We Think You Should Be Aware Of Some Concerning Factors In Formycon's (ETR:FYB) Earnings

The recent earnings posted by Formycon AG (ETR:FYB) were solid, but the stock didn't move as much as we expected. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

See our latest analysis for Formycon

A Closer Look At Formycon's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

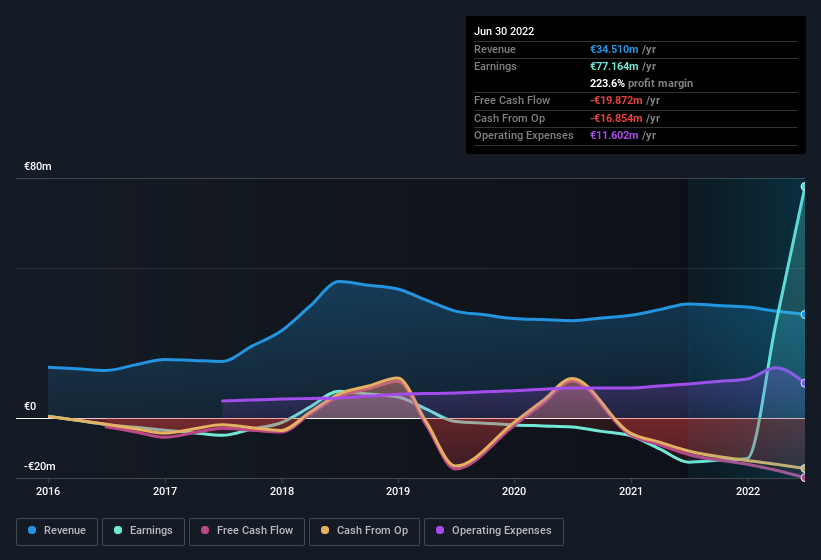

Formycon has an accrual ratio of 0.48 for the year to June 2022. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of €20m, in contrast to the aforementioned profit of €77.2m. We also note that Formycon's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of €20m. One positive for Formycon shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Formycon's Profit Performance

As we discussed above, we think Formycon's earnings were not supported by free cash flow, which might concern some investors. For this reason, we think that Formycon's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into Formycon, you'd also look into what risks it is currently facing. Case in point: We've spotted 1 warning sign for Formycon you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Formycon's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives