- Germany

- /

- Specialty Stores

- /

- XTRA:AG1

Why Investors Shouldn't Be Surprised By AUTO1 Group SE's (ETR:AG1) P/S

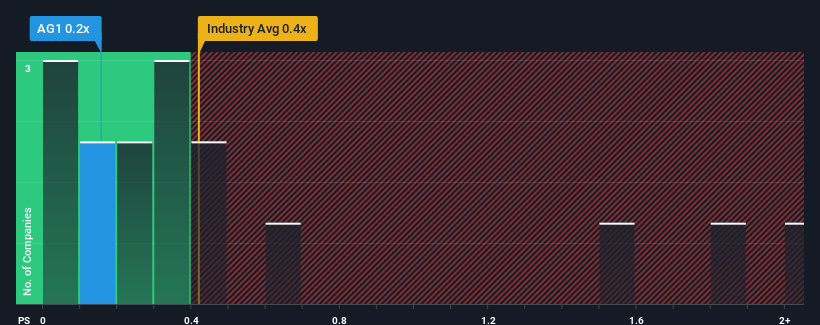

It's not a stretch to say that AUTO1 Group SE's (ETR:AG1) price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" for companies in the Specialty Retail industry in Germany, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for AUTO1 Group

What Does AUTO1 Group's P/S Mean For Shareholders?

AUTO1 Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think AUTO1 Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For AUTO1 Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AUTO1 Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Still, the latest three year period has seen an excellent 86% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 5.7% as estimated by the eleven analysts watching the company. That's shaping up to be similar to the 4.8% growth forecast for the broader industry.

In light of this, it's understandable that AUTO1 Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From AUTO1 Group's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A AUTO1 Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Specialty Retail industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AUTO1 Group that you need to be mindful of.

If you're unsure about the strength of AUTO1 Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AG1

AUTO1 Group

A technology company, operates a digital automotive platform for buying and selling used cars online in Germany, France, Italy, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives