As European markets experience an upswing, with the STOXX Europe 600 Index and major stock indexes like Germany's DAX and the UK's FTSE 100 showing notable gains, investors are increasingly focused on growth opportunities amid this positive momentum. In such a climate, stocks with strong insider ownership can be particularly appealing as they often indicate confidence from those who know the company best, aligning well with current market optimism.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 43.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 75.4% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Pharmanutra (BIT:PHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that researches, designs, develops, and markets nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and internationally with a market cap of €439.35 million.

Operations: Pharmanutra S.p.A. generates its revenue through the research, design, development, and marketing of nutritional supplements and medical devices across various regions including Italy, Europe, the Middle East, South America, and the Far East.

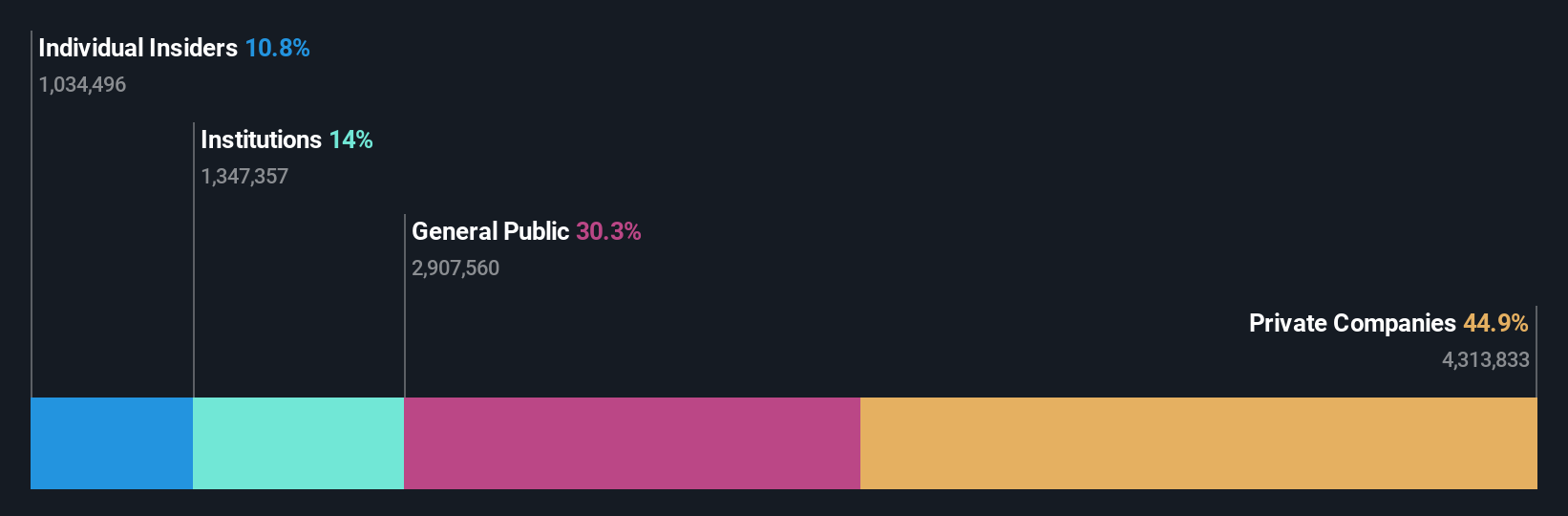

Insider Ownership: 10.8%

Revenue Growth Forecast: 12.3% p.a.

Pharmanutra's robust growth trajectory is underscored by its earnings, which rose 16.6% last year and are projected to grow at 19.23% annually, outpacing the Italian market. Despite high volatility in share price, analysts expect a significant 77% price increase. The company's revenue also shows strong growth potential at €63.1 million for the first half of 2025 compared to €57 million previously, although its dividend remains inadequately covered by free cash flow.

- Click to explore a detailed breakdown of our findings in Pharmanutra's earnings growth report.

- Our valuation report here indicates Pharmanutra may be overvalued.

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★★★

Overview: MilDef Group AB (publ) develops, manufactures, and sells rugged IT solutions across various international markets and has a market cap of SEK7.62 billion.

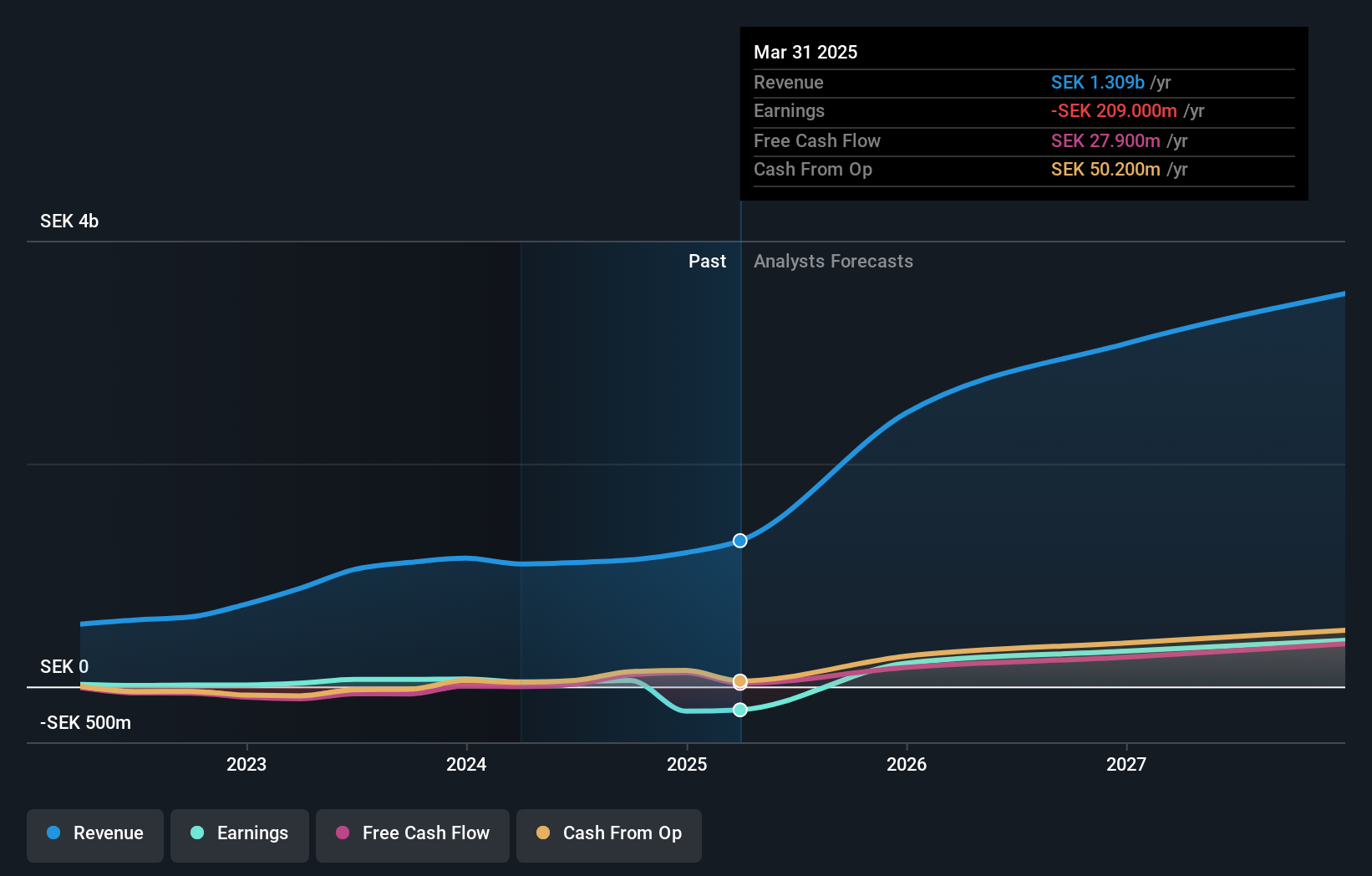

Operations: The company generates revenue from its Computer Hardware segment, amounting to SEK1.68 billion.

Insider Ownership: 13.7%

Revenue Growth Forecast: 29.2% p.a.

MilDef Group demonstrates strong growth potential with a recent Q3 sales surge to SEK 539.7 million, nearly doubling from the previous year. The company's strategic expansion in Rosersberg enhances its capacity for defense and security projects, aligning with NATO demands. Insider activity shows more buying than selling recently, indicating confidence in future prospects. Analysts forecast robust revenue growth of 29.2% annually, surpassing market averages, while shares trade below estimated fair value by 21.7%.

- Unlock comprehensive insights into our analysis of MilDef Group stock in this growth report.

- Our expertly prepared valuation report MilDef Group implies its share price may be lower than expected.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG is a biotechnology company that develops biosimilar drugs in Germany and Switzerland, with a market cap of €399.22 million.

Operations: The company's revenue is primarily derived from its biotechnology segment, which generated €51.78 million.

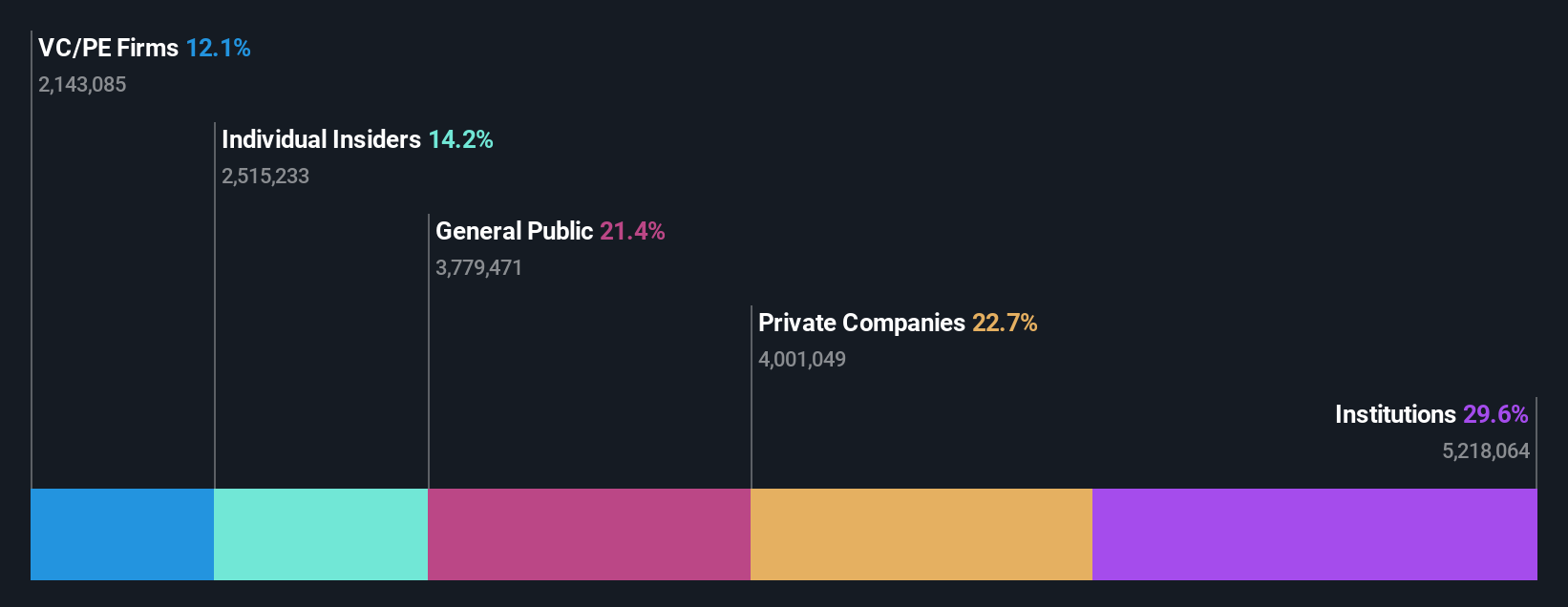

Insider Ownership: 14.2%

Revenue Growth Forecast: 27.4% p.a.

Formycon AG, despite recent removal from the Germany TECDAX Index, showcases strong growth potential with its strategic biosimilar launches. The European introduction of FYB201/Ranivisio® in a pre-filled syringe marks a significant advancement in ophthalmic care. While facing legal challenges, the settlement with Regeneron allows future U.S. market entry for AHZANTIVE®. However, financial performance shows a net loss of €54.19 million for H1 2025 amidst ambitious revenue growth forecasts and limited cash runway.

- Delve into the full analysis future growth report here for a deeper understanding of Formycon.

- Our expertly prepared valuation report Formycon implies its share price may be too high.

Summing It All Up

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 192 companies by clicking here.

- Interested In Other Possibilities? AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives