- Germany

- /

- Entertainment

- /

- XTRA:HLG

Highlight Communications AG (ETR:HLG) Stock Catapults 41% Though Its Price And Business Still Lag The Industry

Highlight Communications AG (ETR:HLG) shares have had a really impressive month, gaining 41% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

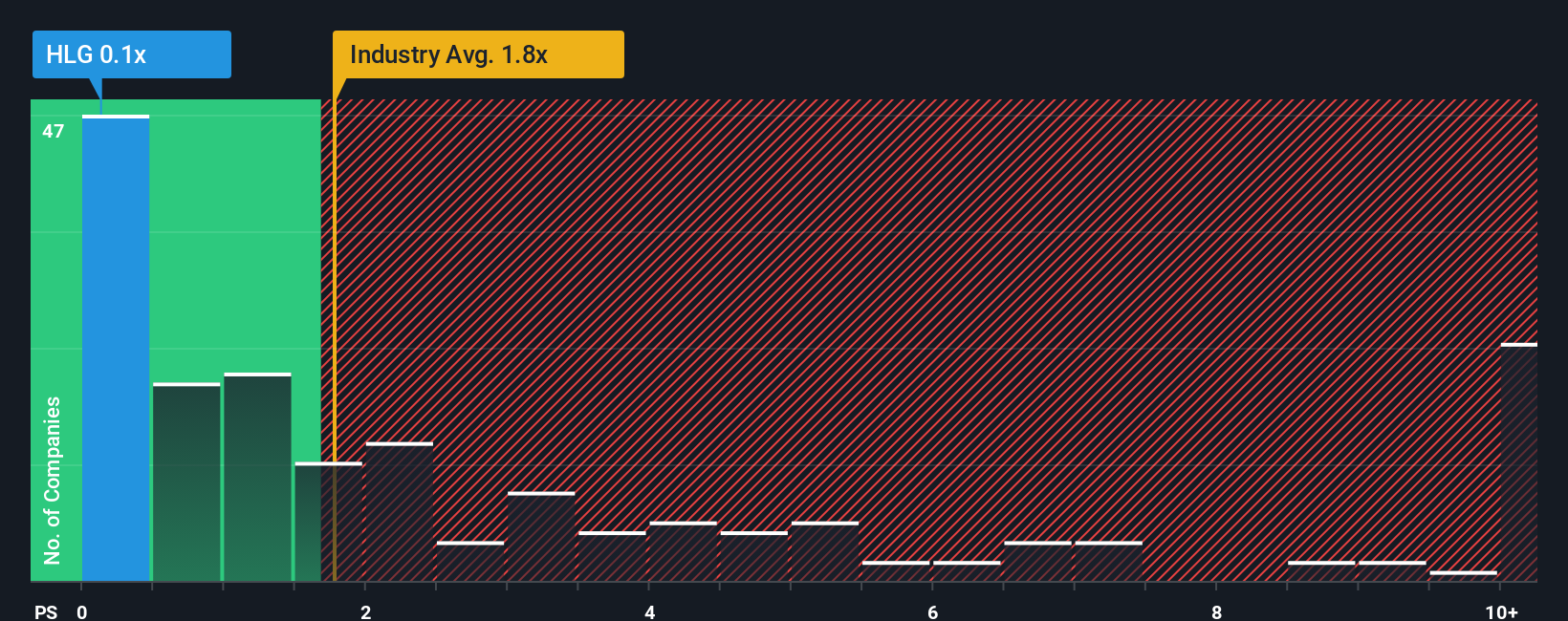

Even after such a large jump in price, Highlight Communications' price-to-sales (or "P/S") ratio of 0.1x might still make it look like a buy right now compared to the Entertainment industry in Germany, where around half of the companies have P/S ratios above 0.9x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Highlight Communications

What Does Highlight Communications' P/S Mean For Shareholders?

The revenue growth achieved at Highlight Communications over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Highlight Communications will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Highlight Communications, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Highlight Communications?

The only time you'd be truly comfortable seeing a P/S as low as Highlight Communications' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 8.6% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 14% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 5.2% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Highlight Communications' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Highlight Communications' P/S Mean For Investors?

Highlight Communications' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Highlight Communications maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Highlight Communications (2 are a bit unpleasant) you should be aware of.

If you're unsure about the strength of Highlight Communications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Highlight Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:HLG

Highlight Communications

Operates as a strategic and financial holding company in Switzerland, Germany, rest of Europe, and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026