Bayer (XTRA:BAYN) Valuation in Focus as Restructuring and Pipeline Advances Draw Attention

Reviewed by Kshitija Bhandaru

Bayer (XTRA:BAYN) has been making headlines through a series of strategic moves, including progress in its gene therapy pipeline and a new marketing partnership aimed at boosting its top brands. The company’s latest efforts highlight a commitment to both innovation and operational renewal.

See our latest analysis for Bayer.

With Bayer rolling out a new marketing partnership and making strides in its gene therapy arm, investor interest has picked up; however, the 1-year total shareholder return is still slightly negative and longer-term returns remain challenging. Momentum could improve if clinical and strategic initiatives start paying off, but for now, the stock’s sideways performance reflects ongoing uncertainty over transformation and growth outlook.

If you’re on the lookout for other compelling pharma names or big dividend opportunities, now is a great time to explore See the full list for free..

With so many pipeline updates and strategic moves, investors may be wondering whether Bayer’s recent transformations signal an attractive entry point. Alternatively, they may be considering if the market has already accounted for the company’s growth prospects in its share price.

Most Popular Narrative: Fairly Valued

With Bayer shares closing at €28.85 and the most followed narrative setting fair value at €28.53, expectations are remarkably in line with the market price. As investors debate the next move, this narrative reveals some major levers believed to support Bayer’s intrinsic worth.

Operational streamlining, litigation containment, and portfolio optimization aim to boost efficiency, resilience, and cash flow while enhancing future market stability.

Curious about what could transform Bayer’s profit trajectory? This narrative is built on a bold profit turnaround and a future multiple typically reserved for market leaders. Ready to uncover the mix of financial forecasts behind this price tag? Dive into the details to see what makes this valuation tick.

Result: Fair Value of €28.53 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent litigation exposures and heightened regulatory scrutiny could still derail expectations. These factors act as key catalysts that may challenge Bayer’s positive turnaround narrative.

Find out about the key risks to this Bayer narrative.

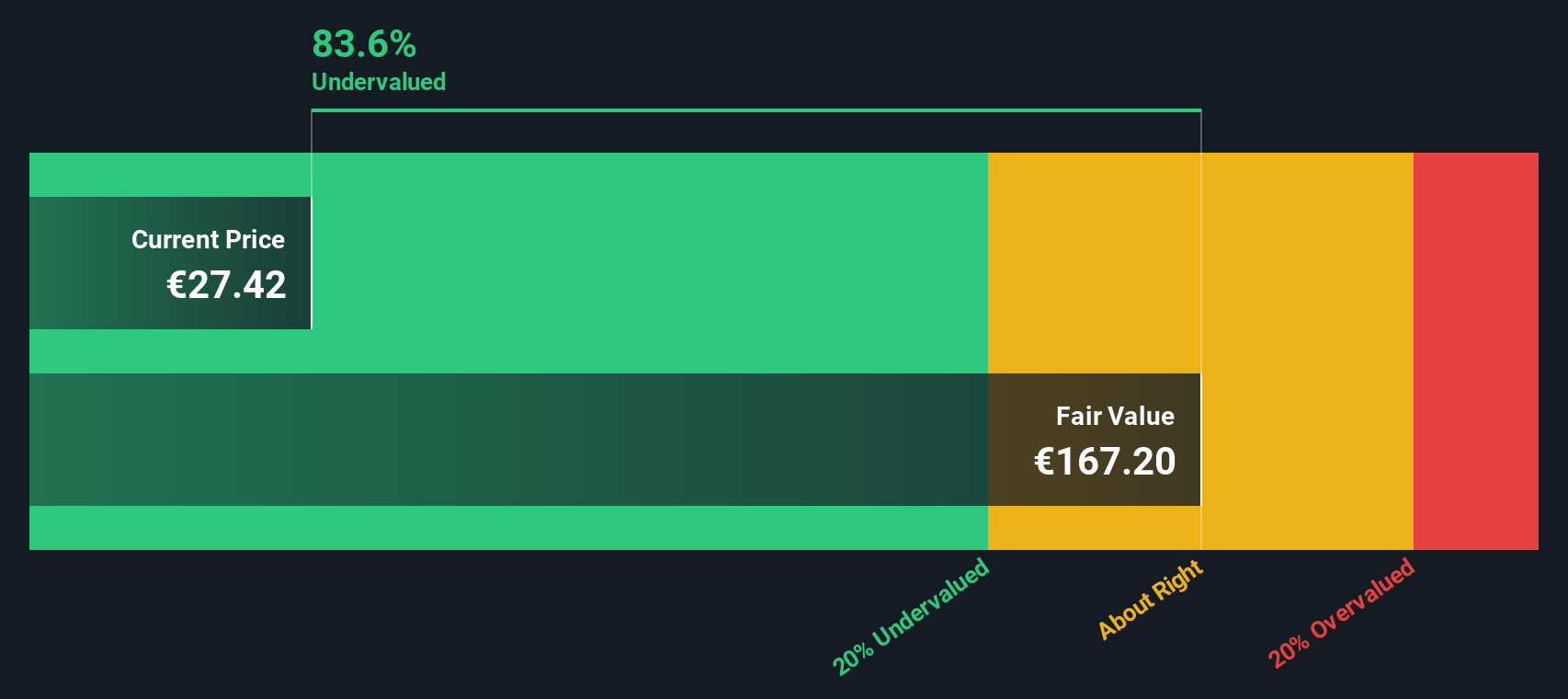

Another View: Discounted Cash Flow Tells a Different Story

While analyst consensus points to Bayer being fairly valued, our DCF model presents a strikingly different picture. The SWS DCF calculation places Bayer’s fair value much higher than its current share price, suggesting the stock is deeply undervalued by the market. Which approach will prove more accurate as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bayer Narrative

If you see things differently or believe a fresh perspective is in order, dive into the data and shape your own analysis in just minutes, then Do it your way.

A great starting point for your Bayer research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to spot tomorrow’s top performers. Simply Wall St’s powerful screeners help you seize quality opportunities before the crowd notices.

- Uncover stocks with outstanding growth potential and shake up your watchlist with these 24 AI penny stocks at the forefront of today’s AI innovation.

- Boost your strategy with reliable income by tapping into these 19 dividend stocks with yields > 3%, connecting you to companies offering robust yields and financial strength.

- Capitalize on emerging trends by targeting undervalued opportunities through these 900 undervalued stocks based on cash flows, revealing value the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives