- Germany

- /

- Real Estate

- /

- XTRA:RCMN

Shareholders Will Probably Hold Off On Increasing RCM Beteiligungs AG's (ETR:RCMN) CEO Compensation For The Time Being

Key Insights

- RCM Beteiligungs will host its Annual General Meeting on 5th of August

- Salary of €361.0k is part of CEO Martin Schmitt's total remuneration

- The total compensation is 42% higher than the average for the industry

- Over the past three years, RCM Beteiligungs' EPS fell by 13% and over the past three years, the total loss to shareholders 34%

In the past three years, the share price of RCM Beteiligungs AG (ETR:RCMN) has struggled to grow and now shareholders are sitting on a loss. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. The AGM coming up on 5th of August will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

Check out our latest analysis for RCM Beteiligungs

Comparing RCM Beteiligungs AG's CEO Compensation With The Industry

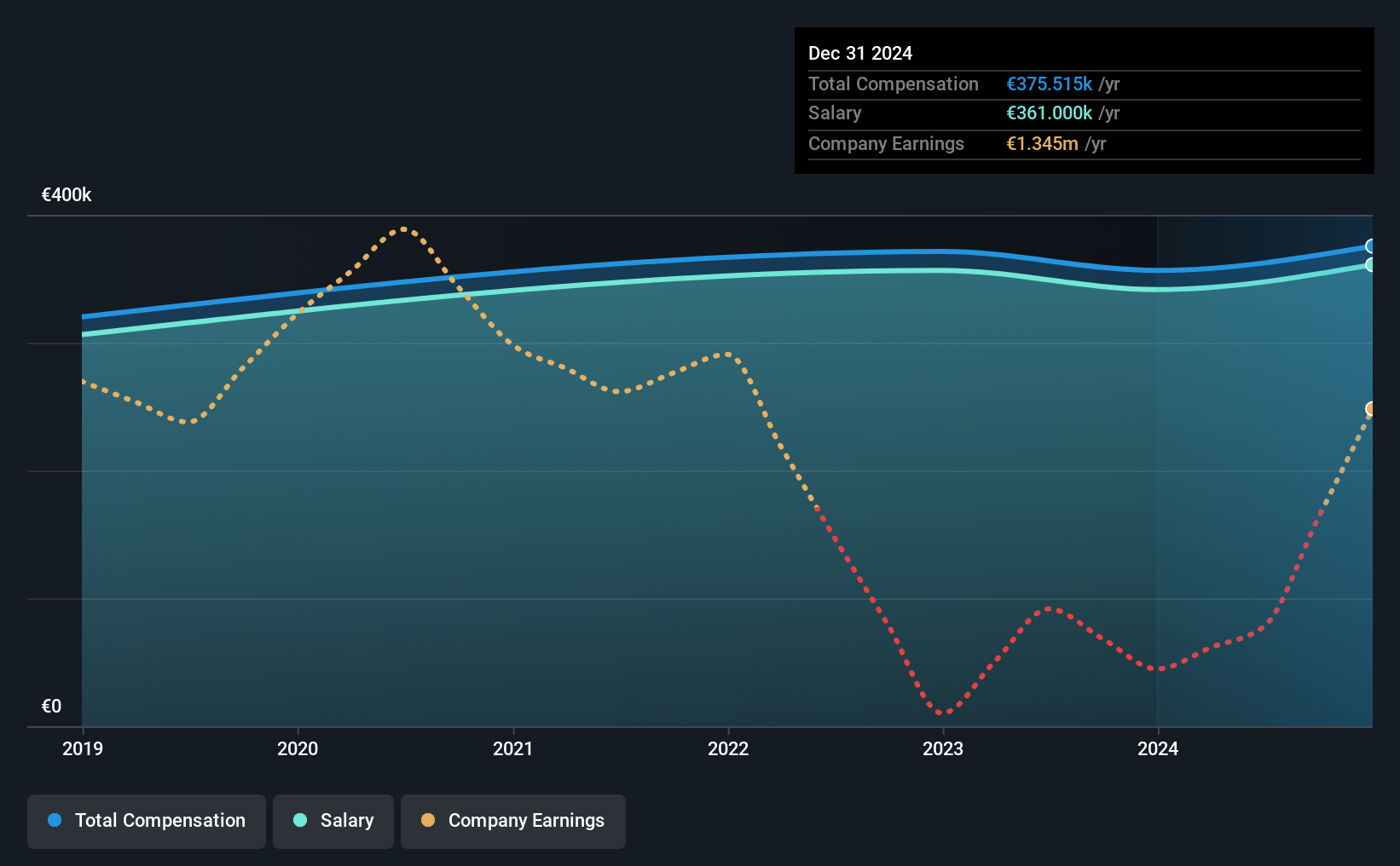

According to our data, RCM Beteiligungs AG has a market capitalization of €17m, and paid its CEO total annual compensation worth €376k over the year to December 2024. That's a fairly small increase of 5.3% over the previous year. We note that the salary portion, which stands at €361.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the German Real Estate industry with market capitalizations below €173m, we found that the median total CEO compensation was €265k. Hence, we can conclude that Martin Schmitt is remunerated higher than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €361k | €342k | 96% |

| Other | €15k | €15k | 4% |

| Total Compensation | €376k | €356k | 100% |

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. RCM Beteiligungs pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

RCM Beteiligungs AG's Growth

RCM Beteiligungs AG has reduced its earnings per share by 13% a year over the last three years. Its revenue is up 134% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has RCM Beteiligungs AG Been A Good Investment?

The return of -34% over three years would not have pleased RCM Beteiligungs AG shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Martin receives almost all of their compensation through a salary. The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 3 warning signs (and 2 which are concerning) in RCM Beteiligungs we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:RCMN

Good value with adequate balance sheet.

Market Insights

Community Narratives