- Germany

- /

- Real Estate

- /

- XTRA:VNA

Vonovia (XTRA:VNA): Exploring Valuation After Debut Bond Issuance in Australian Dollars

Reviewed by Simply Wall St

Vonovia (XTRA:VNA) just made its first foray into the Australian debt market, issuing a total of AUD 850 million in unsecured bonds split between 7 and 10-year maturities. For investors watching the stock, this strategic move to raise funds in a new currency could be more than mere financial housekeeping. It signals a calculated effort to diversify its funding options and build relationships with global investors. The size and structure of this bond issue, paired with a competitive weighted yield after hedging, highlights how Vonovia aims to position itself for future growth or navigate shifts in European interest rates.

This financing decision comes at a time when the company’s share price has drifted lower, with a year-to-date drop of 10% and a 17% slide over the past twelve months, even as net income showed strong annual growth. Shorter-term swings, such as the rally this past week, contrast with a tougher month and 3-month period. This might leave some wondering whether momentum is shifting or just fragmenting. For long-term investors, the stock is still up by nearly 19% over three years but remains well below levels from five years ago, suggesting the road has been far from smooth.

With this latest move to tap international capital, is Vonovia trading at a bargain that markets have overlooked, or is the current price fully capturing its growth plans and risks?

Most Popular Narrative: 29% Undervalued

The prevailing narrative suggests Vonovia is undervalued by nearly a third compared to its fair value, based on future performance expectations and market dynamics.

*The cessation of value decline in property prices and a prediction of stable or increasing transaction volumes suggest future revenue stability and potential appreciation in asset values. Vonovia’s approach to prioritize cash generation and maintain financial stability, including successful completions of the disposal program at or above book value, is expected to positively impact net margins and protect the balance sheet.*

Curious how Vonovia could unlock this hidden value? The fair value hinges on bold assumptions about future earnings momentum and rising profit margins. Want to see which surprising numbers drive this confident outlook? The full narrative breaks down exactly what fuels this 29% upside. Dive in to see what the crowd believes the market is missing.

Result: Fair Value of €37.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising financing costs or delays in non-rental initiatives could challenge the upbeat outlook and prompt a reconsideration of Vonovia’s future earnings power.

Find out about the key risks to this Vonovia narrative.Another View: Market Multiples Raise Caution

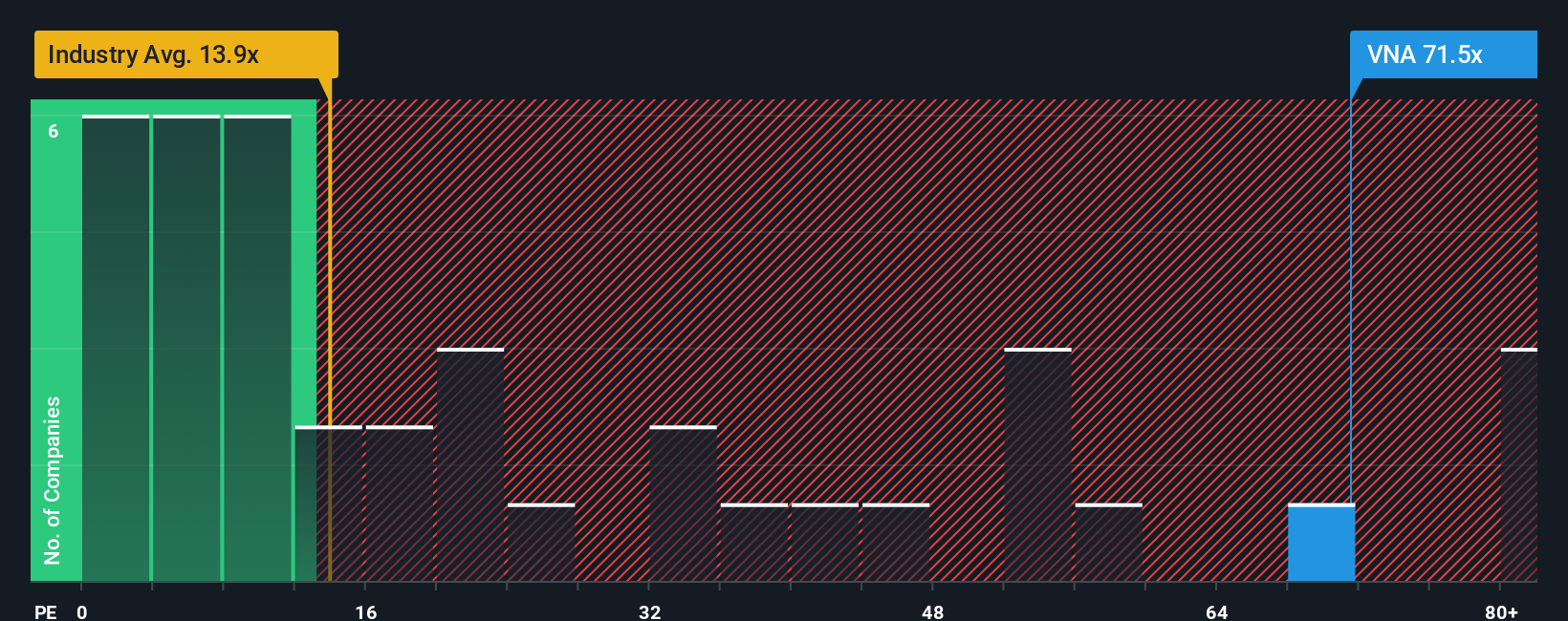

While analyst forecasts paint Vonovia as undervalued, comparing its share price to industry benchmarks reveals the market considers it expensive relative to others in the same business. Are these opposing signals about future value both right, or is one missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Vonovia to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Vonovia Narrative

Feel the urge to chart your own perspective or dig deeper on Vonovia’s numbers? You can craft and share a personalized view in just a few minutes. Do it your way.

A great starting point for your Vonovia research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your investing toolkit by seeking out fresh opportunities that could shape your portfolio’s future. Don’t let today’s trending markets pass you by. These powerful screeners can help uncover hidden potential and keep your strategy ahead of the curve.

- Spot undervalued opportunities by starting your search with undervalued stocks based on cash flows to find companies that could be trading below their true worth.

- Capture high-yield potential in the income space as you explore dividend stocks with yields > 3%, zeroing in on businesses offering strong and consistent dividend payouts.

- Ride the wave of innovation by targeting breakthrough platforms and automation trends through AI penny stocks, putting tomorrow’s technology leaders on your radar today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VNA

Vonovia

Operates as an integrated residential real estate company in Europe.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives