Is There Now an Opportunity in Bayer After Share Price Rose 42% in 2024?

Reviewed by Bailey Pemberton

If you are sizing up what to do with Bayer stock right now, you are not alone. Bayer has been on the minds of many investors recently, especially after a year that saw its share price rocket higher by almost 42% year to date, even as it recovered only modestly in the last week and month (up 1.0% and 0.2%, respectively). Despite steady long-term declines and a tough last three years, with shares down 44%, the rebound so far in 2024 has led many to wonder if the turnaround signals a true comeback or just a brief reprieve.

The narrative around Bayer has shifted dramatically over the past months. A focus on cost cutting, divestment of certain businesses, and continued discussion about legal liabilities has cast both hope and uncertainty onto the stock. Recent news about strategic changes and management shakeups has helped soften risk perceptions, with some market watchers reading these moves as signals that Bayer is proactively addressing its most pressing issues. Others remain cautiously optimistic, waiting to see if these actions will drive sustainable profitability.

When it comes to valuation, Bayer stands out with a value score of 5 out of 6 across six commonly used checks for undervaluation. This suggests that, based on traditional metrics, the stock trades at levels rarely seen for a company of its size and industry position. Of course, not all valuation models tell the full story. Next, we will break down what those checks mean for investors and hint at an even better way to read the numbers before making your move.

Approach 1: Bayer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model provides a forward-looking estimate of a company's value by projecting its future cash flows and then discounting those values back to the present. This approach helps investors gauge what a business is worth today based on expected performance, rather than historical price movements.

Bayer's current Free Cash Flow stands at approximately €4.41 Billion. Using analyst data for the next several years as a base, and then projecting beyond with longer-term estimates, Bayer's Free Cash Flow is forecasted to grow steadily, reaching nearly €7.49 Billion by 2035. While analysts supply estimates up to five years out, further growth rates are extrapolated and provide a comprehensive view of potential value based on cash generation.

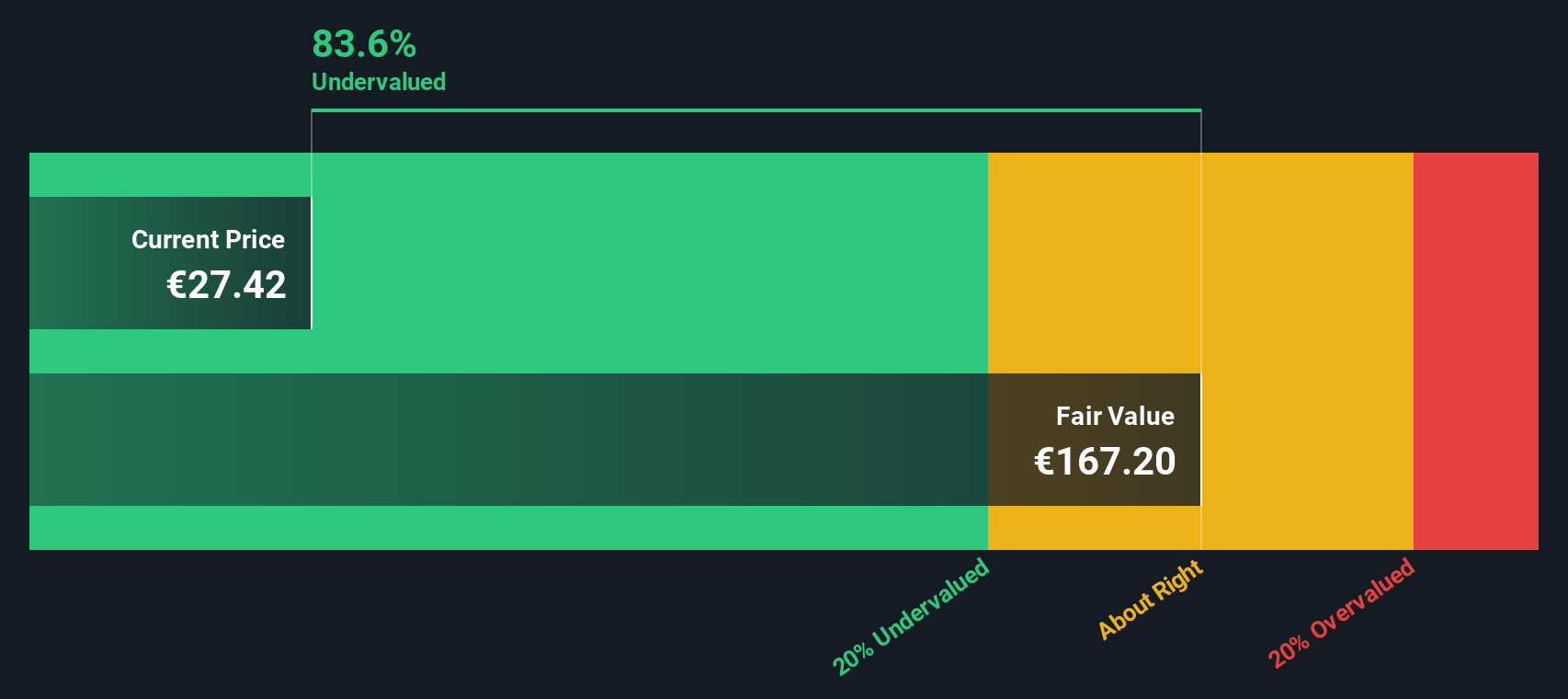

These projections result in a DCF-derived fair value for Bayer of €168.09 per share. This calculation implies that the stock is trading at an 83.6% discount compared to its intrinsic value. Such a sizable gap suggests that the current market price is far below where a typical cash flow model would value the business, indicating a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bayer is undervalued by 83.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bayer Price vs Sales

Price-to-Sales (P/S) is often considered a reliable valuation metric for companies like Bayer, especially when earnings may fluctuate due to extraordinary expenses or temporary setbacks, but underlying revenue remains robust. For large, diversified businesses in the Pharmaceuticals sector, P/S can offer clear insights into how the market values each euro of sales without being distorted by one-off factors in net profits.

Typically, a company's P/S ratio reflects what investors are willing to pay for every euro of revenue. Growth outlooks and risk levels influence what constitutes a fair or “normal” multiple. Strong growth prospects tend to justify higher P/S ratios, while higher risk or sluggish growth push it lower.

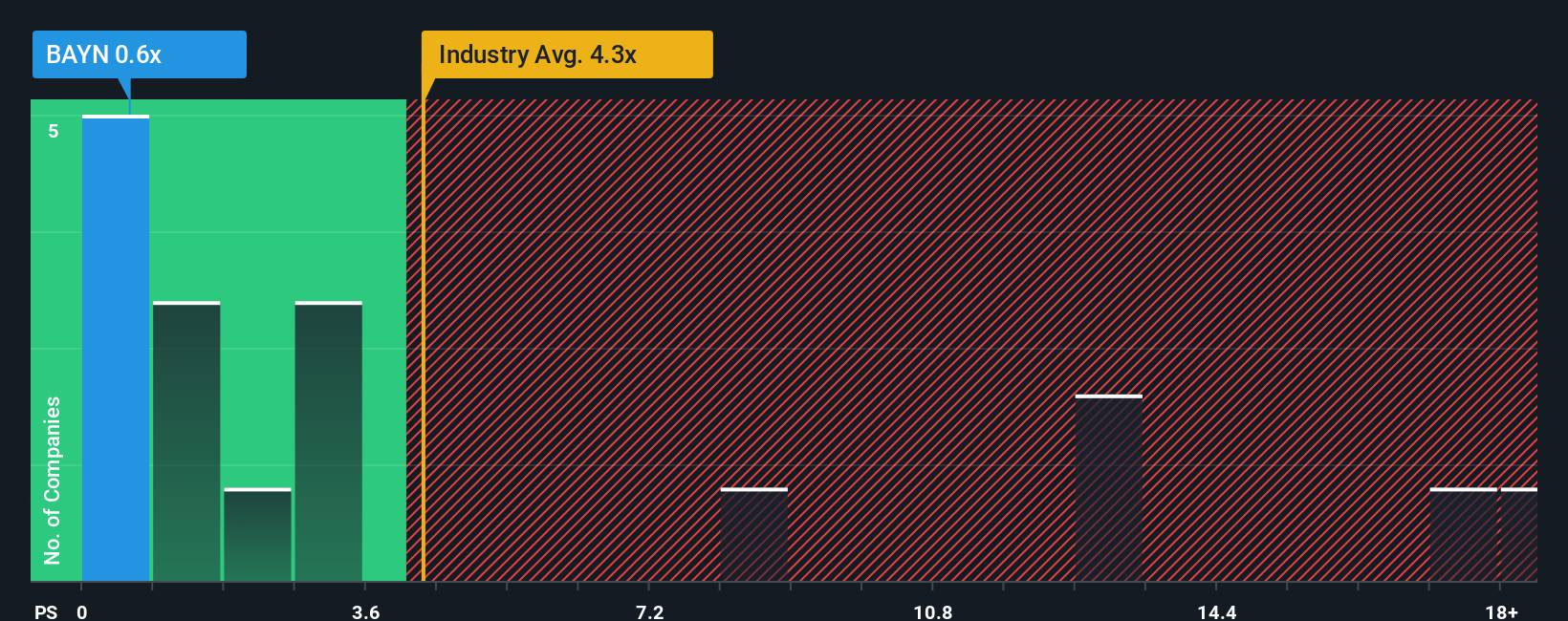

Currently, Bayer trades at a P/S ratio of 0.59x, which is significantly lower than the Pharmaceuticals industry average of 2.81x and its peer average of 1.97x. This stark discount may indicate the market is pricing in above-average risks or uncertainties for Bayer, or it could signal an opportunity if those concerns prove overblown.

Simply Wall St’s proprietary “Fair Ratio” model suggests a fair P/S ratio for Bayer of 1.44x. Unlike a simple comparison to industry or peer averages, the Fair Ratio accounts for Bayer's specific factors, such as its earnings growth forecasts, sector outlook, profit margins, size and unique risk profile. This provides a more accurate read on where the stock should trade.

Comparing Bayer’s actual P/S of 0.59x to its Fair Ratio of 1.44x shows the stock is notably undervalued by this measure, reinforcing the view offered by the DCF approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bayer Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful concept. It’s your personalized story or perspective on a company, grounded in your assumptions about future revenue, profits, and what you believe is a fair value.

Rather than relying on static numbers or analyst targets, Narratives allow you to make your own forecast and map out your investment thesis. They connect your view of Bayer’s challenges and opportunities, translate them into clear numbers and forecasts, and highlight what you think the stock should be worth today.

On Simply Wall St’s Community page, you can quickly create or browse Narratives. Millions of investors already do, giving you an approachable tool to track, refine, and update your outlook any time new news or company results are released.

Narratives make investment decisions straightforward by letting you compare your fair value with the market price. If your story leads to a much higher value than the current price, you may choose to buy, while a lower value might suggest holding off or selling.

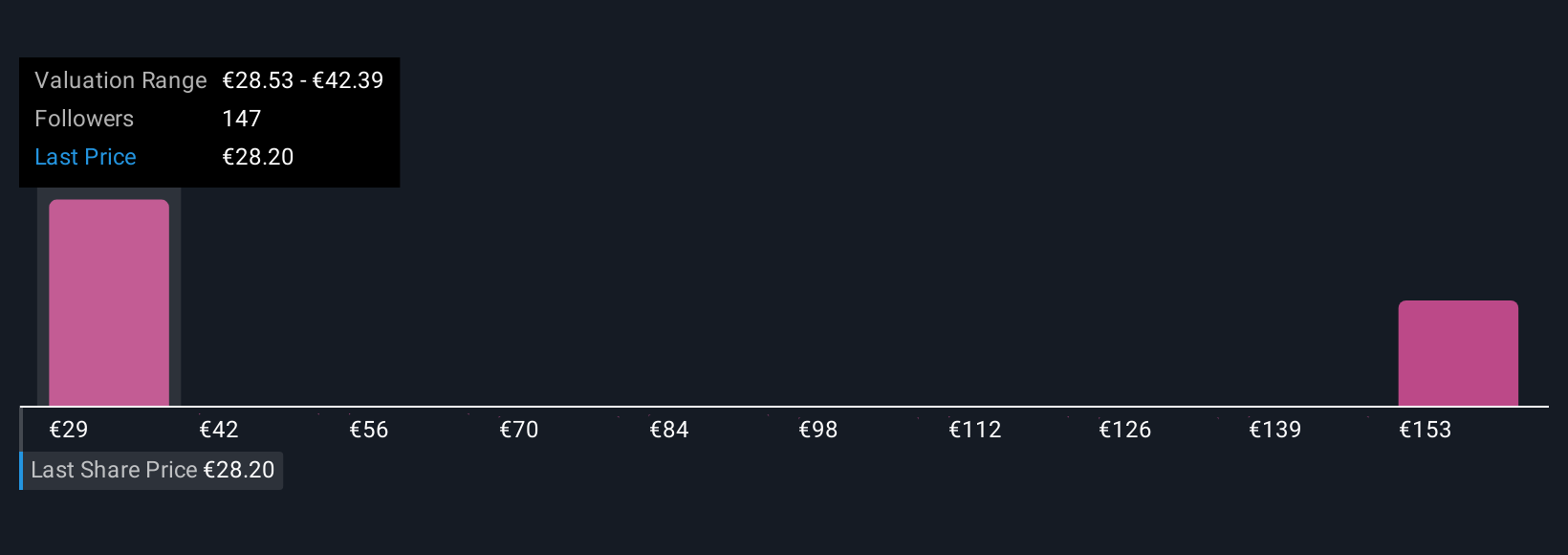

For Bayer, Narratives could range widely: one investor might see legal risks fading and future cash flows supporting a target near €39, while another remains cautious, assigning a fair value of just €23.

Do you think there's more to the story for Bayer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives