- Germany

- /

- Real Estate

- /

- XTRA:AT1

Aroundtown's (ETR:AT1 three-year decrease in earnings delivers investors with a 41% loss

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Aroundtown SA (ETR:AT1) shareholders, since the share price is down 45% in the last three years, falling well short of the market return of around 22%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Our free stock report includes 2 warning signs investors should be aware of before investing in Aroundtown. Read for free now.While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Aroundtown moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Arguably the revenue decline of 4.4% per year has people thinking Aroundtown is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

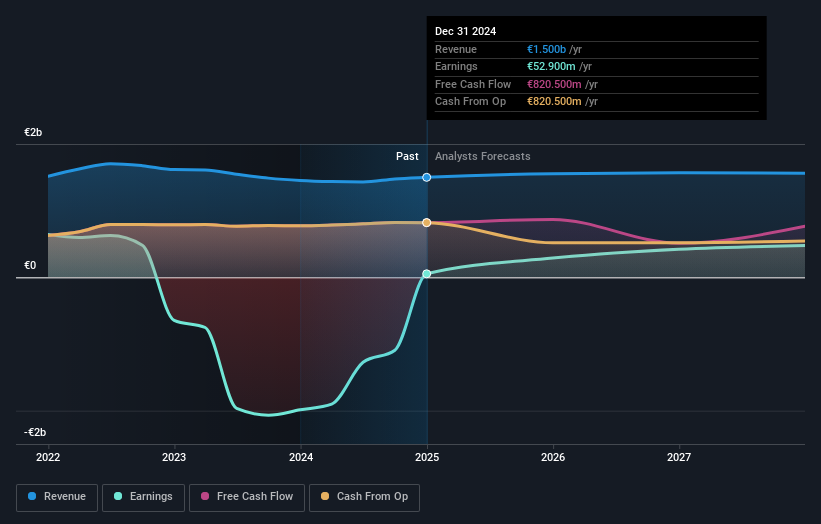

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Aroundtown is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Aroundtown's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Aroundtown shareholders, and that cash payout explains why its total shareholder loss of 41%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

It's good to see that Aroundtown has rewarded shareholders with a total shareholder return of 28% in the last twelve months. Notably the five-year annualised TSR loss of 7% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Aroundtown (1 shouldn't be ignored!) that you should be aware of before investing here.

We will like Aroundtown better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AT1

Aroundtown

Operates as a real estate company in Germany, the Netherlands, the United Kingdom, Belgium, and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Is Global Payments (NYSE:GPN) The Undervalued Cash Cow Your Portfolio Needs?

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026