- Germany

- /

- Real Estate

- /

- XTRA:VNA

Increases to CEO Compensation Might Be Put On Hold For Now at Vonovia SE (ETR:VNA)

Performance at Vonovia SE (ETR:VNA) has been reasonably good and CEO Rolf Buch has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 16 April 2021. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Vonovia

Comparing Vonovia SE's CEO Compensation With the industry

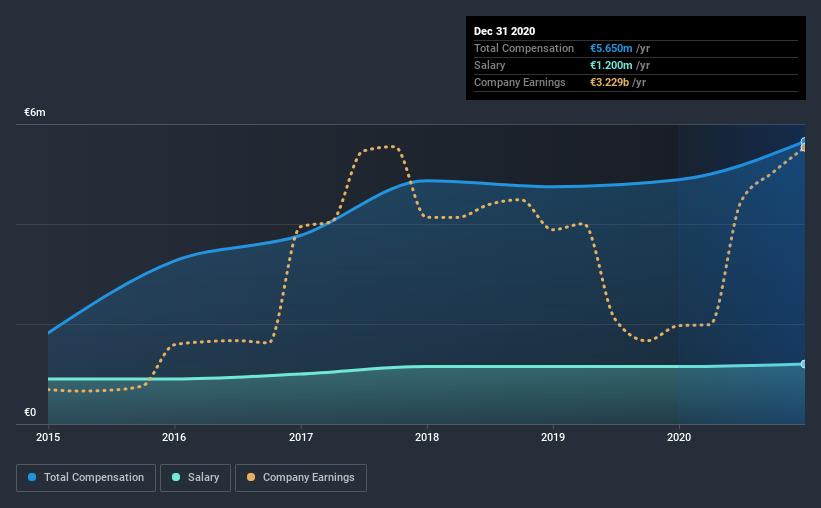

According to our data, Vonovia SE has a market capitalization of €33b, and paid its CEO total annual compensation worth €5.6m over the year to December 2020. We note that's an increase of 16% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €1.2m.

For comparison, other companies in the industry with market capitalizations above €6.7b, reported a median total CEO compensation of €1.8m. Accordingly, our analysis reveals that Vonovia SE pays Rolf Buch north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €1.2m | €1.2m | 21% |

| Other | €4.4m | €3.7m | 79% |

| Total Compensation | €5.6m | €4.9m | 100% |

On an industry level, around 41% of total compensation represents salary and 59% is other remuneration. In Vonovia's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Vonovia SE's Growth Numbers

Vonovia SE's earnings per share (EPS) grew 5.1% per year over the last three years. It achieved revenue growth of 9.8% over the last year.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Vonovia SE Been A Good Investment?

Boasting a total shareholder return of 60% over three years, Vonovia SE has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 5 warning signs for Vonovia (of which 2 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Vonovia, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Vonovia or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Vonovia, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:VNA

Vonovia

Operates as an integrated residential real estate company in Europe.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives