- Germany

- /

- Specialty Stores

- /

- XTRA:AG1

A Piece Of The Puzzle Missing From AUTO1 Group SE's (ETR:AG1) 43% Share Price Climb

AUTO1 Group SE (ETR:AG1) shares have continued their recent momentum with a 43% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

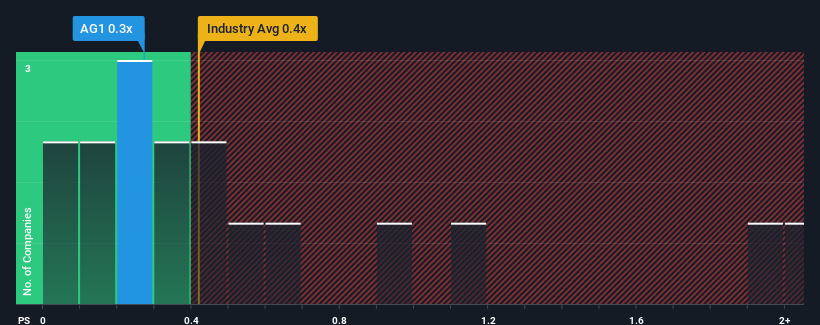

In spite of the firm bounce in price, it's still not a stretch to say that AUTO1 Group's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in Germany, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for AUTO1 Group

What Does AUTO1 Group's Recent Performance Look Like?

While the industry has experienced revenue growth lately, AUTO1 Group's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AUTO1 Group.How Is AUTO1 Group's Revenue Growth Trending?

AUTO1 Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 75% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 8.7% each year during the coming three years according to the eleven analysts following the company. With the industry only predicted to deliver 6.5% per year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that AUTO1 Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

AUTO1 Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at AUTO1 Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for AUTO1 Group (1 is significant) you should be aware of.

If these risks are making you reconsider your opinion on AUTO1 Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade AUTO1 Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AG1

AUTO1 Group

A technology company, operates a digital automotive platform for buying and selling used cars online in Germany, France, Italy, and internationally.

Reasonable growth potential with mediocre balance sheet.