European Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As European markets grapple with concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, the pan-European STOXX Europe 600 Index has seen a decline, highlighting the cautious sentiment among investors. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate strong internal confidence in a company's growth potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 50.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's explore several standout options from the results in the screener.

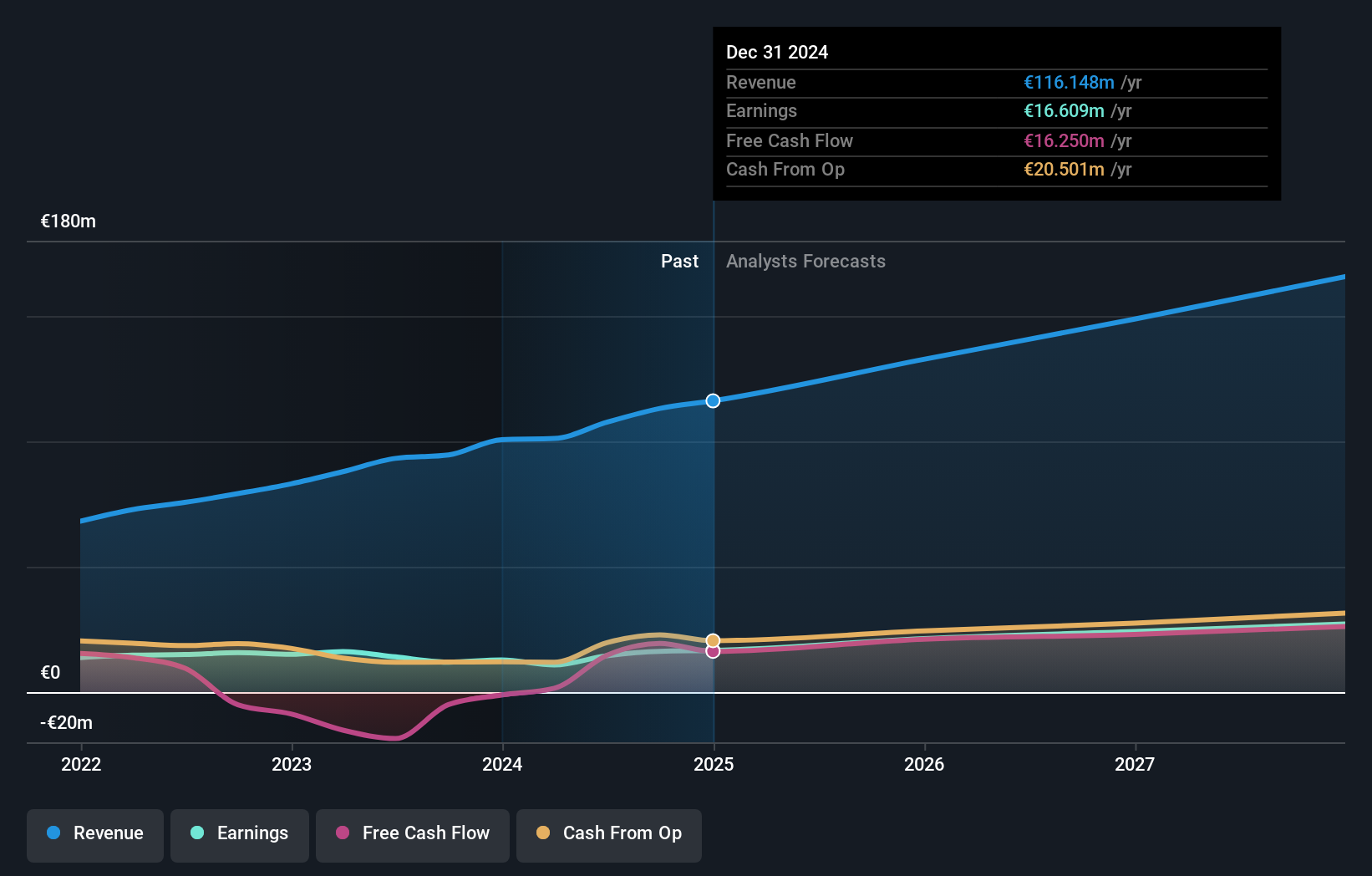

Pharmanutra (BIT:PHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that researches, designs, develops, and markets nutritional supplements and medical devices across various regions including Italy, Europe, the Middle East, South America, and the Far East; it has a market cap of €542.58 million.

Operations: The company's revenue is divided into segments, with €6.82 million from Akern, €75.15 million generated in Italy, and €44.66 million from international markets.

Insider Ownership: 10.8%

Revenue Growth Forecast: 12.8% p.a.

Pharmanutra, a company with significant insider ownership, recently reported strong financial results for the nine months ending September 2025, with sales and revenue both showing year-over-year growth. Despite a volatile share price in recent months, the company's earnings are forecast to grow significantly faster than the Italian market at 20.2% per year over the next three years. Analysts expect a substantial stock price increase of 43.4%, although its dividend yield of 1.77% is not well covered by free cash flows.

- Click to explore a detailed breakdown of our findings in Pharmanutra's earnings growth report.

- Our expertly prepared valuation report Pharmanutra implies its share price may be too high.

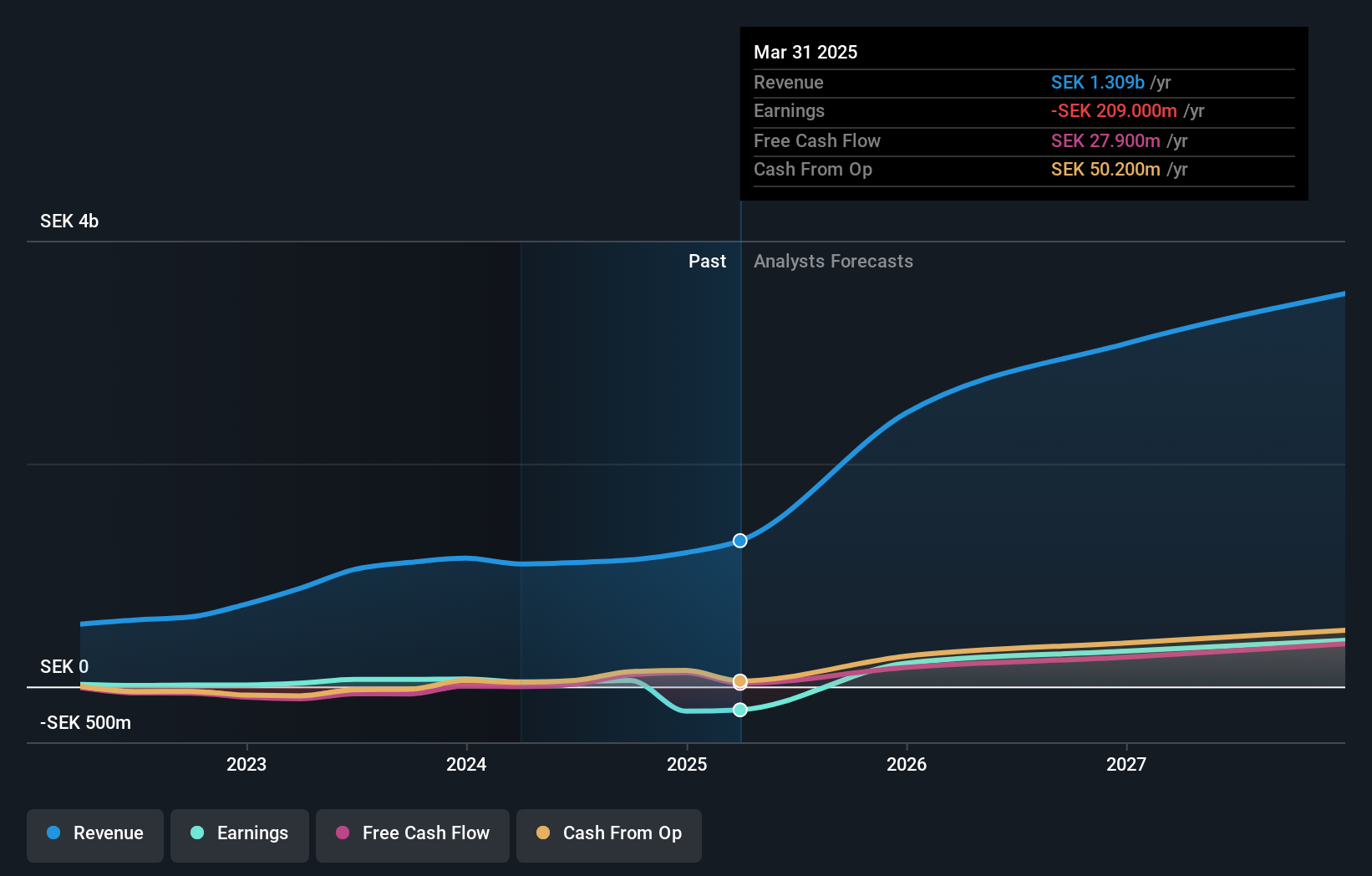

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★★★

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions across several countries including Sweden, Norway, Finland, Denmark, the UK, Germany, Switzerland, the US and Australia with a market cap of SEK5.94 billion.

Operations: The company's revenue is primarily derived from its Computer Hardware segment, which generated SEK1.68 billion.

Insider Ownership: 13.7%

Revenue Growth Forecast: 29.2% p.a.

MilDef Group, with substantial insider ownership, is poised for significant growth. Its revenue and earnings are forecast to grow rapidly at 29.2% and 83% annually, respectively. Recent strong financial results show Q3 sales of SEK 539.7 million and net income of SEK 45.4 million. Analysts expect the stock price to rise by 94.5%. The company is expanding production capacity in Sweden to meet increased defense demands, aligning with its strategic growth initiatives in the defense sector.

- Click here and access our complete growth analysis report to understand the dynamics of MilDef Group.

- In light of our recent valuation report, it seems possible that MilDef Group is trading behind its estimated value.

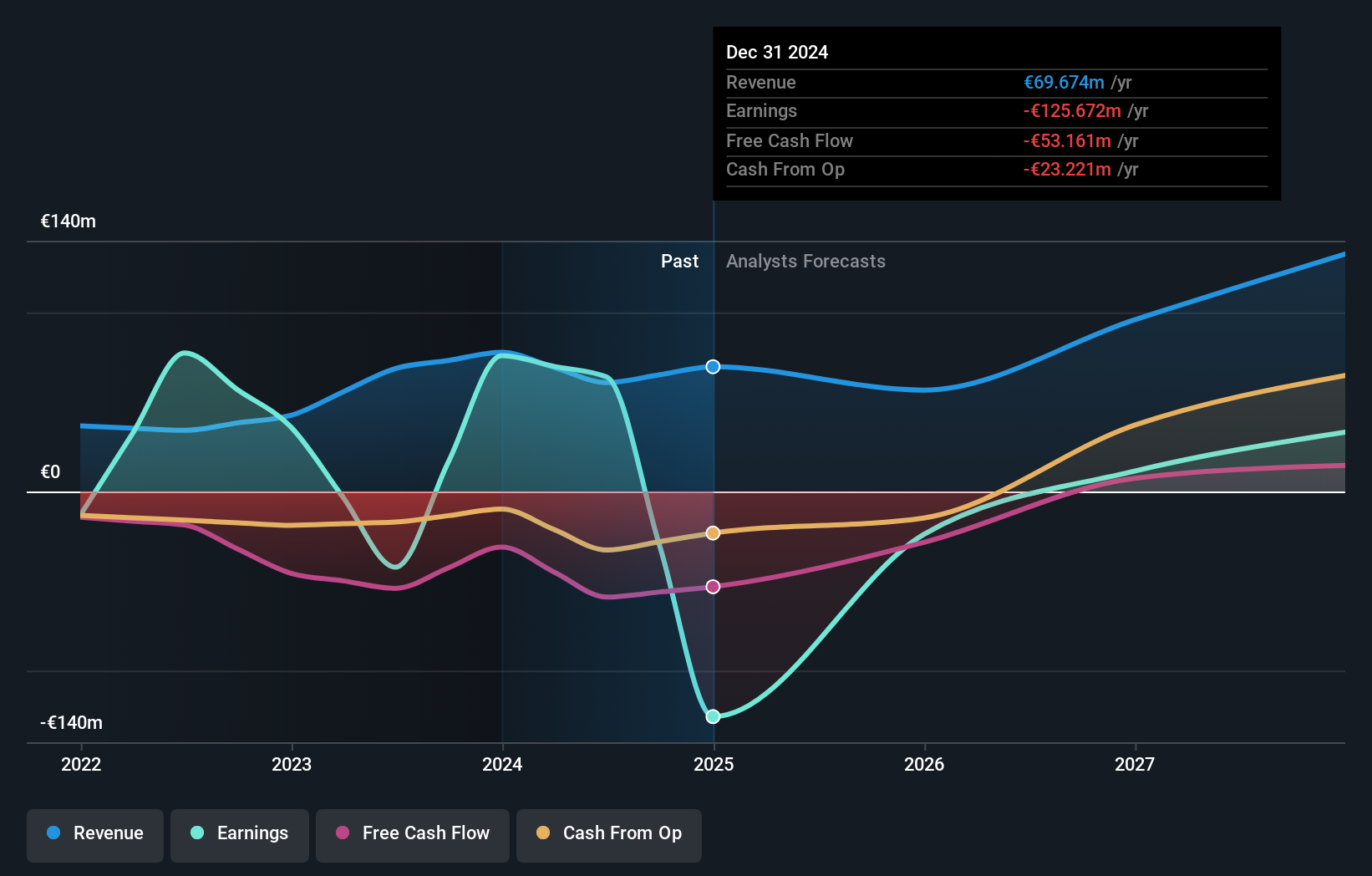

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG is a biotechnology company that develops biosimilar drugs in Germany and Switzerland, with a market cap of €438.08 million.

Operations: The company's revenue is primarily derived from its biotechnology segment, generating €51.78 million.

Insider Ownership: 14.2%

Revenue Growth Forecast: 24.4% p.a.

Formycon, with significant insider ownership, is positioned for robust growth. The company forecasts revenue growth of 24.4% annually, outpacing the German market. Recent developments include the announcement of FYB208, a biosimilar candidate for Dupixent, which has substantial sales potential projected to exceed US$20 billion by 2030. Additionally, Formycon's FYB201/Ranivisio® launch in Europe and settlement with Regeneron over Eylea® patents highlight strategic advancements in its biosimilar portfolio.

- Unlock comprehensive insights into our analysis of Formycon stock in this growth report.

- Upon reviewing our latest valuation report, Formycon's share price might be too optimistic.

Next Steps

- Embark on your investment journey to our 202 Fast Growing European Companies With High Insider Ownership selection here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success