- Wondering if Bayer is finally a genuine value opportunity after years of frustration, or just another value trap in disguise? This article will walk through the evidence with you.

- After a long stretch of underperformance over 3 and 5 years, the stock has surged recently, climbing about 9.3% over the last week, 26.0% over the last month, and 71.8% year to date.

- That sharp move has come alongside renewed investor focus on Bayer's restructuring efforts and ongoing litigation over legacy products, which continues to shape sentiment around its long term earnings power and risk profile. At the same time, the market is watching how management's strategic decisions in pharmaceuticals, consumer health, and crop science could unlock or limit future value.

- Despite the rally, Bayer still scores a strong 5/6 on our valuation checks, suggesting the shares may remain undervalued on several metrics. Next, we will break down what different valuation approaches are saying about Bayer today, and later in the article we will explore an additional way to think about what the stock is truly worth.

Approach 1: Bayer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting them back to their present value. For Bayer, this means taking expected Free Cash Flow in euros and assessing what that stream is worth to shareholders now.

Bayer generated about €3.93 billion in Free Cash Flow over the last twelve months, and analysts expect this to rise steadily, reaching roughly €5.93 billion by 2029. Beyond the initial analyst forecast period, Simply Wall St extends these projections further, assuming modest growth in Free Cash Flow out to 2035 under a two stage Free Cash Flow to Equity framework.

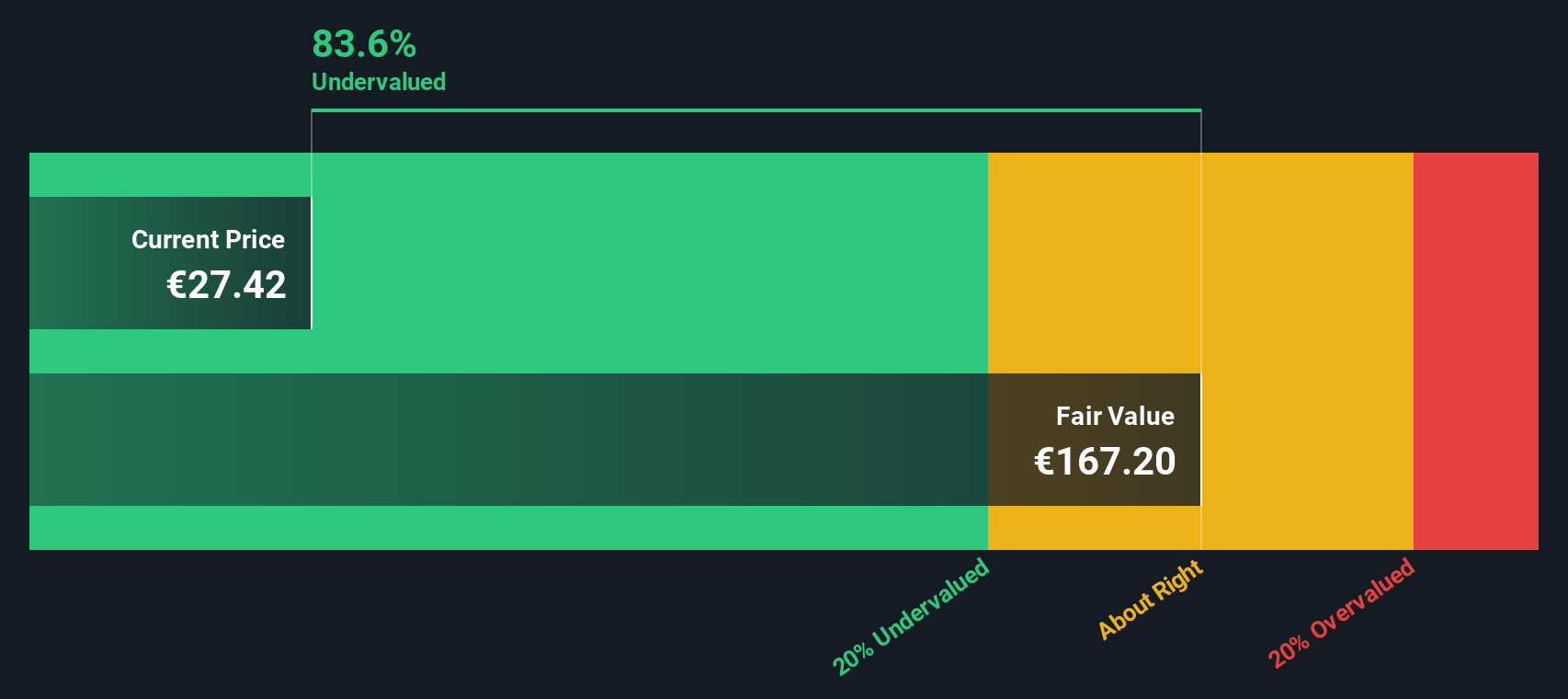

Aggregating and discounting these projected cash flows results in an estimated intrinsic value of around €167.40 per share. Compared with the current market price, this indicates that, based on this model, Bayer is trading at roughly an 80.1% discount to its DCF based fair value.

Result: UNDERVALUED (per this DCF analysis)

Our Discounted Cash Flow (DCF) analysis suggests Bayer is undervalued by 80.1%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Bayer Price vs Sales

For companies where current earnings are distorted or volatile, the Price to Sales ratio is often a more reliable yardstick because it focuses on the scale of revenue the market is paying for rather than short term profit swings. Investors usually accept a higher or lower P S multiple depending on how quickly sales are expected to grow and how risky those future revenues appear.

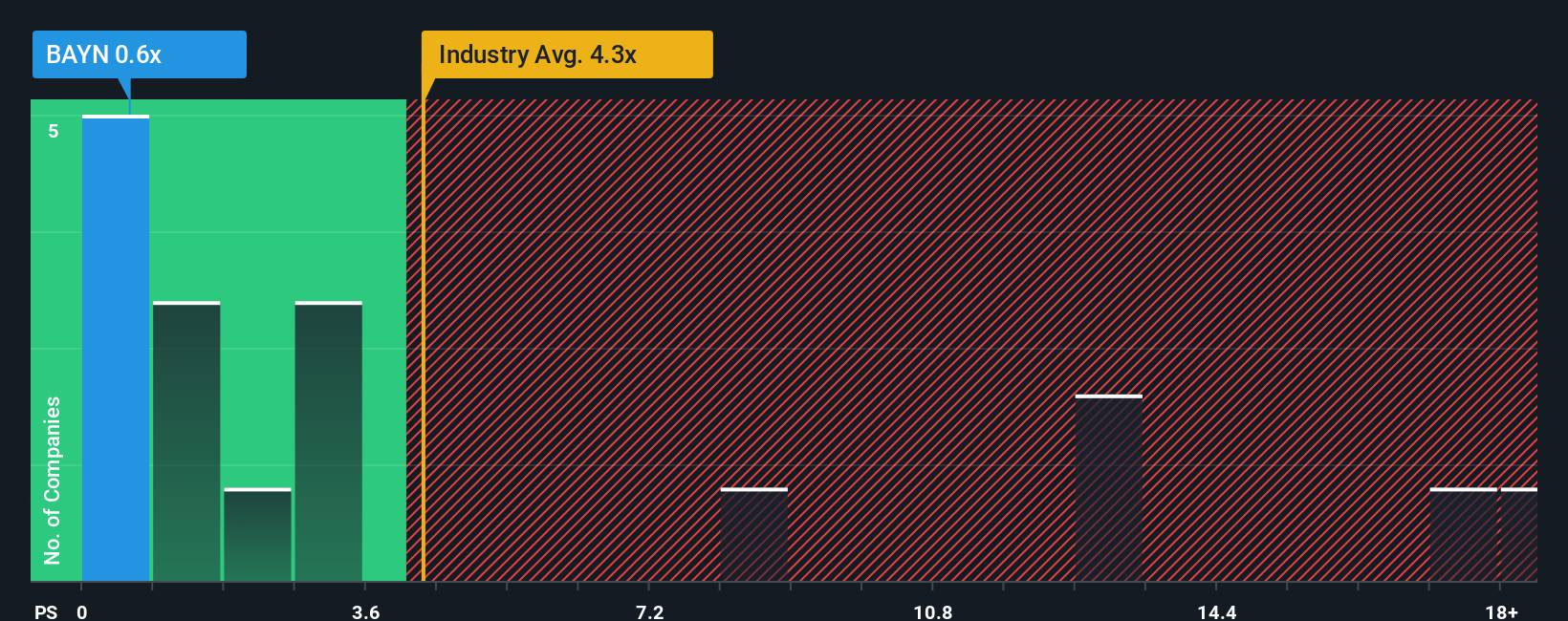

Bayer currently trades on a P S ratio of about 0.71x, which is well below both the Pharmaceuticals industry average of around 2.66x and the peer group average of about 2.11x. To go a step further, Simply Wall St also calculates a Fair Ratio of 1.80x for Bayer, which is the P S multiple the company might reasonably command given its growth outlook, risk profile, profit margins, industry and market cap.

This Fair Ratio is more informative than a simple comparison with peers or sector averages because it adjusts for Bayer specific characteristics rather than assuming all drug makers deserve the same multiple. With the current 0.71x P S sitting materially below the 1.80x Fair Ratio, this approach points to Bayer still looking undervalued on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bayer Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, which are simply your story about Bayer, expressed as assumptions for future revenue, earnings and margins that flow into a forecast and ultimately a fair value you can compare to today’s share price.

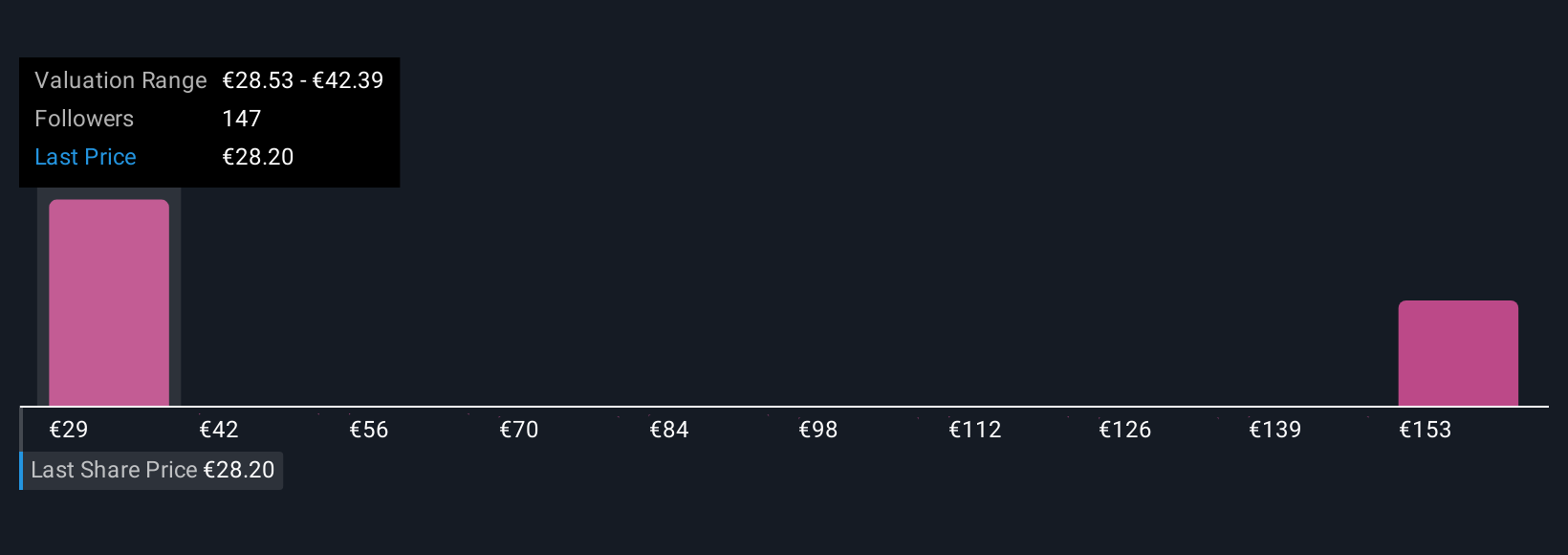

On Simply Wall St’s Community page, used by millions of investors, Narratives make this process easy by guiding you to link what you believe about Bayer’s pipeline, litigation risks and potential agriculture spin out to specific numbers in a forecast model, so you can see whether your fair value suggests a buy, hold or sell compared to the current market price.

Narratives on the platform update dynamically when new earnings, news or analyst revisions come in. This keeps your Bayer view alive and responsive rather than a static spreadsheet that is out of date as soon as something changes.

For example, one investor might build a bullish Bayer Narrative that leans toward the higher end of analyst expectations, assuming stronger earnings and a higher fair value than €39. A more cautious investor could lean toward weaker growth, more litigation drag and a fair value closer to €23. The platform helps each of them see how those differing stories translate into numbers and decisions.

Do you think there's more to the story for Bayer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026