As global markets continue to reach record highs, with small-cap indices like the Russell 2000 joining their larger counterparts in this upward momentum, investor sentiment is being shaped by a mix of domestic policy changes and geopolitical developments. In such a dynamic environment, identifying high-growth tech stocks involves looking for companies that can adapt to shifting economic landscapes and leverage technological advancements to sustain their growth trajectory.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 28.04% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

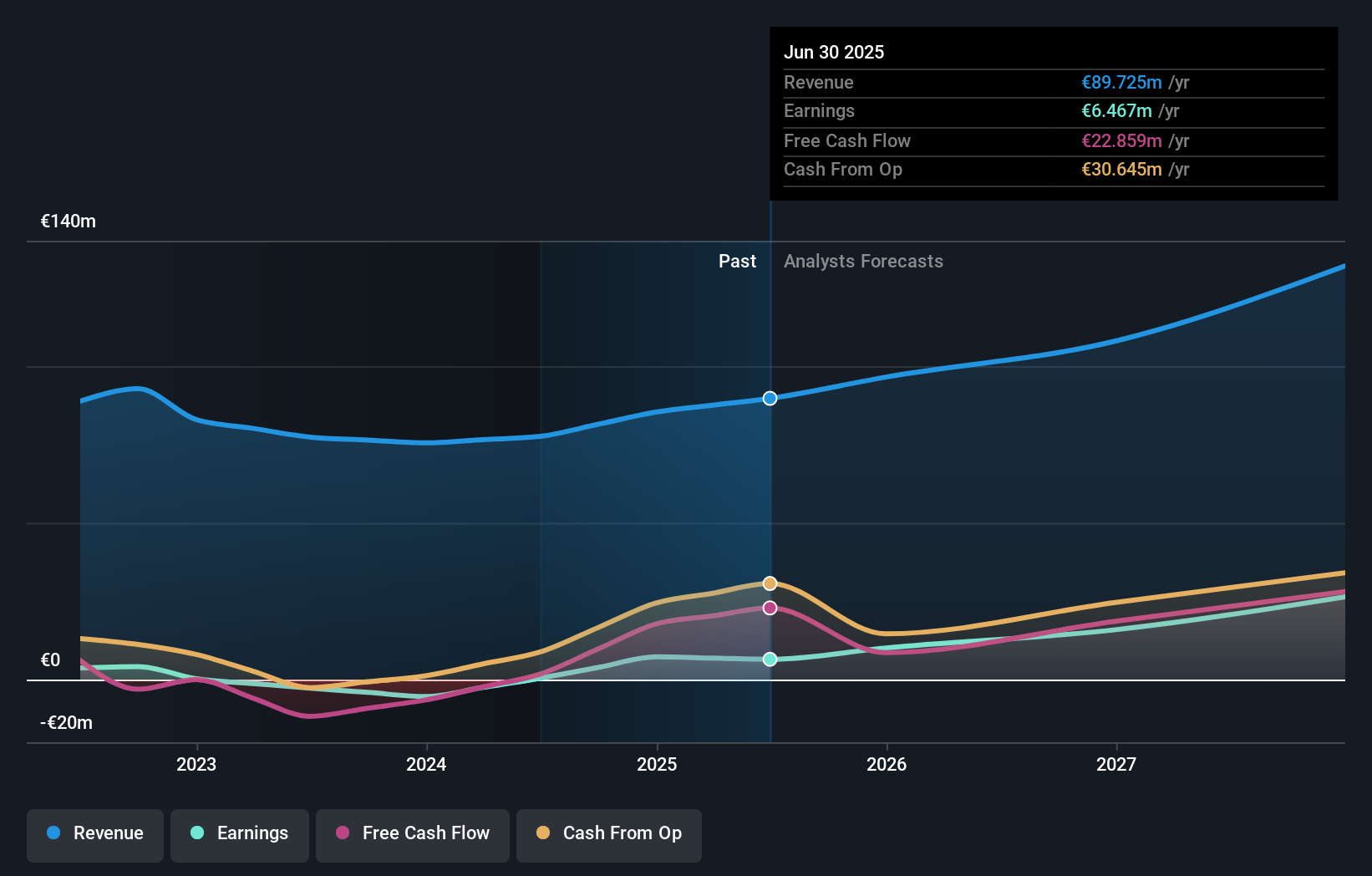

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bittium Oyj offers communications and connectivity solutions, healthcare technology products and services, and biosignal measuring and monitoring across Finland, Germany, and the United States with a market capitalization of €251.24 million.

Operations: The company generates revenue through its diverse offerings in communications and connectivity solutions, healthcare technology products, and biosignal measuring and monitoring services. It operates primarily in Finland, Germany, and the United States. The focus on specialized technology solutions supports its business model across these regions.

Bittium Oyj's recent performance and projections suggest a turnaround, with sales rising from EUR 49.5 million to EUR 52 million in nine months and a shift from a net loss of EUR 6 million last year to a net income of EUR 1.7 million this year. This improvement is underpinned by significant R&D investment, aligning with an industry trend where tech firms intensify innovation efforts to stay competitive. The company's revenue growth forecast at 11.6% annually outpaces the Finnish market's 2.6%, reflecting its recovery trajectory and potential in high-tech sectors despite not being the fastest-growing in its category. Moreover, expected earnings growth at an impressive rate of 40.1% annually indicates robust future prospects, supported by strategic expansions and operational enhancements that could further solidify Bittium's market position.

- Click here to discover the nuances of Bittium Oyj with our detailed analytical health report.

Assess Bittium Oyj's past performance with our detailed historical performance reports.

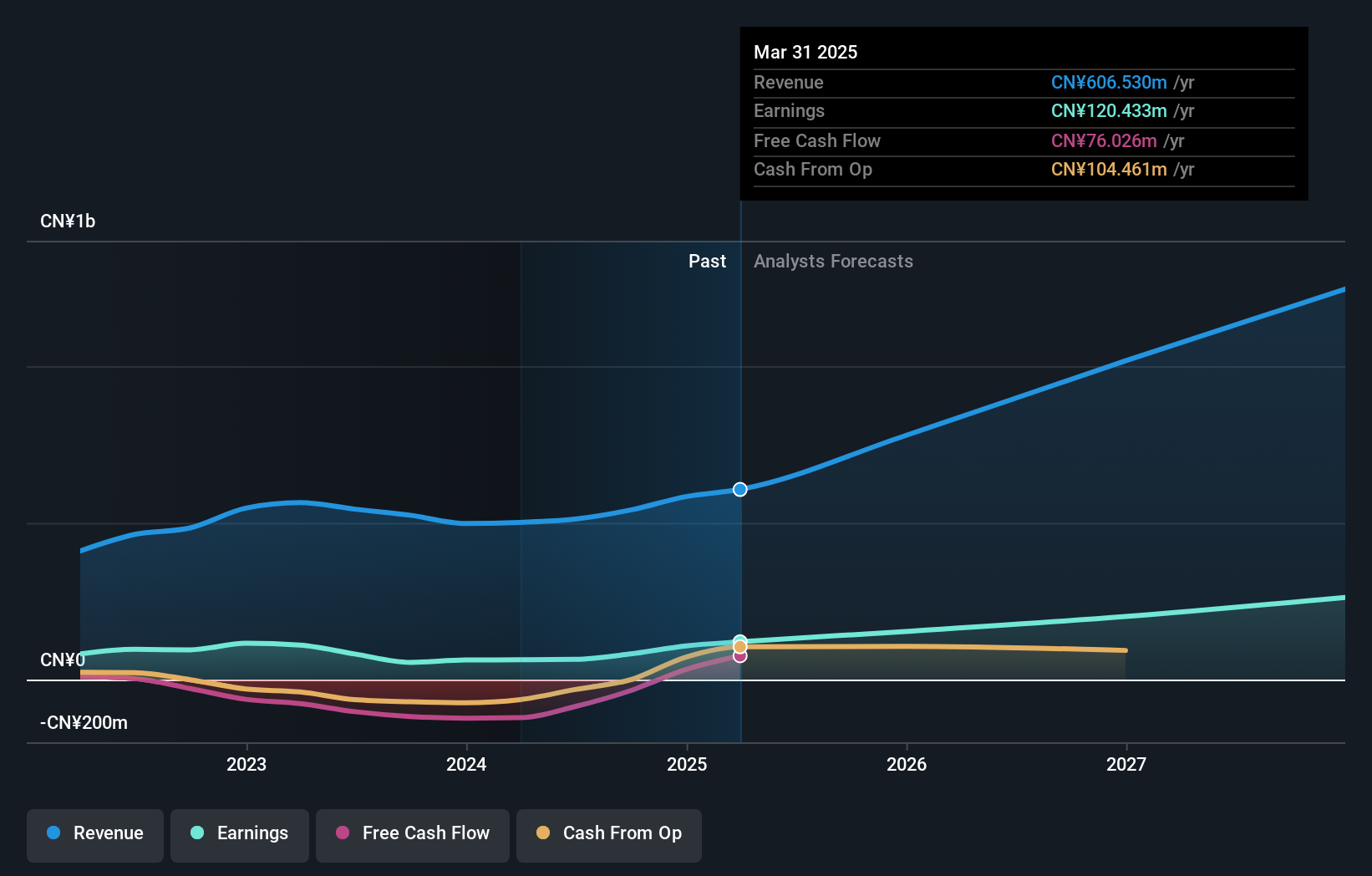

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Ronds Science & Technology Incorporated Company specializes in providing solutions for machinery condition monitoring within the predictive maintenance sector in China, with a market capitalization of CN¥2.96 billion.

Operations: Ronds focuses on machinery condition monitoring solutions within China's predictive maintenance industry. The company operates with a market capitalization of approximately CN¥2.96 billion, emphasizing its role in enhancing equipment reliability and operational efficiency.

Anhui Ronds Science & Technology has demonstrated a notable turnaround, with its revenue climbing to CNY 342.74 million from CNY 299.94 million year-over-year, and shifting from a net loss of CNY 16.37 million to a net income of CNY 2.72 million. This growth is propelled by robust R&D investments, which are crucial as the company's earnings are expected to surge by an impressive 30.8% annually over the next three years, outpacing the Chinese market's projection of 26.1%. Additionally, recent strategic moves like the issuance of over 5.8 million shares have bolstered their financial position, enabling further innovation and expansion in high-tech sectors where dynamic client needs drive technological advancements.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market capitalization of €855.48 million.

Operations: The company generates revenue primarily from its Drug Delivery Systems segment, which contributes €60.80 million.

Formycon AG, a key figure in the biotechnology sector, is steering significant growth with a projected revenue increase of 33.4% annually, outpacing the German market's average of 5.7%. This surge is underpinned by robust R&D efforts, which have not only fueled a 32.3% expected annual profit growth but also positioned the company ahead of Germany’s broader market forecast of 20.8%. Recent FDA approval for its biosimilar product further solidifies Formycon's strategic advancements in healthcare solutions, promising to enhance its competitive edge and market presence significantly.

Key Takeaways

- Navigate through the entire inventory of 1284 High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bittium Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BITTI

Bittium Oyj

Provides solutions for communications and connectivity, healthcare technology products and services, and biosignal measuring and monitoring in Finland, Germany, and the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives