin margins, subdued revenue growth and weak interest coverage highlight how fragile its profitability is compared to market benchmarks and expectations.

If you want businesses with healthier cushions and more resilient performance, use our solid balance sheet and fundamentals stocks screener (1942 results) today to quickly shortlist companies built to withstand tougher conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CEC

Undervalued with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)